The Main Item

Let’s not kid ourselves about the state of venture investing.

At first blush, the latest funding numbers sound okay. There was an uptick in venture funding in the second quarter compared to the start of the year. A handful of top-tier, multi-stage VCs with a lot of dry powder were still writing huge checks to artificial intelligence startups. Crunchbase reports that funding ticked up to $31 billion globally in May, the most since September 2023—but more than a third of it went into just six deals, including Elon Musk’s $6 billion xAI round.

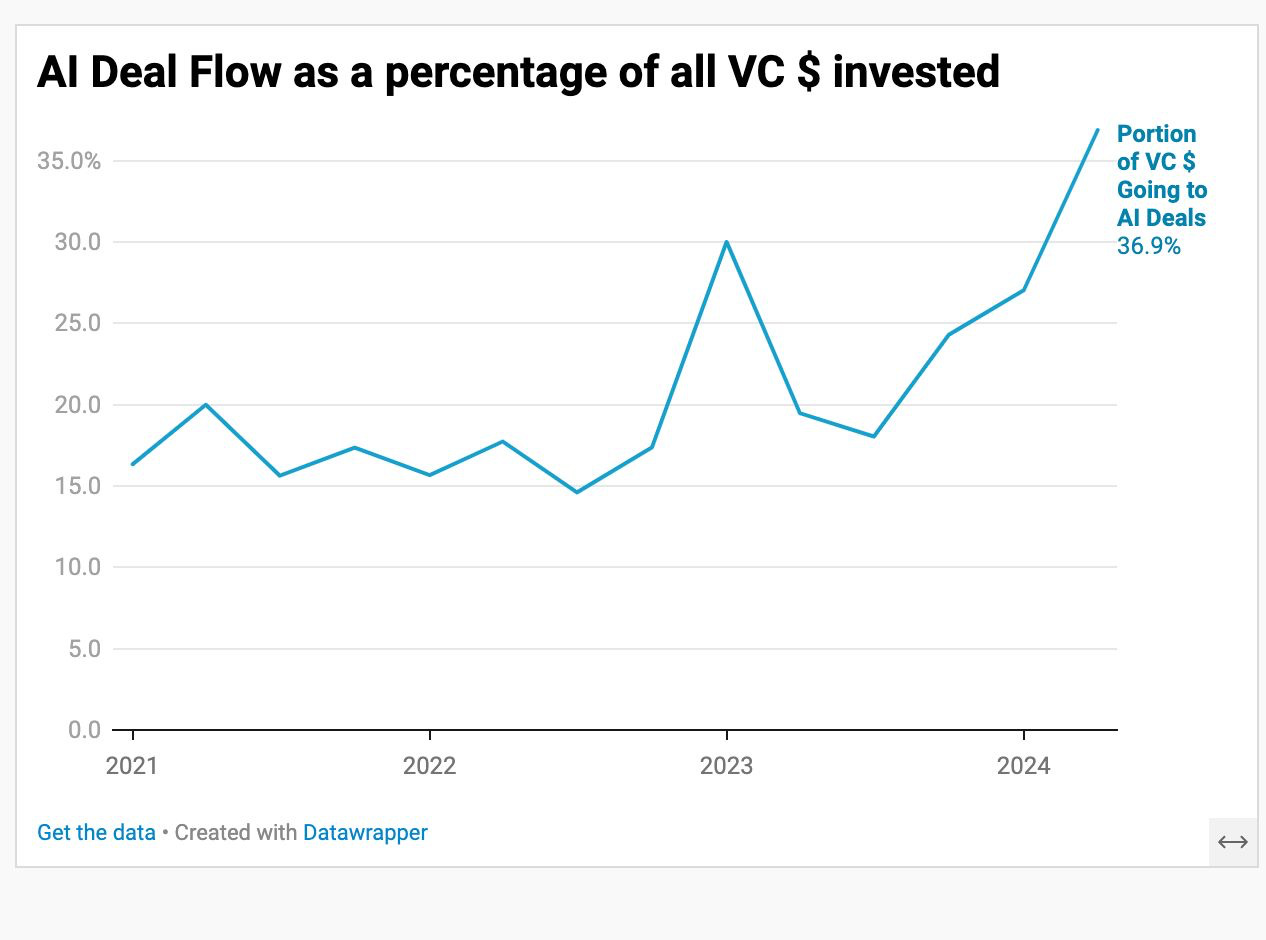

Big artificial intelligence deals are papering over an otherwise brutal startup downturn.

In particular, software-as-a-service companies, the bread and butter for many VCs over the past decade, are having a rough go of it as enterprise customers look to cut costs and rationalize years of heavy software spending.

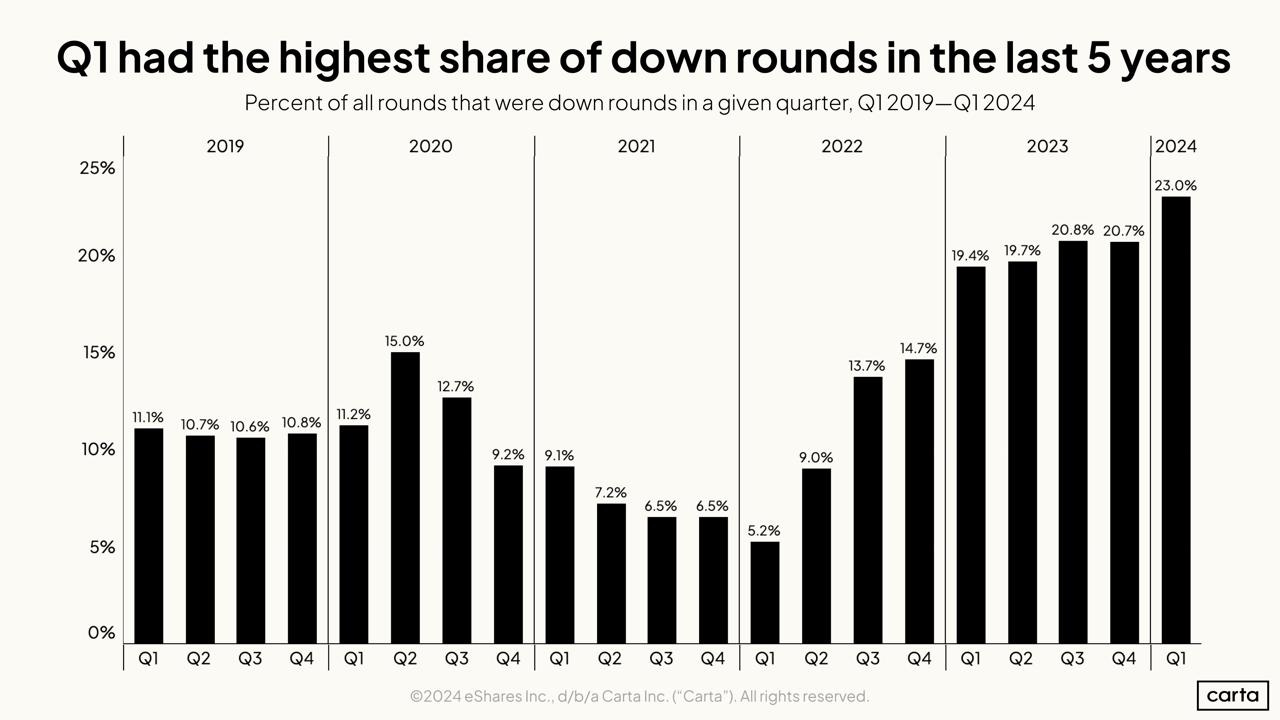

Across the startup industry, down rounds are on the rise.

New data from PitchBook, Crunchbase, and Carta indicates that the AI frenzy may not be enough to make up for the downturn in venture capital funding. It seems hard to believe we are going to climb out of the doldrums this year. We’re still in the slow comedown from the insanity of 2021.

All that adds up to a longer recovery period than anyone wants. But that’s how these things go. Back in 2008, during the last big downturn, it took until 2011 for the venture funding to pick back up, Crunchbase reports. And that was considered a V-shaped recovery, especially compared with the long slog after the 2000 Dot Com bust.

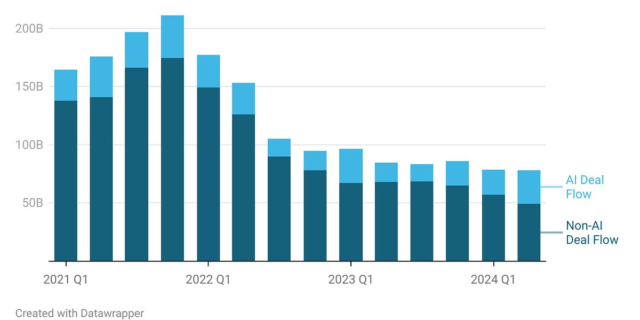

PitchBook’s quarterly VC funding numbers dating back to 2021 show how AI deals are buoying the market even as investment remains far below the boom-time peaks. (Of course if you’re out fundraising right now and not trying to brand yourself as an AI company, what are you even doing?)

Two Big Charts

The weakness of SaaS companies, both public and private, also shows how drastically the market has divided between AI and everybody else.

There have only been 21 SaaS funding rounds of $100 million or more so far this year, Crunchbase reports. Back in 2021, there were 147 deals of that size. Jason Lemkin of SaaStr argues that only 10% to 15% of VC-backed startups can raise another round right now, because only a small subset of companies can hit the growth targets that investors want to see.

“Every enterprise is focused on getting more efficient. Software’s an easy place to cut, as a high-margin recurring revenue product,” said Rick Heitzmann, managing director of FirstMark Capital. “Even the public companies are slowing—UIPath and Salesforce also disappointed and lost billions of market cap each.”

With many companies that raised a few years ago sporting very fat valuations, down rounds are becoming much more common: Carta’s numbers show that Q1 of this year had the largest uptick in down rounds in five years.

As I learned from Carta’s head of insights Peter Walker, this down round data doesn’t include all of the startups raising bridge rounds on convertible notes or SAFEs, a practice that was rare back in 2019 but has since picked up in frequency.

Those financial vehicles can help startups avoid down rounds. They also mean that VCs don’t need to mark down their investments when they report back to their LPs, Walker explained.

Higher interest rates are the basic explanation for the venture retreat. Rock-bottom rates had supercharged interest in the sector, since riskier investments are more attractive when there’s hardly any yield to be had in safer bonds and stocks. Now the flow of institutional capital is reversing. But ultimately startups need to show they can generate profits to justify their valuations.

For venture capital firms, limited partners are just now seeing early results from their boom-time vintages, and so far some aren’t looking good. Flush with cash in 2020-2021, many VC funds lost their minds and let valuation multiples soar towards infinity.

LPs seem to have decided that the big venture firms with established track records can take a mulligan for their 2021 deals. But for everyone else, especially young venture capital firms, the deals they did in 2021 are going to hang around them like an albatross.

The big prestige funds like Sequoia, a16z, General Catalyst, and Lightspeed are now in a more privileged spot than ever, with brand names and many years of strong returns shielding them from restive LPs. Crunchbase reports that a16z and General Catalyst led the most rounds out of any firms in May, at 10 and 8 deals each.

A16z just raised new multi-billion-dollar funds, and Lightspeed has been deploying rapidly into a range of AI application companies like Suno and Glean. The multi-stage VC funds are also facing far less competition on growth-stage deals from the likes of Tiger Global and Coatue.

Emerging managers and smaller funds–especially those that haven’t returned actual money to their investors—face much tougher prospects. As LPs focus more on DPI—a measure of the capital returned back to them relative to their investment—the flight to quality will only increase, explained Beezer Clarkson, who leads Sapphire Partners’ investments into other venture funds.

“Any venture firm, emerging or established, that is over 8 years old and doesn’t have DPI is having a tougher raise as LPs concentrate dollars into managers in which they have higher conviction,” she said.

But even the massive blue-chip firms are being forced to get creative. Eric touched last week on Sequoia’s swing towards late stage-deals and secondary share purchases for its most promising private companies, such as SpaceX. General Catalyst is looking more and more like a private equity firm with its move to purchase a health system.

Of course, the best way for the mood to improve would be if we saw some tremendous exits.

On the M&A side, the antitrust fervor isn’t helping. And some deals are looking bad in retrospect: Vista Equity’s $3.5 billion writedown of its Pluralsight acquisition isn’t going to give anyone confidence.

Meanwhile, the IPO window should be open. Big tech stocks are doing well. Dan Primack recently highlighted the IPO shortage, essentially pleading with companies to go public. But few startups are taking his invitation.

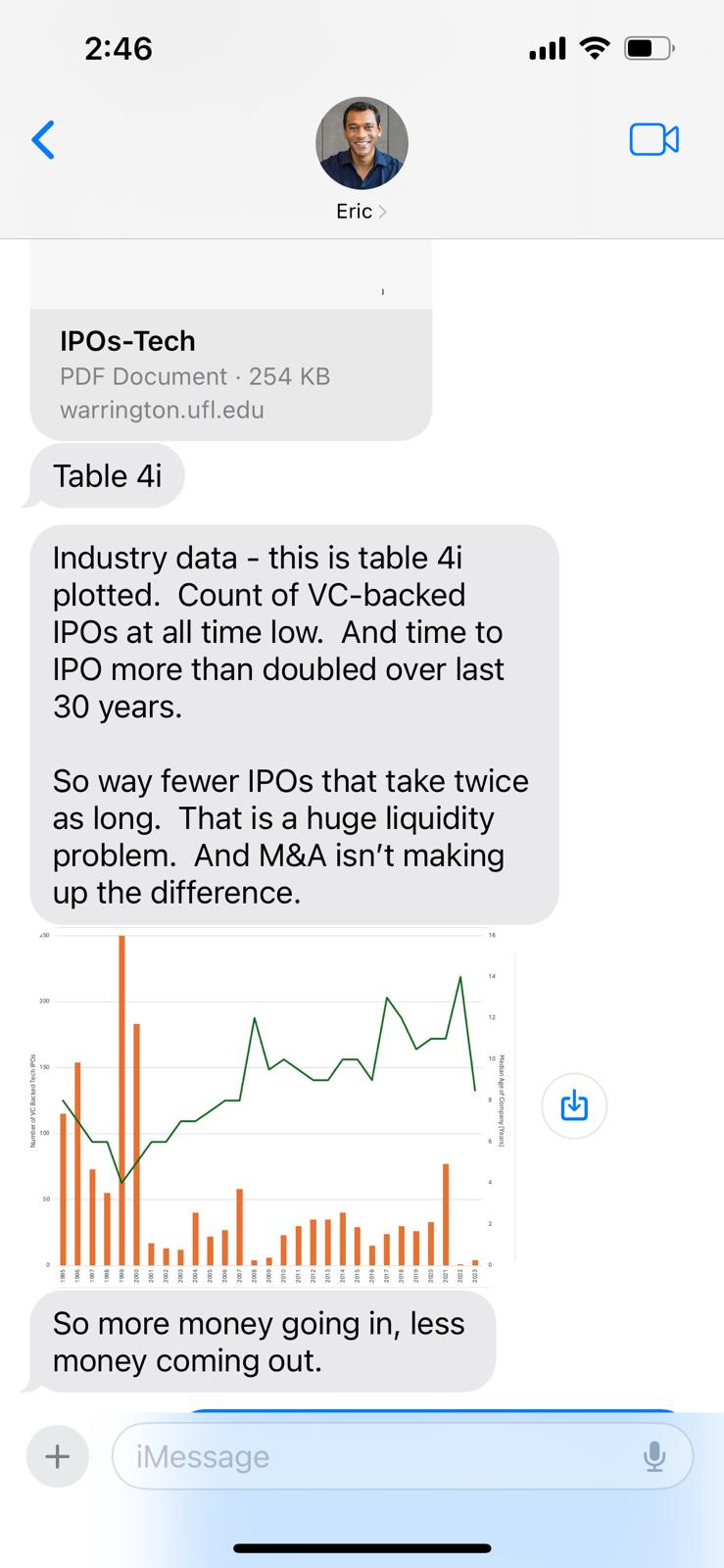

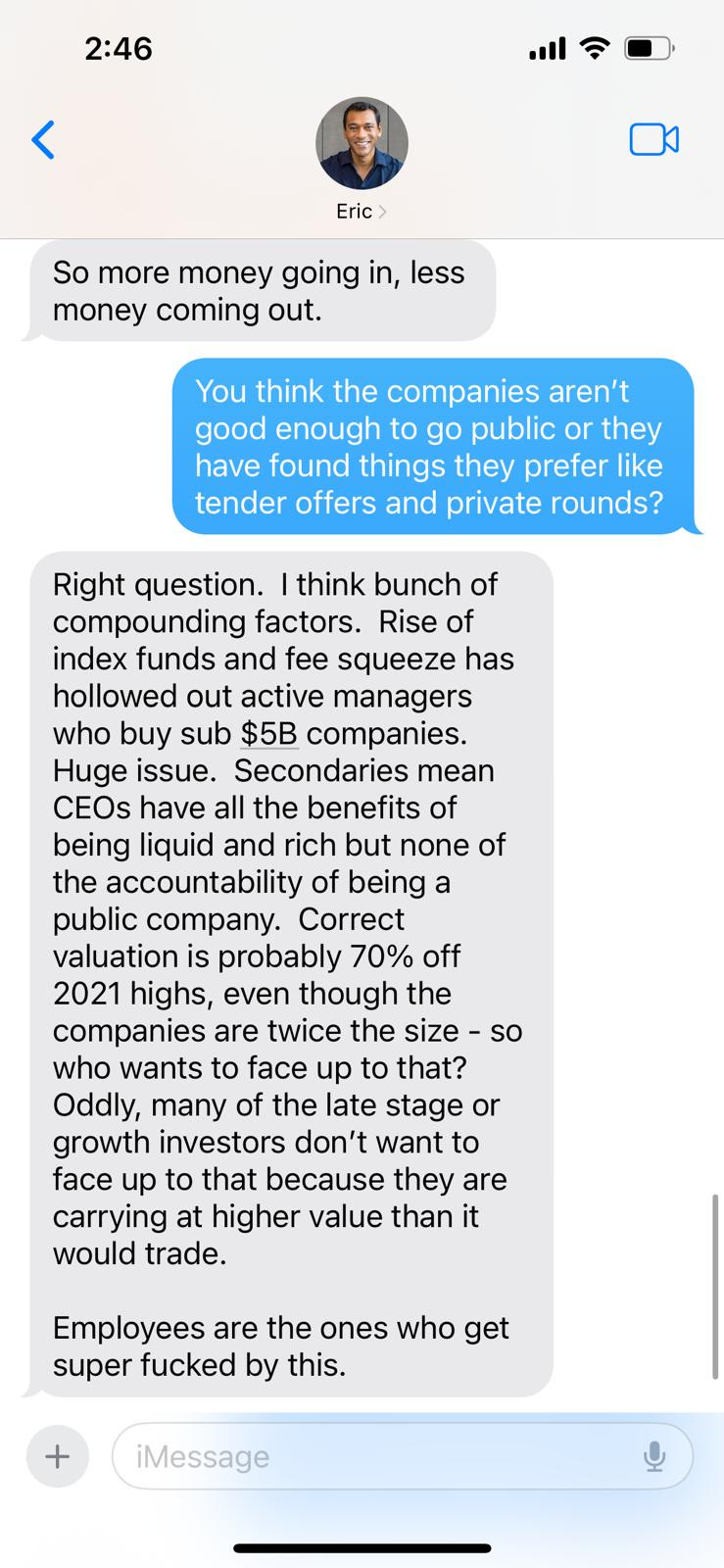

Explaining the sad state of startup exits, Benchmark’s Eric Vishria pointed to data on the abysmal state of the IPO market for the last two years in a text exchange, arguing that pumped-up valuations and CEOs cashing out in tender offers has only exacerbated the backlog.

There were only four VC-backed IPOs in 2023, according to IPO expert Jay Ritter, and only one in 2022.

With the presidential election coming up, even the meager pipeline of IPOs is likely to be frozen in place by the fall. VCs would do well to enjoy their slow summer, and brace themselves for a long winter.