(Bloomberg) — Energy traders who turned the natural gas market into a trillion-dollar industry are beefing up desks with staff specializing in the fossil fuel’s green equivalent.

Gunvor Group, Danske Commodities A/S and STX Commodities BV are among firms investing or adding people in the growing biogas market. As demand is expected to jump in the coming decades, Goldman Sachs Group Inc., BP Plc and Cargill Inc. are spending billions of euros on production facilities from Spain to Germany.

They are betting that this niche industry will become hugely profitable as consumption of fossil fuels eventually starts to decline amid the push toward net zero. The gas is also made in Europe, which limits the impact on supply from geopolitics.

“We expect biomethane to play an increasingly important role in the energy mix,” said Jesper Johanson, chief executive officer at Danish trader InCommodities A/S, which recently set up an environmental products team. The fuel “represents both an attractive clean energy source and a diversifier for EU’s gas supply,” he said.

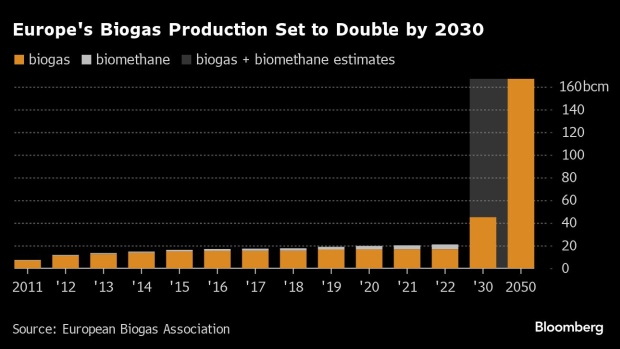

Made from energy crops, food and animal waste, the gas is produced in a similar way to composting, when organisms are broken down in the absence of oxygen. It’s called green because it generates energy from waste without adding greenhouse gases and the European Biogas Association expects the fuel to meet more than half of the region’s gas demand in 2050.

While showing huge promise, the market is still small and fragmented. Bilateral deals dominate rather than organized trading of a standardized contract. That’s a far cry from the global buying and selling of natural gas, with benchmark prices, exchanges, hubs, and multi-year supply deals. There are also brokers that handle the green gas, but it’s more expensive than Dutch futures, the region’s benchmark.

“The various national registries need to acknowledge each other to allow for full cross trading across Europe, which at the moment is only partially doable,” said European Biogas Association’s Chief Executive Officer Harmen Dekker.

That hasn’t deterred Gunvor, one of the biggest traders of traditional liquefied and pipeline gas. The firm is boosting activity as part of its gas, power and renewables group, a spokesperson said by email. To gain a larger slice of the market, it is considering off-take deals and is building a biogas plant at its Huelva bio-refinery in Spain.

STX in Amsterdam is also expanding as part of its focus on environmental commodities markets, where it sees a “positive trend,” according to Sead Keric, managing partner for renewable gas. Trading desks are well placed to handle the risks arising from market segmentation and regulatory uncertainty, he said.

But finding staff with the necessary skills and experience may prove a challenge, according to recruiters. The industry today resembles that of liquefied natural gas when it began to take off in the last decade and demand for experienced traders outstripped supply.

“There is an expectation from hiring companies to find traders with five to ten years experience in a market that has not been around long enough,” said Mark Taylor, managing partner at Imperium Commodity Search in London.

Many gas traders also emerged from the energy crisis with much higher salaries and bonuses as they profited from the record volatility. That will also make it very hard for the sector to compete, Taylor said.

Growth is notable in places like Denmark, where the share of biomethane in the total gas demand rose to nearly 40% last year from 3% in 2016, according to Gergely Molnar, an analyst at the International Energy Agency.

InCommodities, based in the nation’s energy trading hub of Aarhus, currently has 6-7 people focusing on the sector, ranging from traders to business developers and software developers, according to Johanson. More are likely to be added this year, he said. Danske Commodities also expects its desk to continue to grow, according to a spokesman.

The green shoots has attracted one of the world’s biggest banks. Goldman set up Verdalia Bioenergy last year to expand into production facilities across Europe. Cargill Inc., the world’s biggest agricultural trader, plans as many as three plants in the region.

Energy majors, seeking to reduce emissions from their operations, have also joined the frenzy. BP Plc bought Archaea Energy Inc., a provider of renewable gas, while Shell Plc purchased Nature Energy Biogas, which operates plants in Denmark and the Netherlands.

–With assistance from Petra Sorge, Archie Hunter and Laura Hurst.

©2024 Bloomberg L.P.