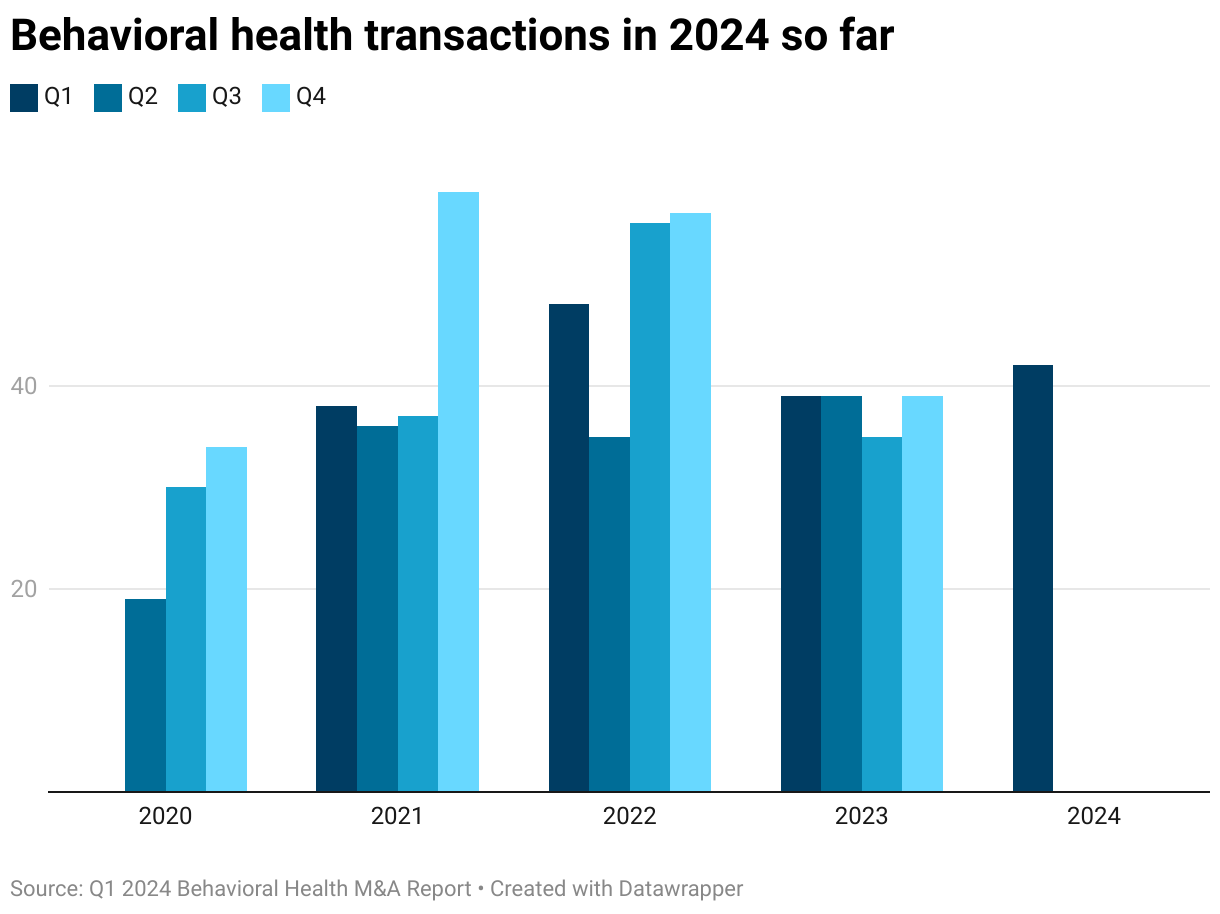

The behavioral health industry appears to have found a new, historically elevated floor for deal flow in the year’s first quarter. Since the beginning of 2023, quarterly deal totals tracked by the M&A firm Mertz Taggart have been at about 40 transactions.

The first quarter of 2024 brought much of the same, with a few more than other quarters: 42 in total, according to the firm’s latest report. The stability shows that behavioral health shows relative resilience to the many pressures tamping down on health care deal volume generally.

Private equity investors continue to be the primary drivers of dealmaking. However, venture capital firms have increasingly engaged in “growth equity” deals where they buy minority stakes in companies they believe demonstrate high scalability. VCs were involved in the 18 growth equity deals the firm tracked.

“To use a baseball metaphor, private equity hits singles and doubles more consistently by either acquiring a majority interest in established behavioral health companies or buying them outright,” Kevin Taggart, founder and managing partner for the firm, said in the report. “Venture capital firms are swinging for the fences with these types of growth investments in startups.

“That approach yields a lot more strikeouts, but also the occasional grand slam.”

The report states that venture capital firms invested about $350 million in the first quarter.

Most venture capital firms’ high-risk/high-reward strategy means they are looking for the next big thing. They also consider the meteoric rise of companies like Refresh Mental Health and LifeStance Health Group (Nasdaq: LFST) as compelling examples of getting the investment thesis right for the space.

The report states that there were 24 “control positions” deals, and eight platform deals.

Interest rates are among the headwinds in behavioral health M&A. The historically high rates have squeezed the financials of highly leveraged companies. If maintained, that pressure could have a magnified impact. Meanwhile, “as banks become more diligent, debt financing becomes harder for buyers to obtain, and covenants with financial institutions [will] become stricter.”

Another headwind includes the heightened scrutiny that the state and federal governments are laying on health care dealmaking. The federal company has launched an initiative to examine the matter, and several states are enacting laws that make deal making more complex. Previous reporting by Behavioral Health Business found that the federal probe may slow dealmaking but not extinguish deals altogether as specific sectors continue to see high-powered growth and demand.

Often, private equity investments in the behavioral health space are about growing and expanding the reach and capabilities of a company. The huge demand and lack of access to services make it compelling to invest for growth and difficult to justify the kind of consolidation at play in the acute and post-acute sectors of the health care economy.

“Smart PE firms tend to understand that those companies that can save the health system money and provide quality patient outcomes will be most attractive,” Taggart said. “To do that, they need to continue to invest, scale and standardize. This is an incredibly underserved market that needs investment to grow.”