The TDR Three Key Takeaways:

1. High Crypto Adoption in Asia: Countries like the UAE and Vietnam are leading in cryptocurrency adoption, indicating a regional trend towards digital currencies.

2. Persistence Despite Regulations: In nations with strict crypto bans like China, people are still actively finding ways to access and invest in cryptocurrency, showing strong demand and determination.

3. Cryptocurrency Alternative Investment: Amid economic uncertainties and traditional market downturns, cryptocurrencies are increasingly viewed as alternative investments, reflecting their potential as economic stabilizers.

Asian nations are at the forefront of cryptocurrency adoption. Triple-A data indicates that the United Arab Emirates leads with a 30.39% adoption rate, closely followed by Vietnam at 21.19%. Other countries like the United States (15.56%), Iran, the Philippines, and Brazil are also significantly engaged with cryptocurrencies. China, with an adoption rate of 4.15%, shows a growing interest in digital assets, although its rate is lower compared to other countries. Despite the ban on crypto purchases in China, the population is actively seeking alternatives, often turning to Hong Kong or exploring other methods to acquire digital currencies.

| Country | Cryptocurrency Usage % Among Population |

| United Arab Emirates | 30.39% |

| Vietnam | 21.19% |

| United States | 15.56% |

| Iran | 13.46% |

| Philippines | 13.43% |

| Brazil | 11.99% |

| Saudi Arabia | 11.37% |

| Singapore | 11.05% |

| Ukraine | 10.57% |

| Venezuela | 10.30% |

| South Africa | 10.00% |

| El Salvador | 10.00% |

| Argentina | 9.73% |

| Thailand | 9.61% |

| Canada | 7.00% |

| Pakistan | 6.60% |

| India | 6.55% |

| Mexico | 6.55% |

| Russia | 6.06% |

| Nigeria | 5.93% |

| Germany | 5.78% |

| United Kingdom | 5.74% |

| Turkey | 5.62% |

| Kenya | 5.08% |

| Morocco | 5.08% |

| Colombia | 4.96% |

| France | 4.72% |

| Nepal | 4.56% |

| Indonesia | 4.40% |

| China | 4.15% |

| Japan | 4.13% |

| South Korea | 4.09% |

Source: Triple-A.io

In China, amidst economic downturns and declining stock markets, individuals and institutions are increasingly turning to cryptocurrencies, as reported by Reuters. Despite the 2021 ban on crypto trading and mining, investors are circumventing restrictions through grey-market channels, engaging with smaller banks, and limiting transaction sizes to avoid detection. These methods are in response to the diminishing returns from traditional investments and the pursuit of more profitable opportunities.

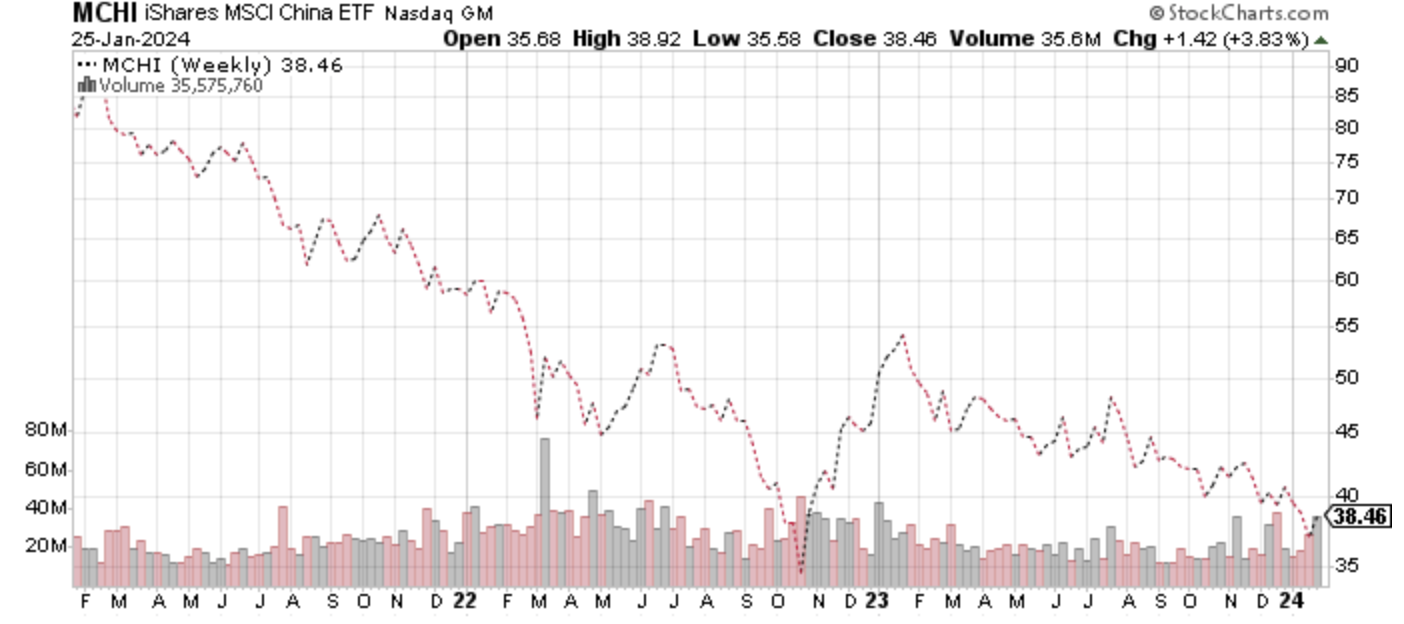

Financial institutions and brokerages, facing limitations in the stagnant traditional financial market of mainland China, are turning their attention to cryptocurrency-related ventures in Hong Kong. This shift is motivated by the pursuit of new growth opportunities outside the restrictive environment of the domestic market. The chart below serves as an indication of the difficulties encountered in the performance of Chinese equities over the last three years.

Access to cryptocurrencies in mainland China, despite the official ban, remains relatively straightforward. Platforms continue to cater to Chinese investors, offering alternative financial services for transactions. This accessibility is evidenced by the significant transaction volume and China’s improved ranking in peer-to-peer trade volume. The underground crypto market, characterized by informal and grey market activities, further demonstrates the robust interest in these digital assets.

The shift towards cryptocurrencies is influenced by the broader economic situation, where traditional sectors like property and stocks are underperforming. Cryptocurrencies, despite their volatility, are attracting attention as alternative investment options amid the prevailing economic gloom.