In this edition, we explore India’s deep-tech surge, fueled by policy support and private capital, and examine how Canadian pension funds are reassessing their Asia Pacific PE strategies.

Shot in the arm for India’s deep tech sector

India’s deep-tech startups, which build products around emerging technologies such as AI, biotech, and advanced materials, have long struggled to draw private capital.

As a ‘sunrise’ sector, they were often viewed with scepticism by investors wary of long development cycles and uncertain returns, which made it difficult for promising innovations to scale.

That could soon change.

In July, India approved a Rs 1 lakh crore ($12 billion) Research, Development, and Innovation Fund-of-Funds (RDI Scheme) to help build a competitive deep-tech ecosystem.

To ensure efficient deployment of these funds, earlier this month, the government also cleared the creation of a dedicated funds custodian – a Special Purpose Vehicle (SPV) under the Anusandhan National Research Foundation, India’s apex body for guiding research and development across the country.

The initiative not only aims to reduce early-stage risks for startups but also to create a more predictable funding environment that could attract new participants into the market.

As Pratip Mazumdar, co-founder and partner at deeptech-focused Inflexor Ventures, puts it: “This brings long-term, patient capital that can support scale and growth. In today’s era of deglobalisation, the availability of homegrown funding is important to support innovation and scale.”

Domestic investors, historically cautious about the long gestation periods and uncertain returns of deep-tech ventures, may find fresh incentives to engage with the sector.

At the same time, foreign investors are likely to view this as a signal that India is serious about fostering an innovation-driven ecosystem, potentially making the country a more attractive destination for high-impact frontier technologies.

“Global investors are always on the lookout for scalable opportunities, and India offers both high-quality innovation and cost-efficient execution,” said Anil Joshi, Founder and Managing Partner at Unicorn India Ventures and member of the VC Council at IVCA, an industry body representing PE, VC, and other alternative investment funds.

“The combination of talent, market size, and policy push will make it increasingly difficult for global players to ignore India’s deep-tech story,” he added.

With the startup ecosystem evolving, several opportunities are emerging within the broader deep-tech umbrella, particularly in semiconductors, space tech, defence tech, and med-tech.

Industry watchers say the RDI Scheme will give private investors the confidence to allocate more meaningful capital to deep-tech ventures. Already, global and domestic funds such as Prosus, Accel, and Peak XV are ramping up their focus on this space, earmarking larger pools of capital for frontier technology investments.

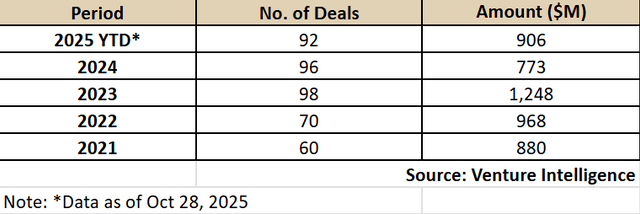

According to data from Venture Intelligence, PE-VC investments in Indian deep-tech startups have already reached $906 million this year, surpassing last year’s $773 million. In terms of deal volume, activity has remained steady, with 92 deals so far compared with 96 in 2024. For context, deep-tech startups raised $1.2 billion across 98 deals in 2023.

PE-VC Investments in Deeptech Companies in India

(2021 – 2025 YTD*)

Top PE Investments in Deeptech Companies in India

(2021 – 2025 YTD*)

Developing a strong deep-tech ecosystem is crucial as India transitions from a services-driven economy to one led by products and deep innovation, said Raja Lahiri, Partner, Grant Thornton Bharat.

“We are seeing private funds being set up specifically for deep-tech, which is a healthy sign for the ecosystem, but we need more,” he added. Deep-tech, after all, remains capital-intensive and demands patient funding, long R&D cycles, and a strong ecosystem of labs, researchers, and industry partnerships. So, there are challenges that will require sustained attention.

India’s deep-tech playbook appears to follow a model proven elsewhere, such as Taiwan, Israel, and South Korea, wherein governments took on early risk to attract private participation, then gradually stepped back as the ecosystem matured.

However, it is critical to note that government funding alone won’t be enough to build a lasting deep-tech ecosystem. India will need follow-up reforms and ensure faster intellectual property (IP) adjudication to protect R&D, single-window clearances to cut red tape, tax tweaks to match global norms, and visa reforms to draw top research talent.

With policy, private capital, and structural reforms coming together, India’s deep-tech startups are entering a phase that could finally unlock the country’s frontier technology potential.

Canadian pensions reorganise for returns

News that one of Canada’s largest public pension funds, the Ontario Municipal Employees Retirement System (OMERS), is cutting its Asia buyout team follows a series of high-level changes at the fund, and indications of a review of its private equity business amid an investment environment characterised by geopolitical uncertainty and trade wars.

Last year, the fund announced the retirement of its global head of private equity, Michael Graham. Responsibilities at the PE business have been divided between Eric Haley, head of PE, and Michael Block, head of Private Capital – a new portfolio that includes in its strategies ventures, growth, and APAC PE.

In August, the fund reported that PE delivered a negative net return (-1.3%) for the half-year financial period that ended June 30, 2025 – the only one of the fund’s seven asset classes to do so. The fund’s infrastructure and private credit investments were the better performers, generating 3.6% and 2.7% in net return for the half-year, respectively.

What does this mean for the broader PE investment environment in the Asia Pacific? Are the funds pulling back on their direct investments? Or, are they refocusing on the strategies that make the most sense amid what has been a broadly brutal environment for private equity and venture capital?

To be sure, OMERS has reportedly stated that Asia Pacific “remains a core geography” under their investment strategy. The fund currently allocates 11% to what it groups as ‘Asia Pacific and Rest of World’.

By comparison, La Caisse (formerly CDPQ) has a 10% allocation to Asia Pacific (as at end-2024), down from 12% in 2019; while OTTP’s exposure to the region stood at 8% at the end of last year.

The outlier appears to be CPP Investments, whose exposure to APAC stood at 17% as at March 31, 2025, with deepening commitments to India. However, the fund has also stated it is trimming its exposure to emerging markets, which includes Asia Pacific. For its fiscal year 2025, exposure to emerging markets was 15% of net assets, down from 20% from the previous year.

As a region, Asia Pacific generated a 6.2% return over five years; vs 9.6% in the US and 8.2% in Latin America, for CPP.

Over the past few years, as DealStreetAsia has reported, many major LPs including the Canadian pensions, have done more direct deals and co-investments in a bid for better returns. Still, those have been selective.

For instance, in 2024, OTTP was reported to have laid off four venture capital and growth equity dealmakers in its Hong Kong team, to focus on investments in India. Around that time, OTTP acquired a significant minority stake in a non-banking financial company Kogta Financial (India), for about $148 million. And, OTTP is expected to wind down its Hong Kong operations by next year.

Ultimately, investors would go where returns are best, whether it means shifting away from directs towards private credit and infrastructure strategies.

Top PE developments

Deals

Blackstone said it will invest $705.05 million in India’s Federal Bank via preferential equity shares and warrants, while British International Investment announced a $75 million financing facility for Blueleaf Energy, a Macquarie Asset Management–backed renewable energy platform operating across Asia.

In other significant developments, True North Private Credit led a $40.8-million investment in Innova Rubbers and Vee Tee Auto Manufacturing to help consolidate promoter stakes and boost growth in India.

Ares Management’s Asia PE arm entered Vietnam’s healthcare market through an investment in Medlatec Group.

Pentagreen Capital, the manager of a blended finance strategy under Singapore’s Financing Asia’s Transition Partnership, announced a $55 million loan to Citicore Solar Energy Corporation.

Singapore state firm Temasek is understood to be in advanced talks to back Somerset Indus Capital Partners’ third fund focused on scaling mid-sized healthcare firms in India.

Hong Kong–based fintech FundPark has raised $71 million in debt and equity funding to expand its global presence and strengthen its AI capabilities.

ANE (Cayman), a consortium comprising its largest shareholder, Centurium Capital, Temasek and True Light, has offered to take it private in a deal valuing the China-based transportation and delivery services group at $1.84 billion.

Fundraising

Singapore-headquartered KV Asia Capital is in the process of finalising the first close of its third private equity fund for Southeast Asia.

Singapore-headquartered asset manager Lighthouse Canton said it has plans to park over $1.5 billion in India in the next few years, with a focus on private credit and real estate.

Exits

US-based PE investor Advent International’s affiliate Jomei Investments sold its entire equity stake in India’s Aditya Birla Capital in a block deal.

IPO buzz

Companies across Asia — including Lenskart, Coliwoo Holdings, Mr DIY Group, Maynilad Water, and Akasa Air — are gearing up to tap the public markets.

People Moves

Malaysian private equity firm Creador has announced the appointment of Syed Yasir Arafat Bin Syed Abd Kadir as senior advisor.