Deals by private equity funds in Central and Eastern Europe are set to continue their rebound this year as monetary policy eases around the globe and investors in the region come to terms with the impact of the war in Ukraine, according to the latest Private Equity Report from Bain & Company.

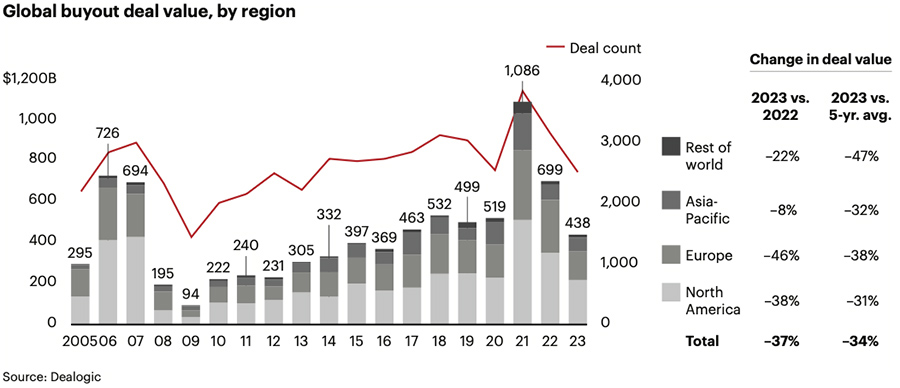

Globally, buyout investment value last year dropped to $438 billion, a 37% decrease from 2022 and the worst total since 2016. Overall deal count dropped 20% to around 2,500 transactions. The malaise infected regions across the world, with Europe and Asia-Pacific both experiencing significant declines.

The Central and Eastern Europe region however managed to buck the trend, with buyout transaction value up from the record low of $300 million in 2022 to $800 million last year.

Seventeen of the industry’s 37 buyout transactions in Central and Eastern Europe last year, excluding add-ons, came in Poland, while the Czech Republic took second place with 10 deals. Counting add-on transactions, funds made 68 acquisitions in the region, which also includes Bulgaria, Croatia, Estonia, Hungary, Latvia, Lithuania, Romania, Slovakia and Slovenia.

“Last year was a tough one for the private equity industry globally, but here in Central and Eastern Europe we saw the beginning of a rebound,” said Jacek Poświata, senior partner at Bain & Company.

The 2024 outlook

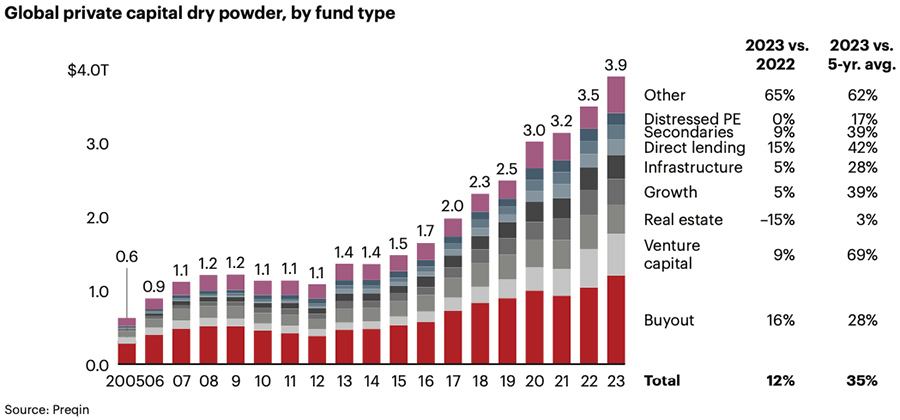

For the year ahead, Bain & Company’s authors said that they expect the global market to rebound. “Interest rates appear to be stable. Record dry powder is stacked and ready for deployment. A sizable chunk of this dry powder is aging and needs to be put to work. Looking into portfolios, nearly half of all global buyout companies have been held for at least four years. In short, the conditions appear to be shifting in favour of hitting the go button.”

Poświata forecasts a similar picture to unfold in the region. “As interest rates ease around the globe and it becomes clear that our region is managing to cope with the consequences of the tragic war in Ukraine, we expect funds to continue deploying their record resources of dry powder on acquisition opportunities here.”

“Our region remains attractive for international investors, both private equity funds and industry players, as it continues to post faster growth than Western Europe in a process of convergence with the EU,” Poświata said. “Funds are continuing to pursue a buy-and-build strategy of assembling regional champions, which then are more attractive to strategic investors.”