At Fortune’s Most Powerful Women Dinner in San Francisco, Murati clapped back at Elon Musk, talked up OpenAI’s commitment to privacy, touted new executive hires, discussed Apple, circumnavigated IPO questions, and overall hammered home the message that OpenAI is in its “next phase.”

All of this lines up pretty clearly with what we know to be true: that for all the day-to-day drama that OpenAI is embroiled in, the company is still very clearly at the top of the AI heap.

So sure, call it the company’s “next phase” as Murati does, but what I’d argue is that there’s something more nuanced going on right now: OpenAI’s path forward is clearing. After Sam Altman’s November boardroom saga, the AI startup now seems to have so many newsworthy irons in the fire that they might outshine and overshadow all that troublesome “old news.”

Take OpenAI’s partnership with Apple, which launched this week—Murati spent time at the dinner talking about privacy, as OpenAI and Apple start the process of integrating ChatGPT into features on iPhones. “We’re trying to be as transparent as possible with the public,” she said.

Elon Musk’s best effort to slime the OpenAI-Apple deal by branding it “creepy spyware” hasn’t gotten much traction, and Murati casually flicked away Musk’s assessment like a gnat on her shoulder: “That’s his opinion. Obviously I don’t think so.”

Some other Muskian clouds also cleared up on Tuesday when the billionaire—who despite cofounding OpenAI has become one of its most blazingly vocal critics—dropped his lawsuit against OpenAI. That’s got to be a relief for a startup that’s drawn reality TV levels of big-name drama. It’s impossible to know what the fate of that lawsuit would have been, but it’s clear it would have attracted the sort of headline-grabbing scrutiny OpenAI just doesn’t want while it’s trying to roll out ChatGPT in all our Siris.

All of this to say: Things are looking up for OpenAI this week, with another vaunted Big Tech endorsement on the books and an evaporated Musk lawsuit. You know how in an Indiana Jones movie, there’s usually a moment where Harrison Ford has successfully traipsed through a murky cave or slashed through a dense jungle with a machete, coming out on the other side into the light? It’s a bit like that. They’ve survived a giant pile of snakes, with an asterisk.

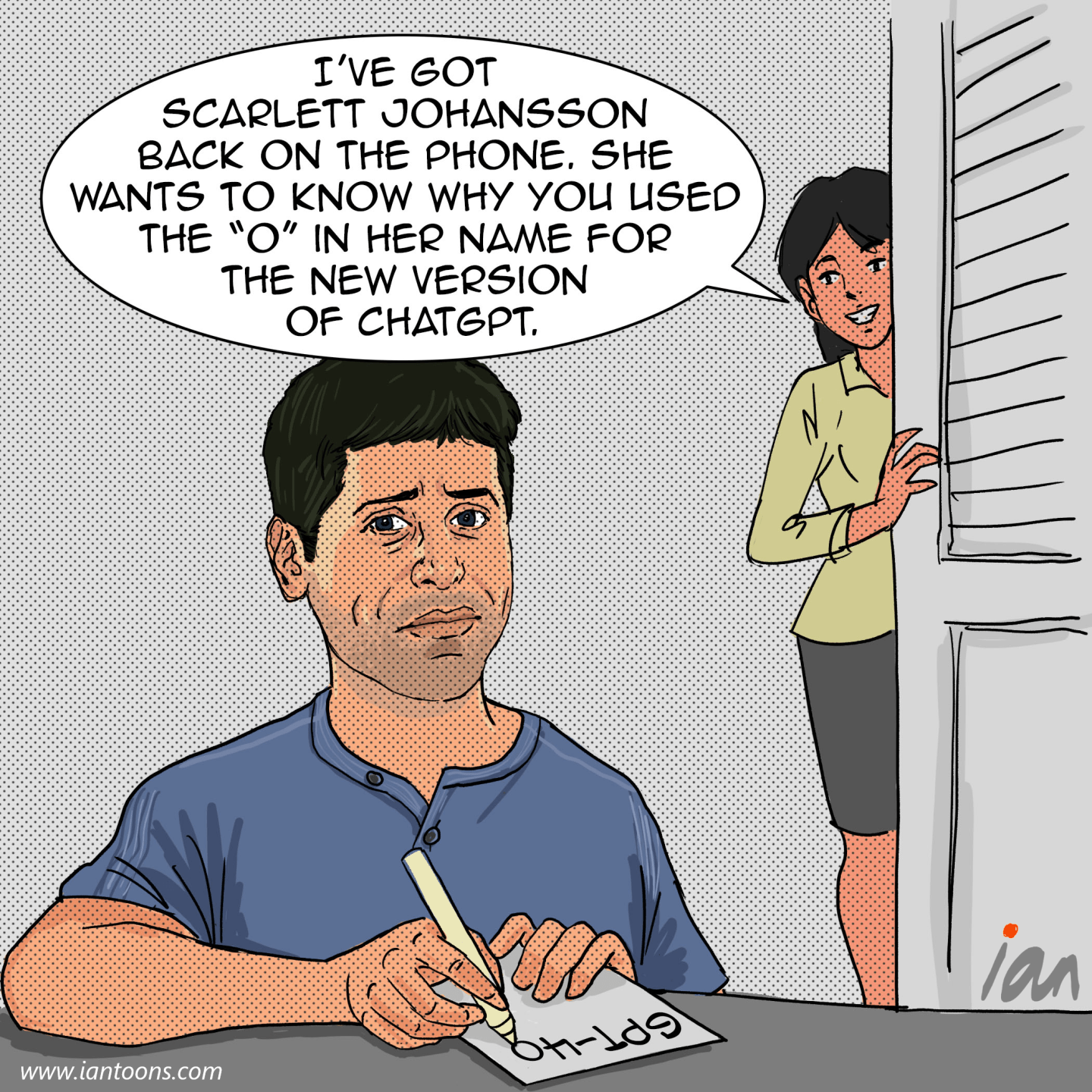

As much as OpenAI hopes to leave the tangle of troubles behind it, it’s not going to be easy. Old problems recede or resolve, new ones come to the fore and, for OpenAI, they could be equally high-profile problems: This week, for example, it was also reported that Scarlett Johansson may testify in Congress about OpenAI and its alleged use of her voice. There are still concerns about Altman’s ouster: Murati’s explanation at the Fortune dinner described it as a problem of “oversight,” but forgive me if it still sounds like there’s more to the story.

Then, there’s the tech itself, because when it comes to generative AI, the next scandal is always just one hallucination away.

Elsewhere…The Federal Reserve held interest rates steady yesterday, sending up a smoke signal that they’re only cutting rates once this year. For everyone else keeping score, we went into this year with three expected rate cuts on the theoretical books. I’ve written before that these rates are actually, when taken in historical context, not high at all. But that doesn’t mean this is easy.

This month’s cartoon…Here’s our June cartoon, by Ian Foley.

See you tomorrow,

Allie Garfinkle

Twitter: @agarfinks

Email: alexandra.garfinkle@fortune.com

Submit a deal for the Term Sheet newsletter here.

Joe Abrams curated the deals section of today’s newsletter.

VENTURE DEALS

– Cognigy, a Düsseldorf, Germany-based developer of AI customer service agents, raised $100 million in Series C funding. Eurazeo Growth led the round and was joined by Insight Partners, DTCP, DN Capital, and others.

– Canary Technologies, a San Francisco-based developer of hotel guest management technology, raised $50 million in Series C funding. Insight Partners led the round and was joined by existing investors F-Prime Capital, Thayer Ventures, Y-Combinator, and Commerce Ventures.

– Swift Solar, a San Carlos, Calif.-based solar technology company, raised $27 million in Series A funding. Eni Next and Fontinalis Partners led the round and was joined by Stanford University, Good Growth Capital, BlueScopeX, Hl Ventures, and others.

– ElectronX, a Chicago, Ill.-based exchange of electricity-related derivatives designed to support the transition to clean energy, raised $15 million in seed funding. Innovation Endeavors led the round and was joined by DCVC, Amplo, BoxGroup, and Lightning Capital.

– Grayce, a San Francisco-based social care platform for families, raised $10.4 million in Series A funding. Maveron led the round and was joined by BBG Ventures, Correlation Ventures, GingerBread Capital, Alumni Ventures, Visible Ventures, Gaingels, and What If Ventures.

– Radian Arc, a Subiaco, Australia-based developer of cloud infrastructure and cloud gaming technology, raised $9 million in Series B funding. BITKRAFT Ventures led the round and was joined by AMD Ventures, Boston, and Saffelberg.

– Aepnus Technology, an Oakland, Calif.-based developer of an electrochemical platform designed to reduce emissions in chemicals used in the battery supply chain, raised $8 million in seed funding. Clean Energy Ventures led the round and was joined by Voyager Ventures, Lowercarbon Capital, Impact Science Ventures, Muus Climate Partners, and Gravity Climate Fund.

– Restate, a Berlin, Germany-based platform for building applications, raised $7 million in seed funding. Redpoint Ventures led the round and was joined by Essence VC, firstminute.capital, and angel investors.

– InScope, a San Francisco-based automation platform for financial reporting and technical accounting tasks, raised $4.3 million in seed funding. Lightspeed Venture Partners and Better Tomorrow Ventures led the round and was joined by others.

– PLATMA, a Wilmington, Del.-based no-code software development platform, raised $1.9 million in pre-seed funding. Almaz Capital led the round and was joined by MOST Ventures, Activat VC, and others.

PRIVATE EQUITY

– 3t, backed by Bluewater, acquired ALL STOP!, a Houston, Texas-based training services company for the energy, wind, and other sectors. Financial terms were not disclosed.

– Civic Renewables, a portfolio company of GEF Capital, acquired Green Rack Solar, a Pittsburgh, Pa. and Columbus, Ohio-based residential solar installer, and Ipsun Solar, a Wahsington, D.C. and Fairfax, Va.-based residential and commercial solar installer. Financial terms were not disclosed.

– EQT agreed to acquire a majority stake in CluePoints, a Louvain-La-Neuve, Belgium-based provider of risk-based quality management software for clinical trials. Financial terms were not disclosed.

– Everfox, backed by TPG, agreed to acquire Garrison Technology, a London, U.K.-based cybersecurity company. Financial terms were not disclosed.

– Stellex Capital Management recapitalized TriplePoint MEP, a Houston, Texas-based mechanical services provider. Financial terms were not disclosed.

EXITS

– A consortium of ES-KO, Phatisa, and management agreed to acquire International Facilities Services, a Mauritius-based facilities management business, from Development Partners International. Financial terms were not disclosed.

– Everfox acquired Garrison Technology, a London, U.K.-based cybersecurity firm, from BGF. Financial terms were not disclosed.

– Simulations Plus (Nasdaq: SLP) acquired Pro-ficiency, a Raleigh, N.C.-based provider of training and compliance solutions for clinical trial investigators and staff, from QHP Capital. Financial terms were not disclosed.

OTHER

– Voodoo acquired BeReal, a Paris, France-based social media platform, for €500 million ($541 million).

IPOS

– NIP, a Stockholm, Sweden-based esports organization, filed to go public on the Nasdaq. The company posted $84 million in revenue for the year ending December 31, 2023. Seventh Hokage Management Limited, Digilife AS, Liwei Sun, Nyx Ventures, Tolsona, and Shanghai Yuyun Management Partnership back the company.

FUNDS + FUNDS OF FUNDS

– Foresite Capital, a Los Angeles, Calif, New York City, and San Francisco.-based venture capital firm, raised $900 million for its sixth fund focused on life sciences and health care companies.

– Parquest, a Paris, France-based private equity firm, raised €414 million ($448.5 million) for their third fund focused on small-to-medium-sized business-to-business and healthcare companies.

PEOPLE

– Permira, a London, U.K.-based private equity firm, promoted Brian Ruder and Dipan Patel to co-managing partners and co-CEOs.

– Pritzker Private Capital, a Chicago, Ill.-based private equity firm, hired Anna Edgcomb as vice president-manufactured products and Alyson Brown as vice president-services. Edgcomb was previously with PPC but left to pursue an M.B.A. at the University of Chicago and Brown was formerly with Wind Point Partners.