After a long weekend, the market action on January 16th held some surprises.

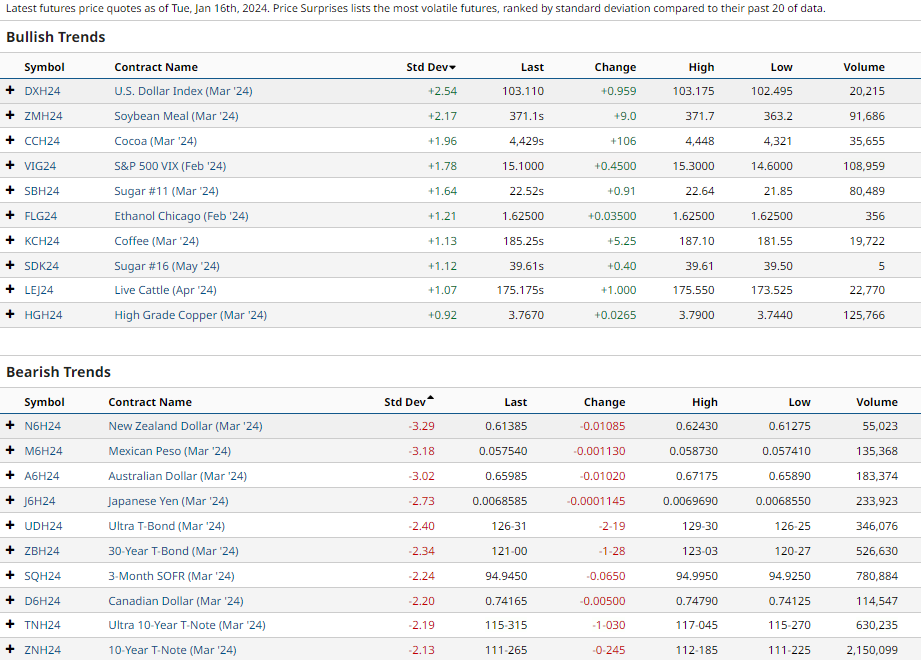

The Bullish Trends or gainers were the and here is the surprise for some-many different commodities.

The Bearish Trends or losers were foreign currencies, long bonds and (not shown on the chart) US equity indexes.

To be fair, there were many commodities that did not perform well.

after a spectacular run fell hard, as did , , oil and aluminum.

Two commodities though, the ones we track the most for signs of any reignition of inflation, did ok to great.

Why do we focus on to gold ratio and sugar futures?

As stated over the weekend, silver futures have been experiencing narrower trading ranges.

“With higher lows since October, the recent support at $22.50 an ounce, if holds, could mean this week is the week we start to see this metal shine.”

Today, silver futures had an inside day and outperformed gold which fell about $19.00 to $2,032.

Silver held $23.00 and the underlying support level.

All things considered; gold also held near-term support at $2029.

Yet we are yet to see silver outperform gold, so we watch.

Sugar cleared 22 cents a pound closing at 22.52.

Coffee and cocoa rallied as well. So, it was a big day for the softs.

Back to the notion that today could be the start of the decoupling.

We need to see more.

But, we are paying attention.

ETF Summary

- S&P 500 (SPY) 480 all-time highs 460 underlying support

- Russell 2000 (IWM) 195 pivotal 180 major support

- Dow (DIA) Needs to hold 370

- Nasdaq (QQQ) 408 now the immediate pivotal number with 405 support

- Regional banks (KRE) Failed 50 but not by too much at this point

- Semiconductors (SMH) The winner again.

- Transportation (IYT) Needs to hold 250

- Biotechnology (IBB) 135 pivotal support

- Retail (XRT) To maintain a bullish stance this should hold 65 and get back over 70.00