Middle-market fintech and payment companies are gaining significance within the broader fintech mergers and acquisitions (M&A) landscape, attracting attention from private equity (PE) firms for their strong growth potential, stable profits margins, and solid customer bases, a new analyst note by private market data provider PitchBook says.

Middle-market fintech firms fall between small, early-stage startups and large, established corporations in terms of size and maturity. These companies target mid-sized businesses or consumers, and often specialize in specific products or services tailored to their target audience. They typically generate moderate revenue and hold moderate market presence compared to larger fintech players but still represent a significant portion of the overall fintech ecosystem.

According to the PitchBook note, middle-market fintech companies are increasingly appealing to larger firms, especially given the relative ease of financing and executing deals in this space. These companies have also shown strong performance amid high inflation, making them attractive targets for investment.

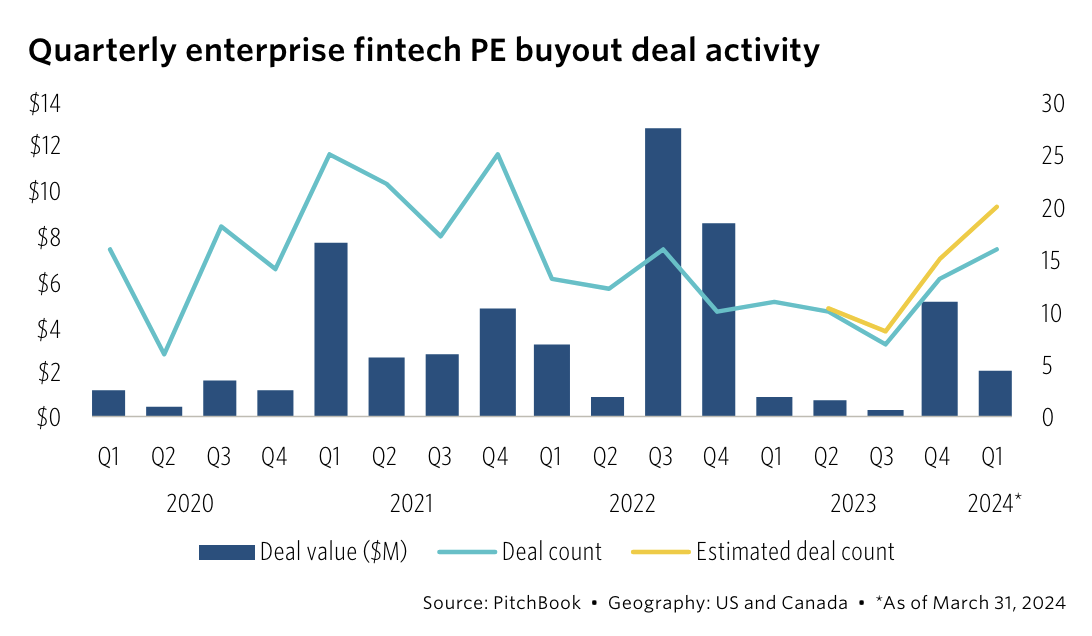

In Q1 2024, PitchBook recorded 16 fintech PE buyouts, a notable increase compared to 11 in Q1 2023, to 2023’s average of 11 buyouts per quarter, and to H2 2022’s average of 14 per quarter. Among these transactions, payments companies accounted for the majority at 38%, continuing a trend observed over at least the past four years. Enterprise payment had been the top segment for PE buyout over the prior 12 months (27%), as well as over the last four years (26%), the note says.

Quarterly enterprise fintech PE buyout deal activity, Source: Q1 2024 Fintech M&A Review, PitchBook, May 2024

According to PitchBook, payment companies are particularly attractive targets because of their ability to withstand inflation and maintain steady revenue streams. These companies provide a service that nearly everyone needs and benefit from robust consumer and business spending. Unlike software-as-a-service (SaaS) businesses, payment companies charge customers based on a percentage of each transaction rather than a fixed annual contract price. This model shields them from the negative impacts of inflation and may even offer some advantages in such economic conditions, the note says.

Additionally, PitchBook emphasizes that industry-specific payment tools, combined with workflow software, can generate the kind of revenue growth and margin that create attractive buyout returns. One such example is the acquisition of Jobox.ai by Talus Pay, a provider of payment processing solutions for small and mid-sized merchants that’s owned by Alvarez and Marsal Capital. Jobox.ai specializes in home services payments and workflow software. This acquisition complements Talus Pay’s existing focus areas, including healthcare, retail, restaurants, manufacturing, and government.

Another example is the acquisition of MuniciPAY by Autoagent Data Solutions in January. MuniciPAY operates as a citizen payment gateway for municipalities. Autoagent Data Solutions, known for its escrow tax and government payment processing services, acquired MuniciPay to expand its citizen payment gateway, allowing local governments to consolidate their incoming revenue in one place.

According to the note, these companies, which combine payments and software, have a competitive advantage that is hard for others to penetrate, along with a loyal customer base, making them attractive targets.

Fintech M&A activity sees rebound

Delving into corporate acquisition patterns, the PitchBook note highlights a rebound in activity this year. In Q1 2024, corporate acquisitions reached 18 deals, up from a four-year low of 14 in Q4 2023.

During the quarter, the increase in corporate M&A was largely driven by a more positive outlook among executive leadership teams. Until recently, corporate leaders faced challenges related to slowing revenue growth due to waning stimulus. They also expected a recession due to rate hikes and an inverted yield curve. However, the ecosystem surpassed expectations, the report says.

The quarter also witnessed large financial companies actively acquiring fintech companies to add new products and improve existing offerings. JP Morgan, for example, purchased LayerOne Financial in March to improve its offerings for hedge funds. With the deal, clients of JP Morgan’s wholly-owned subsidiary Neovest will be able to monitor their portfolios, conduct risk assessments, send orders to their brokers and perform compliance checks all from one platform, the companies said in a statement.

In Q1 2024, corporate acquisitions in North America were concentrated in New York, San Francisco, and other major cities, the note says. Many of these deals involved small businesses with five to 20 employees, indicating that corporates continue to acquire for talent and technology. Top segments by deal count were capital markets (23%), CFO software (18%) and financial services infrastructure (18%).

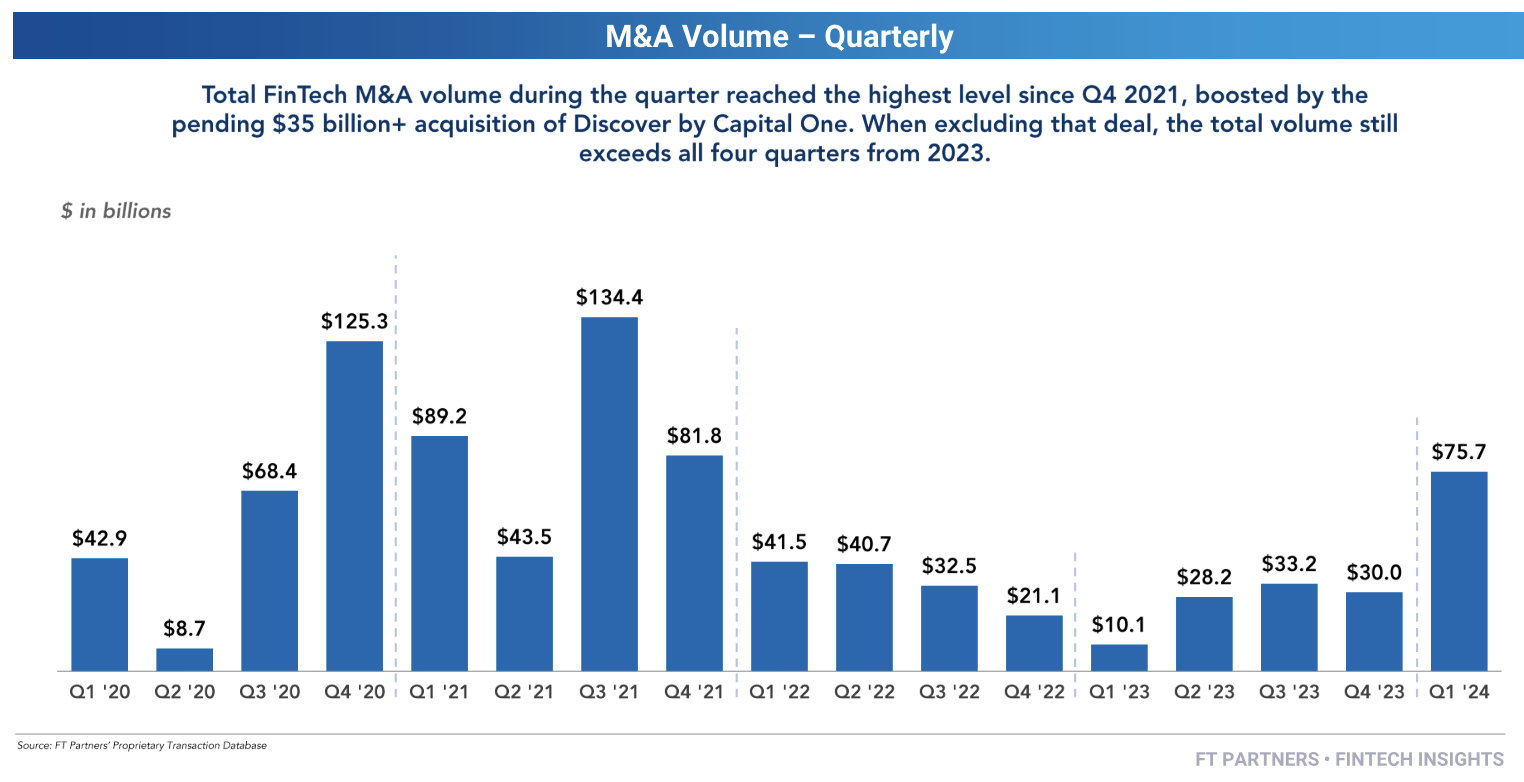

Globally, the total value of fintech M&A deals announced in Q1 2024 reached its highest level since Q4 2021, totaling US$75.7 billion across 282 transactions, data from Financial Technology Partners, an investment banking firm focused on fintech, show. Although the number of deals decreased 11% compared to Q1 2023, the overall volume increased 7.5 times.

Increased M&A volume was driven by a resurgence in US$1 billion+ M&A deals, which totaled 11 in Q1 2024 compared to only two announced during the same period last year. These large deals included Capital One’s proposed US$35 billion acquisition of Discover Financial Services, KKR’s purchase of a 50% stake in Cotiviti at a US$11 billion valuation, trading platform Webull’s US$7.3 billion merger agreement with special purpose acquisition company (SPAC) SK Growth Opportunities, and Nationwide Building Society’s US$3.7 billion acquisition of Virgin Money.

Global fintech M&A volume – quarterly, Source: Q1 2024 Quarterly Fintech Insights, Financial Technology Partners Research, Apr 2024

This article first appeared on fintechnews.am

Featured image credit: edited from freepik