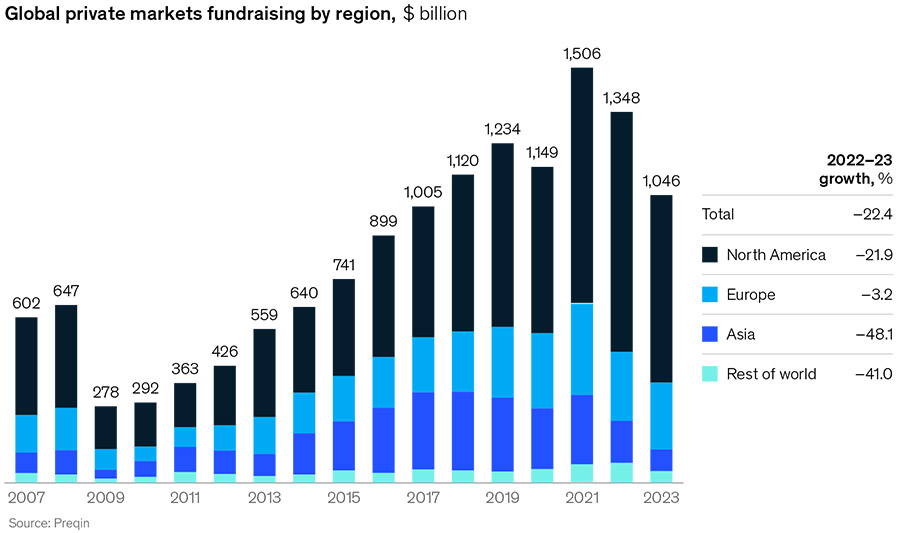

Fundraising by private sector companies and funds fell to a six-year low last year, hitting just over $1,000 billion, with Asia the region impacted the most. This is according to research from McKinsey & Company.

On the heels of two consecutive years of record-breaking performance, global private markets fundraising dipped 22% in 2023 to $1.0 trillion, the lowest total since 2017. Notably, fundraising declined from the prior year in every asset class and region.

In North America, fundraising declined 22%, led by large drops in infrastructure, natural resources, and real estate funding. Fundraising in Asia received the biggest hit, down 48% to a 13-year low, while Europe showed the most resilience, at minus 2% to $243 billion, accounting for just under a quarter of the global market.

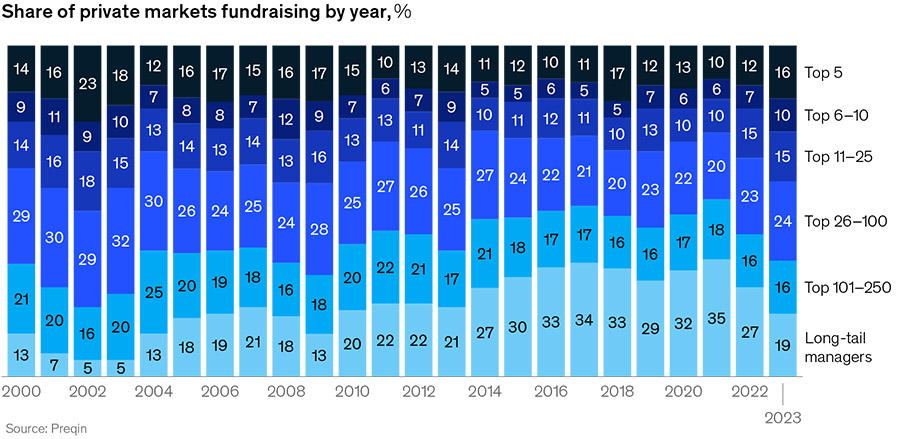

McKinsey & Company highlights that the drop in funding was in part due to smaller funds struggling to deal with the sluggish environment. Only 1,650 funds of less than $1 billion closed during the year, the fewest since 2012 and about half the number formed in 2022.

Consequently, the top 25 fund managers amassed 41% of all funds raised, the most since 2008. Ann the top ten managers alone captured 26% of all fundraising activity globally.

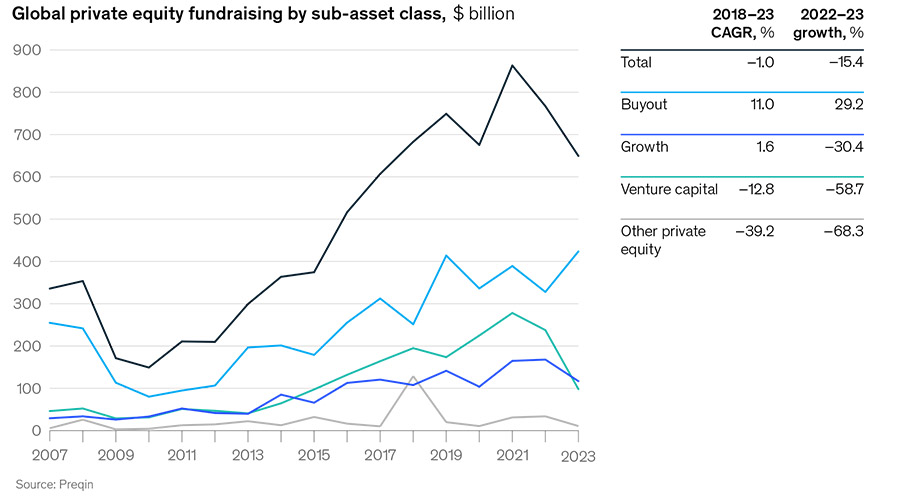

Private equity

One of the largest segments within private sector fundraising is private equity, which last year saw its capital raised fall 15% to $649 billion. Main reasons for the drop are according to the researchers: a more conservative deals environment (both deal activity volume and count fell sharply), high interest rates, more caution among investors, and broader geopolitical uncertainty.

Funds focused on venture capital and growth equity strategies led the decline, dropping to their lowest level of cumulative capital raised since 2015.

Despite the drop in aggregate fundraising, assets under management of private equity firms increased 8% to $8.2 trillion, mainly due to better performance of existing portfolio assets.

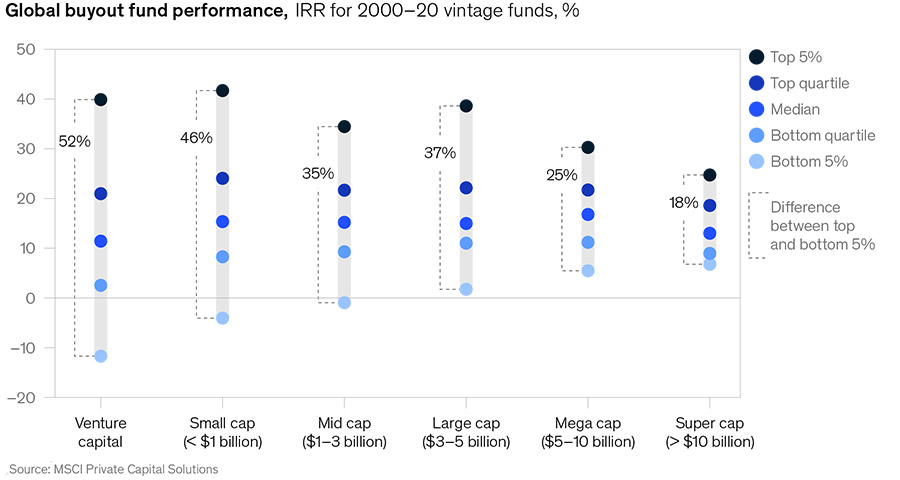

The report also found that while the returns on investment of different fund sizes are roughly comparable, larger funds have a lower dispersion in their returns.

The authors conclude from this analysis that private equity fund strategy matters – “optimal fund strategy and portfolio management matters greatly for returns that financial sponsors achieve.” It also explains in part why the largest funds are only getting larger (more popular), and why consolidation is to a larger extent taking place in the long-tail of the market.

Looking ahead at 2024, McKinsey & Company’s experts expect many of the headwinds that emerged last year – including inflation, high interest rates, slow economic growth and the impact of conflict – to persist throughout the year, pressuring fundraising, dealmaking, and performance.