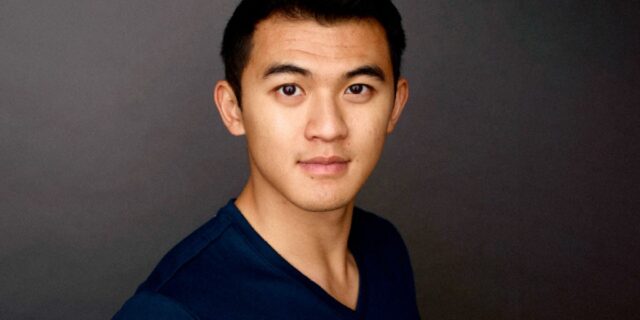

Happy Friday. This week, Leo Schwartz published a devastating profile of Yida Gao, a young venture capitalist whose sparkling resumé ticked all the boxes for success: Phi Beta Kappa honors, a stint at Morgan Stanley, and even a teaching gig to succeed Gary Gensler at MIT, where Gao had received his computer science degree.

But credentials are no guarantee of integrity and as Leo’s feature reveals, Gao was willing to cut corners when it came to the rules for handling investor money. Most notably, he raised $200 million for his crypto venture fund Shima from prominent backers like Dragonfly Capital but redirected portions of it to a secret overseas company without telling his investors. While Gao has not been charged with a criminal act, and Shima has suggested the unusual arrangement was a version of “warehousing” that VC funds engage in while raising money, at least one observer suggests it is a violation of at least one SEC law.

It’s also telling that the value of Shima’s assets under management has fallen to $158 million and that Gao is struggling to raise more funds despite the crypto market going gangbusters. Meanwhile, Shima in the past had a hard time finding an auditor (though it currently has retained a Cayman-based entity)—an unusual problem for a U.S. venture firm and one that does reflect well on its behavior.

How did things get to this point? As the report notes: “Several investors, prospective backers, and would-be portfolio companies described Gao and his team to Fortune as young and inexperienced people who didn’t really know what they were doing but rode the crypto wave nonetheless.”

In other words, it appears Gao won the trust of prominent backers even though he may have lacked the requisite experience or character. It looks to be a case of a young entrepreneur relying on his association with prestigious institutions to take unacceptable risks and paper over his flaws. Sound familiar? Be sure to make time to read Leo’s whole report. Have a great weekend.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

Kraken is seeking to raise $100 million in a final funding round ahead of a long-deferred IPO, and to add a “marquee” company to its board. (Bloomberg)

The Coinbase-backed lobby group Stand With Crypto announced they reach 1 million members this week. (CoinDesk)

Telegram has a new currency, called Stars, for buying good and services in its “mini apps” that developers can redeem for the app’s TON cryptocurrency. (Decrypt)

Bitcoin ETFs attracted net inflows for a record 18 consecutive days as the crypto boom rolls on. (Bloomberg)

A Solana-based memecoin called GME—which has the same symbol but lacks any affiliation with Gamestop—is going crazy as Roaring Kitty madness returns. (CoinDesk)