Hi, Leo Schwartz here filling in for Allie.

Stop me if you’ve heard this story before. A crypto boy wonder rises through the ranks of blue-chip institutions, with credentials from MIT, Morgan Stanley, and the Forbes 30 under 30 list. He gains the trust and support of leading investors in finance and crypto, from Bill Ackman to the Galaxy firm. But just under the surface, trouble—and serious legal ramifications—loom.

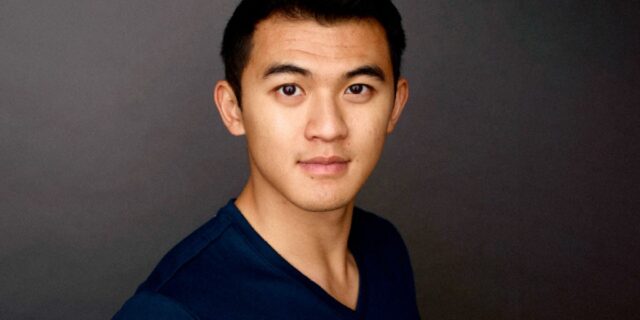

No, this is not Sam Bankman-Fried, or Do Kwon, or Kyle Davies and Su Zhu, although I acknowledge this beat is starting to sound like a broken record. Instead, I have a new investigation on Yida Gao, who just a couple of years ago was a rising star in blockchain. His firm, Shima Capital, raised $200 million in its debut fund, backed by some of the industry’s biggest names. Gao quickly became one of the most active investors in the space and even taught a course on crypto at MIT’s business school, filling a position vacated by SEC Chair Gary Gensler.

Behind the scenes, however, Gao appears to have cut some crucial corners while operating his fund, alienating his investors and possibly running afoul of key SEC rules. In the most glaring example, Fortune’s investigation revealed that Gao funneled investments into a secret offshore entity he wholly owned without disclosing the arrangement to investors—a potential breach of the Investment Advisers Act, according to experts I spoke with. “It doesn’t make any sense,” Eric Hess, a venture and blockchain lawyer, told me. “I don’t think that’s a defensible strategy.”

Gao doesn’t only have the SEC to worry about. Shima has also alienated backers, with the crypto firm Galaxy redeeming its investment and others raising alarm bells. According to one source, Shima struggled to raise further capital due to concerns over its performance and behavior, and a representative confirmed the firm is not currently fundraising, despite the red-hot crypto market.

It shouldn’t be a surprise that compliance is still a struggle for crypto firms. The industry still lacks clear regulation in the U.S., and most mainstream venture funds who want to participate in blockchain deals have to set up a web of offshore entities. But that shouldn’t mean flouting the law or basic investor protection principles.

While there is no evidence that Gao and Shima set out to misappropriate funds, their actions are at best careless, and at worst could result in severe legal penalties. It’s a tale all too common in the crypto industry, which seems to replicate the same missteps every cycle.

“There’s a lot of softness around the edges, sometimes a lot of ‘Trust me, bro,’” Hess told me. “We need to start paying attention to these standards and not pretending unless we’re just the derelict children of the financial system.”

You can read the full story here.

Leo Schwartz

Twitter: @leomschwartz

Email: leo.schwartz@fortune.com

Submit a deal for the Term Sheet newsletter here.

Joe Abrams curated the deals section of today’s newsletter.

VENTURE DEALS

– Cube, a San Francisco-based developer of a universal semantic layer designed to help companies manage and optimize their analytics workflow, raised $25 million in funding. Databricks Ventures led the round and was joined by Decibel, Bain Capital Ventures, Eniac Ventures, and 645 Ventures.

– Fizz, a New York City-based credit card company for students, raised $14.4 million in seed funding. Kleiner Perkins led the round and was joined by SV Angel, Y-Combinator, New Era Ventures, and others.

– Qargo, a London, U.K. and Ghent, Belgium-based workload management platform for the trucking industry, raised £11 million ($14 million) in Series A funding from Balderton Capital.

– Torpago, a San Francisco-based company that helps banks launch business credit cards, raised $10 million in Series B funding. Priority Tech Ventures and EJF Ventures led the round and was joined by BankTech Ventures and existing investors.

– Eyebot, a Boston, Mass.-based developer of automated, self-serve vision testing terminals, raised $6 million in seed funding. AlleyCorp and Ubiquity Ventures led the round and were joined by Humba Ventures, Ravelin, Spacecadet, and existing investors.

– Sware, a Boston, Mass.-based provider of a software validation solution for life science companies, raised $6 million in Series B funding. First Analysis led the round and was joined by existing investors LRVHealth, New Stack Ventures, and Insight Partners.

– OneScreen.ai, a Boston, Mass.-based platform designed to connect startups with out of home advertising opportunities like billboards or subway ads, raised $4.7 million from Asymmetric Capital Partners, Techstars, and Impellent Ventures.

– Greptile, a San Francisco-based platform designed to let engineers use natural language to index and search large codebases, raised $4.1 million in seed funding. Initialized Capital led the round and was joined by angel investors.

PRIVATE EQUITY

– Aterian Investment Partners acquired Contract Pharmaceuticals Limited Canada, a Mississauga, Canada-based contract development and manufacturing organization of non-sterile liquid and semi-solid pharmaceutical products. Financial terms were not disclosed.

– B&R Auto, a portfolio company of Highview Capital, acquired Reno Auto Wrecking, a Reno, Nev.-based provider of recycled automotive parts to collision and repair centers. Financial terms were not disclosed.

– Charlesbank Capital Partners acquired a majority stake in Quorum Cyber, an Edinburgh, Scotland-based cybersecurity firm. Financial terms were not disclosed.

– Hop Lun, a portfolio company of Platinum Equity, acquired P.H. Garment, a Hong Kong-based manufacturer of bras, shapewear, and activewear. Financial terms were not disclosed.

– Right Time Group of Companies, backed by Gryphon Investors, acquired Belyea Bros, a Toronto, Canada-based provider of heating, cooling, electrical, and other home services. Financial terms were not disclosed

– JSI, a portfolio company of Stone-Goff Partners, acquired Inteserra, an Alpharetta, Ga.-based compliance and advisory firm for the telecommunications business. Financial terms were not disclosed.

– Sylvan, a portfolio company of Blue Point Capital Partners, acquired Anchor Conveyor Products, a Dearborn, Mich.-based producer of conveyor components. Financial terms were not disclosed.

– Turnspire Capital Partners acquired Swanson Industries, a Morgantown, W.V.-based provider of manufacturing, repair, and other services for mining equipment and related industrial equipment, and Tiefenbach North America, a Morgantown, W.V.-based supplier and servicer of hydraulic products. Financial terms were not disclosed.

– Yellow Wood Partners acquired Elida Beauty, a London, U.K.-based portfolio of consumer brands including Q-tips, Caress, and Ponds, from Unilever (NYSE: UL). Financial terms were not disclosed.

EXITS

– nVent Electric (NYSE: NVT) agreed to acquire a majority interest in Trachte, an Oregon, Wis.-based manufacturer of steel substation control buildings and electrical equipment enclosures, from Palladium Equity Partners, for $695 million.

– Tenex Capital Management acquired Behavioral Innovations, a Dallas, Texas-based provider of behavioral analysis therapy to children with developmental disabilities, from Shore Capital Partners. Financial terms were not disclosed.

– The Access Group acquired Sceptre Hospitality Resources, a Houston, Texas-based provider of Ai-powered tools and software designed to improve hotel revenue and efficiency, from Serent Capital. Financial terms were not disclosed.

OTHER

– Dolby Laboratories (NYSE: DLB) agreed to acquire GE Licensing, a Boston, Mass.-based intellectual property business focused on the consumer digital media and electronics sectors, for $429 million in cash.

FUNDS + FUNDS OF FUNDS

– Aquiline Capital Partners, a New York City, London, U.K., Philadelphia, Pa., and Greenwich, Conn.-based private equity firm, raised $2.3 billion for their fifth private equity fund and $1.1 billion for their continuous fund, both focused on financial services and related technologies.