Between 2023 and 2024, CVC and family office deal volumes in India surged by approximately 1.8x , a clear indicator of their accelerating commitment

While CVCs do participate in early stages via accelerators and selective cheques, the heavier capital and lead roles skew toward Series A-late and B+ stages

Corporate venture arms of companies like ITC, JSW, and Aditya Birla have collectively backed over 500 startups

In the last decade, the Indian startup ecosystem hasn’t just grown; it’s matured, expanding its horizons across capital sources, scaling models, and operational depth.

This evolution is now being powered by a strong, quantifiable force: the emergence of Domestic Corporate Venture Capital (CVC) as a critical, strategic fourth pillar of the ecosystem.

For years, the story of Indian venture was told by three core classes: venture capital (VC) firms, angel investors, and family offices. While they remain the vital financial engine, their focus is often prioritised towards financial returns and rapid scale.

Historically, Indian corporates focused on traditional value return mechanisms, such as dividends and internal R&D. But a crucial realisation has dawned in Indian boardrooms: disruptive innovation often happens faster outside the organisation than within.

This insight is reshaping priorities, unlocking dedicated CVC arms, and building bridges to the startups that are shaping their industries’ future.

This isn’t a passing trend; it’s a structural change.

Between 2023 and 2024, CVC and family office deal volumes in India surged by approximately 1.8x , a clear indicator of their accelerating commitment. However, while CVCs do participate in early stages via accelerators and selective cheques, the heavier capital and lead roles skew toward Series A-late and B+ stages.

Domestic CVCs are becoming essential to building a more resilient, sustainable, and strategically integrated ecosystem. In a selective market, CVCs are stepping up as true partners, complementing the crucial financial rigor brought by VCs.

Strategic Capital: Quantifying The Growth

Look at the market today – capital is returning. Total Indian VC funding rebounded to $13.7 Bn in 2024, a 1.4X increase from 2023, driven by a surge in deal volume. However, this funding resurgence remains uneven. Additionally, domestic capital is replacing foreign capital, and this is where CVCs can play a strong role. Many early stage founders still need hands-on operational support to move beyond initial milestones and toward sustainable growth, an area where few CVCs are currently active.

CVCs typically engage via two distinct clusters:

- Corporate Accelerators & Pilot Programs: At the pre-seed/seed stage (e.g., Reliance’s JioGenNext; Maruti Suzuki Accelerator/MAIL), these are primarily for pilots and vendor onboarding, with small or no equity cheques. They are excellent for proof-points and commercial access, but rarely primary capital

- Corporate Venture Arms: From seed to series B+, these arms (e.g., Wipro Ventures, Global CVCs like Qualcomm Ventures/Intel Capital) write follow-on-friendly cheques, scaling up at B+

Corporate venture arms of companies like ITC, JSW, and Aditya Birla have collectively backed over 500 startups. These are not passive investments; they are purpose-built to support product validation, customer acquisition, and operational scaling, perfectly complementing the financial rigor and governance of VCs.

This is where domestic CVCs deliver unmatched operational context.

The CVC Value Proposition: Context And Competence

What makes CVCs uniquely powerful is their ability to de-risk and accelerate startups, providing contextual support grounded in market realities, infrastructure, and deep domain expertise.

There are primarily 3 ways in which CVCs can add value:

Local Market Access & Distribution: CVCs bring a unique advantage to startups by providing immediate access to extensive nationwide infrastructure. For example, ITC next connects startups to large distribution networks, while RPSG capital ventures leverages Spencer’s retail footprint. This offers a swift pathway to market validation.

Deep Industry Expertise & Mentorship: With their rich operational experience, CVCs offer startups invaluable insights into regulation, compliance, and supply chain management. This strategic focus varies by sector:

- Enterprise/SaaS: Services-majors’ CVCs (Wipro, etc.) actively invest at seed/series-A to create immediate solution partnerships and co-sell motions

- Deeptech / Silicon / Edge AI: Global CVCs (Qualcomm/Intel) often engage early for strategic tech diligence and pilots, keeping dry powder for growth once validation is complete

- Mobility/Manufacturing: OEM programs (Maruti, TVS) begin with POCs/accelerators at seed, with smaller capital cheques until product integration risk is retired

- Regulatory & Licenses: DSP mutual fund, for instance, supports fintech startups in navigating India’s complex financial regulations. This guidance helps streamline execution

The “Halo Effect” & Strategic Credibility: Startups backed by leading corporate investors gain enhanced credibility, especially among businesses & potential customers. Participation from the likes of an Aditya Birla sends a strong signal of quality, acting as a powerful de-risker that can unlock further capital from venture capitalists and institutional investors.

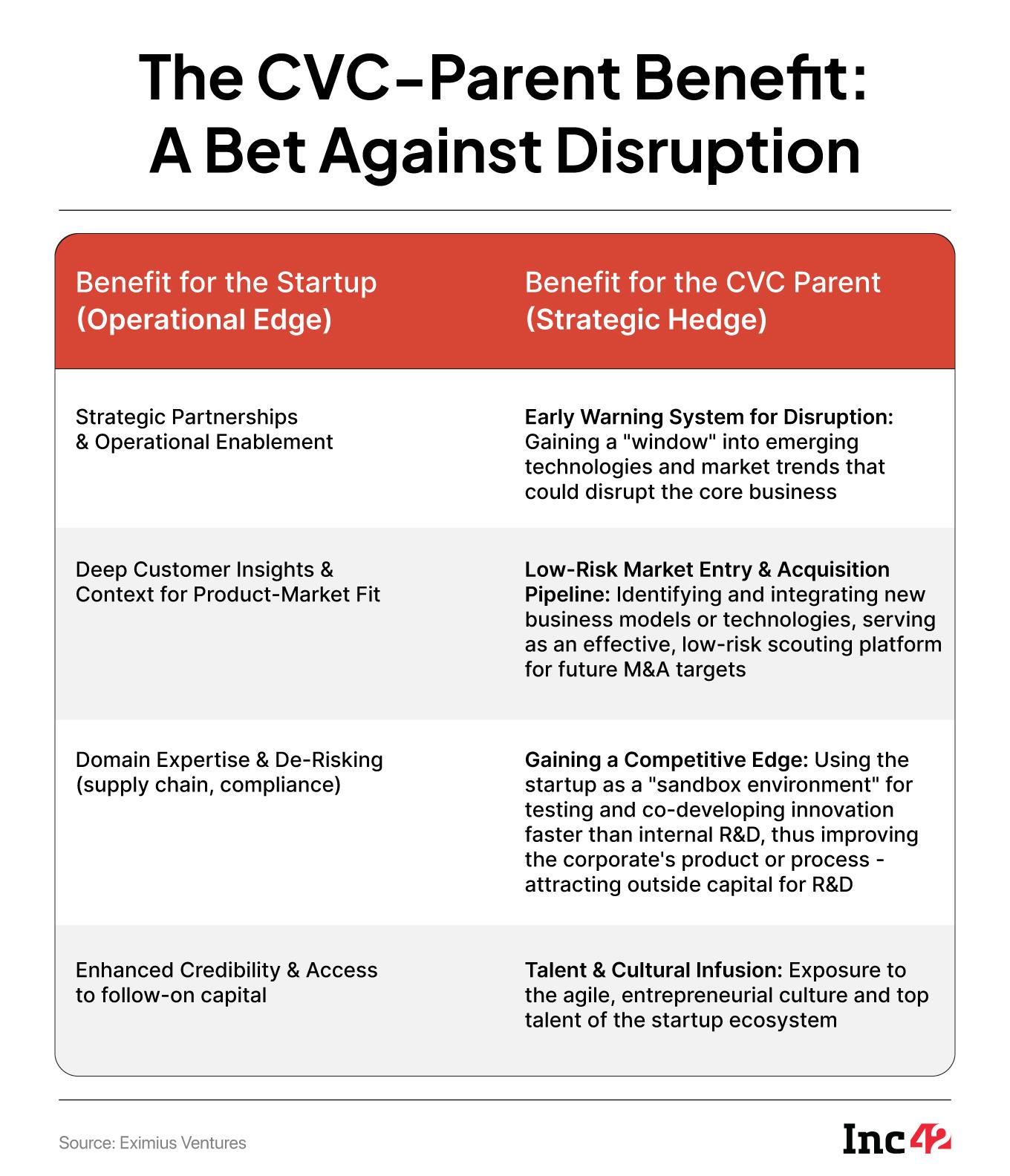

The CVC-Parent Benefit: A Bet Against Disruption

For the corporate parent, CVC investments are not merely a diversification play, they are a strategic bet against disruption and an external R&D function. The value-add flows both ways:

CVCs are thus an extension of the parent company’s innovation strategy, offering low-risk exposure to future growth engines. Take BPCL’s CVC, which has invested more than INR 88 Cr ($10.5 Mn) into 30+ startups across energy, AI, and sustainability, allowing the company to integrate cutting-edge solutions into its core operations faster than internal R&D ever could.

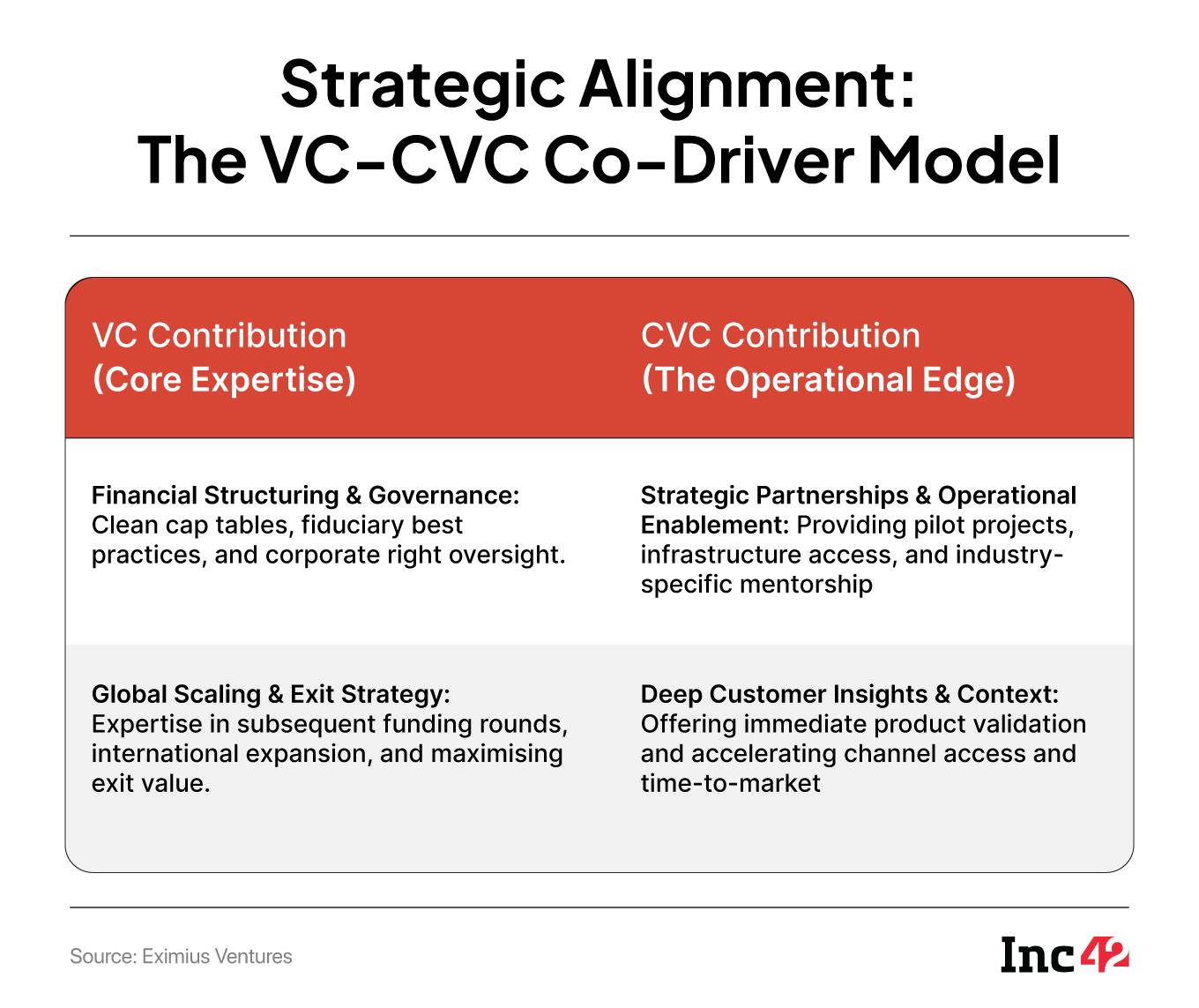

Strategic Alignment: The VC-CVC Co-Driver Model

The most powerful force in Indian venture today is not VCs or CVCs independently; it’s the combination of both. CVCs are emerging as highly complementary in the funding journey.

A VC, brings the essential financial expertise, rigorous governance, and future expansion channels. CVCs, in turn, provide the vital operational context, market access, and industry-specific enablement that dramatically accelerates the path to product market fit. Together, a full-stack capital model is formed.

This synergy is especially potent in sectors like consumer tech, AI manufacturing and fintech, where strategic integration coupled with capital is the need of the hour.

From Passive Investors To Ecosystem Builders

Domestic CVCs are no longer peripheral players; they are central to India’s innovation journey. The 1.8X increase in their deal volume is tangible proof of a fundamental shift.

Firms like RPSG Capital Ventures, Aditya Birla Ventures, HeroHatch, JSW Ventures, ITC Next, BPCL, Biocon Biovations, and Marico Innovation Foundation are actively building the next generation of Indian champions.

The capital comes with context and the networks come with access. And their involvement brings added trust, speed, and scale to startups operating in complex markets.

For India, they are shaping a more resilient, strategically integrated, and truly homegrown innovation engine, while simultaneously acting as the corporate parent’s most effective hedge against future disruption.