This article first appeared in The Edge Malaysia Weekly on April 15, 2024 – April 21, 2024

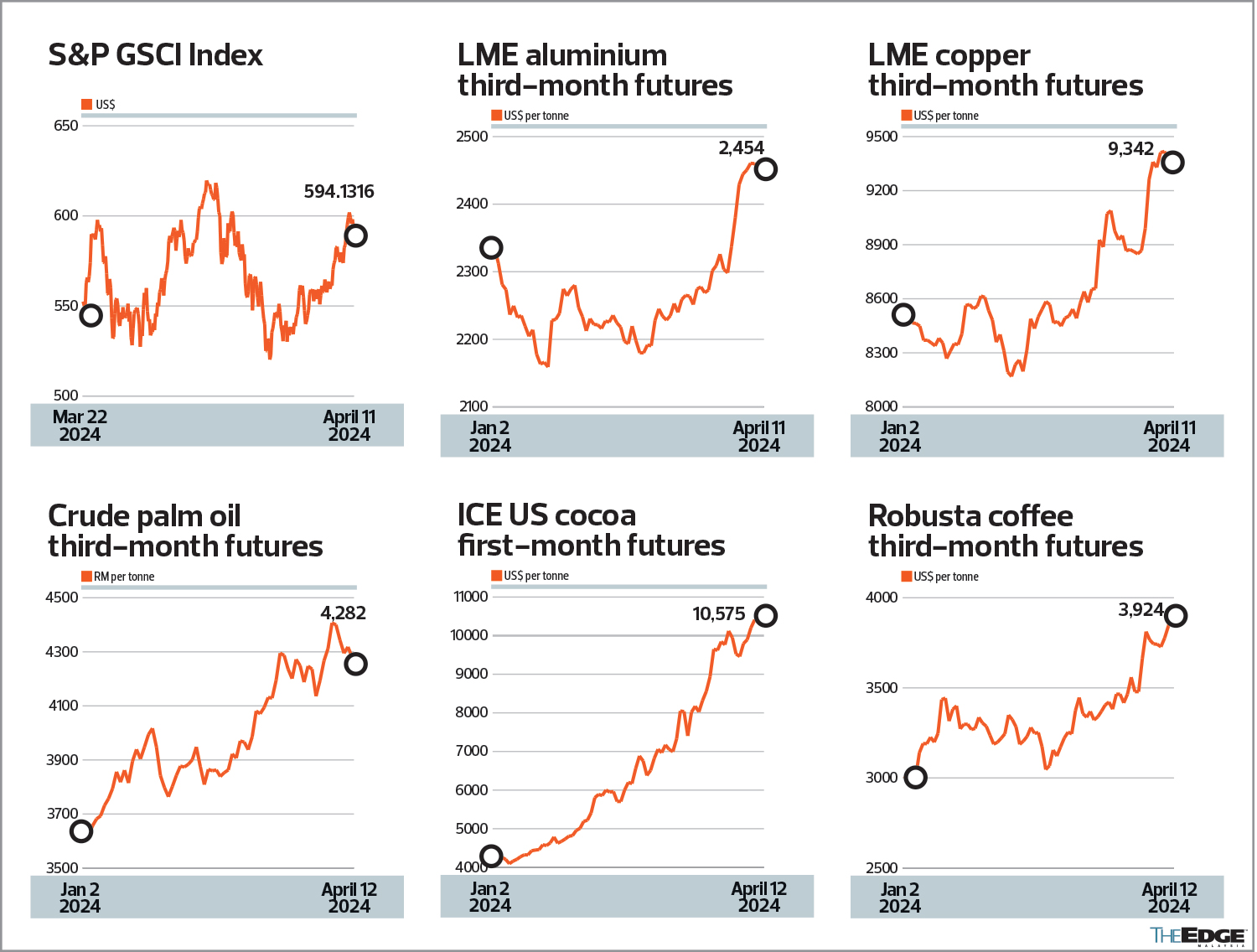

THE uptrend in the prices of a number of commodities — reflected in the 14.2% rise in the S&P GSCI from its recent December trough — brought back memories of the commodity bull run in 2021 and 2022, when the effects of the Covid-19 pandemic followed by the war in Ukraine choked global supply chains and sent food prices higher.

With the current trajectory of commodity prices, is the asset class headed for another bull run so soon after the last one?

Commodity experts say the strength seen in prices so far has varied from one commodity to another, but they are convinced that prices have found a new base. This means that the next move for prices is upwards this year, but many are not calling it a bull run just yet.

“We see global commodity price cycles as having passed their troughs, with prices expected to be higher on average in 2024 than in 2023,” says Paul Bloxham, HSBC’s chief economist for Australia, New Zealand and global commodities.

On whether the uptrend can be sustained and even move higher, the answer seemed to be dependent on the type of commodity.

Standard Chartered head of commodities research Paul Horsnell believes that for some key commodities like oil and copper, the lack of investment in previous years has led to the supply side being stressed as demand rises. “This is most pronounced in oil and we see scope for further price increases over the next 18 months to balance the market.” He adds that copper should similarly rise into the medium term with the global energy transition proving to be a strong medium-term positive for many metals.

HSBC’s Bloxham calls the current commodity price uptrend a “super-squeeze, not a super-cycle”, a view he has held since the last commodity boom in 2021/2022.

“The difference is that the still-elevated commodity price levels are due to supply constraints, rather than strong demand, as was the case in the China-led super-cycle in the earlier part of this century. The key supply constraints driving the super-squeeze include geopolitics, climate change and the energy transition,” he explains.

In an April 1 report, DBS Research says a price surge in commodities will not be occurring soon but it believes the turnaround seen in commodity prices could mark the end of the disinflationary trend that has soothed equity, bond and credit markets in the past year.

China factor

There are several key themes that seem to be affecting commodity prices, the most positive factor being the bottoming of China’s economy.

The country had an insatiable appetite for industrial and construction growth and was one of the largest importers of key metals such as iron ore, copper and aluminium as well as key agricultural commodities. But all that came to a sudden halt due to its strict zero-Covid policy and troubled property sector that led to plummeting demand for metal and other commodities.

However, a pickup in economic activities in the first two months of this year, coupled with the improvement in China’s Purchasing Manager Index (PMI) in March, sparked hope that the worst could be behind the world’s second largest economy.

The PMI rebounded from 49.1 in February to 50.8 points in March. It was the first time in six months that the PMI data had turned expansionary.

“Commodity traders are increasingly encouraged by signs of demand bottoming in China. This optimism is reflected in fledgling buoyancy in the markets, as critical commodities like crude oil, cocoa, cotton, sugar, palm oil, nickel, aluminium and copper rallied in the first quarter of 2024,” says DBS Research in the April report.

Copper futures on the London Metal Exchange (LME) have gained about 9.15% year to date, but most of the gains have been made in recent weeks. As at April 11, the metal’s three-month futures stood at US$9,342 per tonne.

According to a report by ING Research, the global supply for the metal is tightening as copper mines currently in operation are nearing their peak due to declining ore grades and reserves exhaustion.

“In Chile, Codelco — the world’s biggest supplier of copper — is struggling to return production to pre-pandemic levels of about 1.7 million tonnes a year by the end of the decade, from around 1.3 million tonnes this year. This marks the lowest level in a quarter century amid ageing assets and declining ore grade. At the same time, there is a lack of high-quality large-scale projects in the pipeline that could push the copper market into deficit as demand from the green energy sector grows,” says the research outfit.

Aluminium prices have in recent weeks picked up pace as the LME aluminium futures rebounded from the low of US$2,159 on Jan 22 to US$2,454 per tonne on April 11.

However, it is not “all coming up roses” yet for China. UOB Global Economics & Markets Research in an April 3 report says the country’s real estate market indicators remain negative and “together with the high local government debt, continue to be a major drag on the recovery”.

The research house adds that the outlooks for private consumption and employment remain lacklustre at the moment, bringing concerns of deflation to the forefront. Headline inflation was flat in January and February, while core inflation averaged at 0.8% y-o-y.

In March, prices rose 0.1% y-o-y but fell 1.0% month on month, as price pressure stayed muted after the Lunar New Year.

UOB expects China’s full-year 2024 gross domestic product (GDP) to grow 4.5% compared with the official target of 5%.

Geopolitics keeps prices of oil and safe-haven assets elevated

In the Middle East, Israel’s bombardment of Gaza has escalated since its first attack in the final quarter of 2023. The region has seen geopolitical tensions rise in the past months, from Hamas’ surprise invasion of Israel on Oct 7 to the ongoing Red Sea crisis that started earlier this year.

In recent weeks, the situation escalated further after Iran’s consulate in Syria was destroyed in a suspected Israeli missile attack. Seven people were killed, including a top commander and his deputy.

When the Israel-Gaza war erupted last October, there was an initial knee-jerk reaction, with Brent crude prices climbing to US$92.38 per barrel by Oct 19. But the price rally did not hold and declined thereafter. The consensus was that the war would not cause Brent crude prices to soar as neither parties are major oil exporters.

Nevertheless, close to six months later, views seem to have changed. Following the April 1 attack on Iran’s consulate in Syria, analysts see heightened risks of tension in the Middle East, spreading beyond the Gaza strip.

According to an April 5 report by Maybank Investment Bank Bhd, the price action in financial markets is suggesting a “non-zero chance” of an escalation in the conflict, with oil, gold and safe-haven currencies being better supported.

Meanwhile, the war between Ukraine and Russia continues to rage, going into the third year. Ukraine has started to target Russia’s energy and refinery facilities, adding another layer of complication for crude oil prices.

If history could serve as a marker, the Iraqi invasion of Kuwait in August 1990, which saw 4.3 million barrels per day being removed from global markets, resulted in crude oil prices skyrocketing from US$34 per barrel to US$77 per barrel.

“An escalation of security risks in Ukraine and the Middle East is always on the cards, threatening to affect the supply-demand balance at a time when global energy inventory levels are lean,” says DBS Research.

Crude oil is also facing the likelihood of tighter supply ahead, keeping prices elevated as Opec+ maintains its supply cuts, shifting the oil market from a surplus environment to one of a deficit soon.

“While a rollover of some of the Opec+ (Organization of the Petroleum Exporting Countries plus other oil-producing countries) voluntary cuts was expected, the fact that the full 2.2 million barrels per day of cuts was rolled over into the second quarter of 2024 leaves the oil market in a deeper-than-expected deficit over this period,” says ING Research in a March 21 report.

This year, Brent crude prices have climbed 18% from US$77.04 per barrel to US$90.85 on April 12.

Gold has also skyrocketed, as anticipated back in 2023, with gold futures rising by about 15% since the start of the year, hitting record highs on a daily basis. As at April 11, gold futures stood at US$2,396.30 per troy ounce.

While geopolitics teased the price of the bullion higher, expectations that the US Federal Reserve would cut rates this year have also contributed to the uptrend. Interestingly, global central banks have been accumulating gold at a record pace since last year, adding to the soaring prices (see “Four factors behind gold price climb”).

Weather and underinvestment hit harvests

Meanwhile, climate change has severely impacted the harvest of various crops, leading to soaring prices for these agricultural commodities. Take, for example, cocoa, where global shortages have pushed prices to stratospheric levels, reaching above US$10,000 per tonne this year.

On April 12, cocoa futures on the Intercontinental Exchange (ICE) hit a high of US$10,582 per tonne, rising over 151% year to date.

Droughts have ravaged cocoa crops in West Africa, the world’s biggest producer of the beans, while severe underinvestment in cocoa farms in the past has compounded the issue.

“According to the International Cocoa Organization, global cocoa supply will decline by almost 11% over the 2023/2024 season. The crop is still largely cultivated by smallholder farmers, many of whom struggle to make a living income and lack the means to reinvest in their land — which translates to lower yields over time,” notes JPMorgan in a report dated April 3.

The report also says that what was initially a structurally led, supply-side issue that has been exacerbated by dry weather has now morphed into an “investor-driven parabolic move in prices”. “For instance, non-commercial investors now hold over 60% of total open interest across cocoa futures and options in the New York market, which is an historical high. Consumers are now scrambling to hedge forward exposure in thin liquidity,” it explains.

Coffee is also seeing a similar situation, where concerns that the hot weather across Vietnam will impact harvests, driving robusta coffee prices up. Vietnam is the world’s largest producer of robusta coffee beans.

The country’s agriculture department has forecast a 20% drop in its coffee production this year to 1.472 million metric tons — the smallest harvest in four years — on account of the drought.

Robusta coffee futures have also climbed significantly this year with the July contract increasing 29% since the start of the year. It closed at US$3,932 per tonne on April 12.

The dry and hot weather in Malaysia, attributed to the lingering effects of El Niño, has also driven palm oil prices higher on the expectation that production will be affected.

Last week, palm oil futures traded on Bursa Malaysia Derivatives reached over RM4,440 per tonne, having risen 19% since the start of the year. Nevertheless, prices closed lower at RM4,282 on April 12.

Recent data from the Malaysian Palm Oil Board shows that the February stockpile dropped to 1.92 million tonnes, a seven-month low, on lower production and stocks, as well as higher domestic consumption.

Analysts are expecting prices to remain supported for a while, until output increases. Some see this happening as soon as the second quarter, before reaching a peak in the third quarter.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple’s App Store and Android’s Google Play.