Further undermining investor appetite for assets linked to commodities was the halting of production at another Australian mine because of the weaker prices.

Canadian explorer First Quantum announced on Monday that it would stop mining at Western Australia’s Ravensthorpe nickel and cobalt mine, which followed a similar decision by Panoramic Resources because of falling nickel prices.

‘Irrational exuberance’

Earlier this month, Core Lithium scaled back its operations in the Northern Territory following the collapse of prices for the battery metal.

National Australia Bank head of FX strategy Ray Attrill said a lot of the Aussie dollar’s strength in December looked “exaggerated” after the decline in US bond yields and the weakness in the US dollar.

“We’re seeing a bit of a hangover from the irrational exuberance before Christmas,” he said.

Mr Attrill said the next big chart level for the dollar was around US65.7¢, which would be the 50 per cent retracement level of the technical Fibonacci sequence between the October 2023 low and the December peak.

Investors are now awaiting China’s industrial production data, which includes steel and aluminium on Wednesday for clues on future demand from the Asian giant for commodities including iron ore, Australia’s biggest export.

Commonwealth Bank mining and energy commodities strategist Vivek Dhar is pessimistic about steel demand in China due to a profit margin squeeze in mill operations there.

“Typically negative steel mill margins will weigh on iron ore prices as the economic incentive to produce steel and consume iron ore is reduced,” he said. Mr Dhar said prices of the steelmaking ingredient could dip below $US100 per tonne before stabilising around $US100 to $US110.

Earlier this month, iron ore prices topped $US145 a tonne, the highest in two years, before tumbling to $US127.5 as of Tuesday.

The near term outlook for the local currency will also be determined by local economic data. The Australian Bureau of Statistics is due to release employment numbers on Thursday.

The Reserve Bank is hoping for a loosening in the job market to return inflation to its 2 per cent to 3 per cent target, so a weaker than expected report is likely to pressure the $A.

Economists expect that 18,000 net jobs were created in December and that the jobless rate will stay steady at 3.9 per cent.

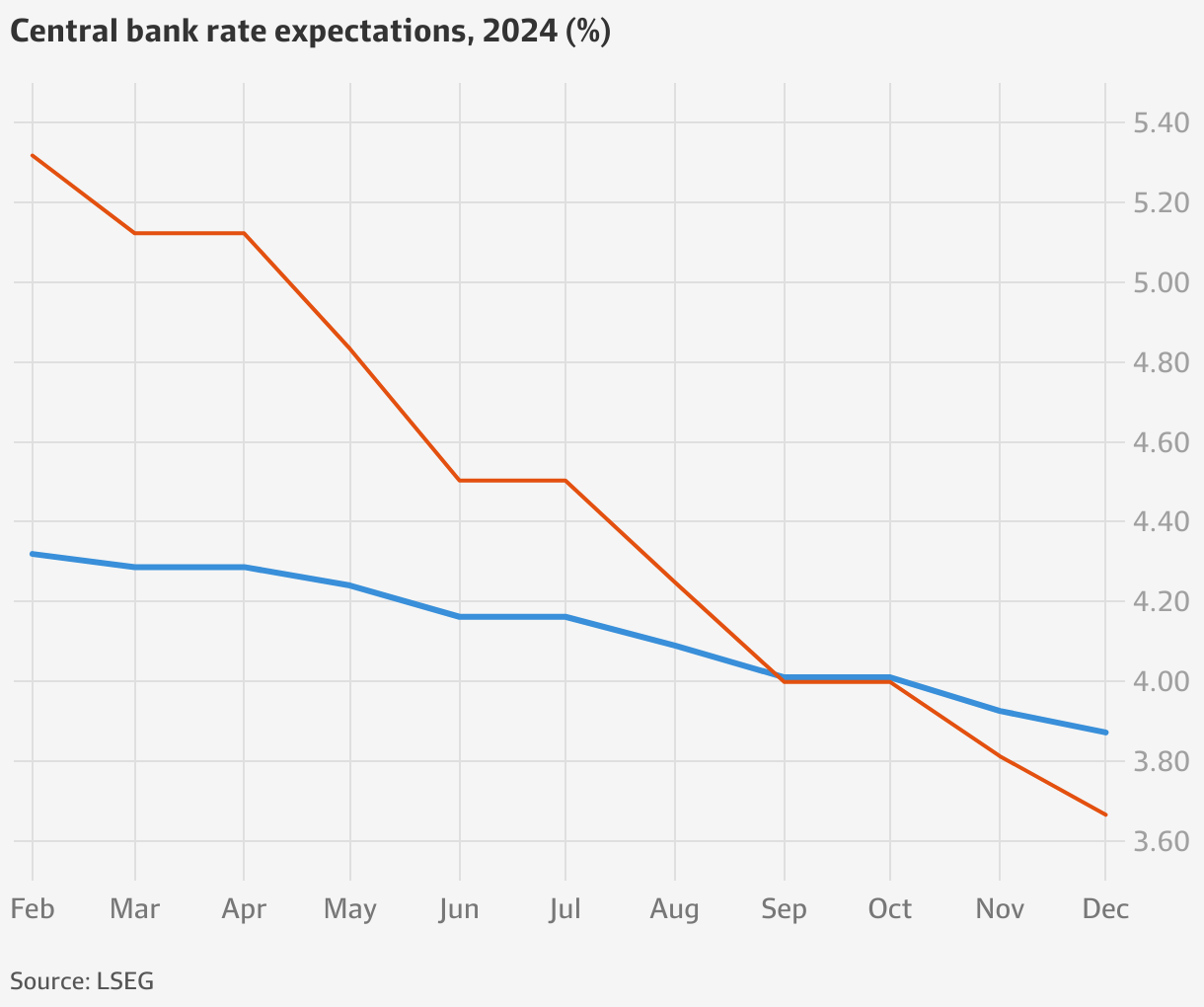

Bond futures are fully priced for the RBA to start cutting interest rates in September. They imply about a 50 per cent chance of a follow-up move this year. Markets have been toying in the past two months between one and two rate cuts, starting in June.

This compares to the minimum of six interest rate cuts expected this year by the US central bank. Fed futures imply an 80 per cent chance it will start happening in March.

Mr Attrill said: “Weakness in US economic numbers may be the catalyst for the US dollar to start losing ground again, and that would be a springboard for the Aussie to recover, but at the moment, the path of least resistance looks to be down.”