How hard each province is hit will depend on their relative exposures to these markets, says economist

Article content

How hard each province is hit by this year’s expected recession will depend on their relative exposures to the housing and commodities markets, says one economist.

Article content

“Housing and other interest‑rate‑sensitive sectors will feel the coming economic downturn most acutely, whereas commodity producers will be less vulnerable,” Marc Desormeaux, principal economist at Desjardins Group, said in a report on Jan. 23. “We think this contrast will become starker in 2024.”

Advertisement 2

Article content

Montreal-based Desormeaux said Ontario and British Columbia — home to Canada’s two biggest housing markets — will take the largest economic hit, with each contracting 0.1 per cent in 2024, compared with growth in commodity-focused Alberta, Saskatchewan and Newfoundland and Labrador of 0.9 per cent, 0.7 per cent and 1.7 per cent, respectively.

Real estate accounted for about 20 per cent of total gross domestic product, according to Statistics Canada, but the sector has been struggling under the weight of higher interest rates.

Home sales fell 11.2 per cent in 2023 from 2022, according to the Canadian Real Estate Association, as higher interest rates cut into activity. CREA in its most recent housing report said “price declines have been predominantly located in Ontario markets … and to a lesser extent British Columbia.”

With real estate activity accounting for almost 13 per cent GDP in Ontario and almost 20 per cent in B.C., it’s no wonder Desormeaux predicts a tougher road ahead for those provinces until interest rates start to fall — something economists are forecasting for the middle of this year.

Article content

Advertisement 3

Article content

Meanwhile, the strong outlook for commodities, particularly oil, potash and uranium, are expected to provide economic cushions for Alberta, Saskatchewan and Newfoundland and Labrador.

Toronto home sales rose at the end of the year due to lower mortgage rates, but that “could be a double-edged sword,” Desormeaux said, as it augurs worsening affordability in a province with the biggest shortage of housing.

Furthermore, housing starts are expected to fall in 2024, household consumption is slumping — “unusual outside a recession” — and the savings rate is declining, so various economic headwinds are building.

But the economist is most worried about the effects of high rates in B.C.

“B.C. remains Canada’s most housing‑oriented provincial economy, and its households are the most indebted,” he said, adding that a struggling labour market and weakening retail sales are showing signs of the strain from higher interest rates.

Desormeaux’s outlook is sunnier for Alberta. The commodity-dependent economy is looking at stronger-than-expected growth based on increasing oil output. Desjardins is forecasting an average oil price of US$80 per barrel with the nearly finished Trans Mountain pipeline expansion expected to “support Alberta prices.”

Advertisement 4

Article content

Commodities will also smooth things out in Saskatchewan and Newfoundland and Labrador.

Uranium production in Saskatchewan is expected to keep rising and oil production will outpace 2023 levels. A $7.5-billion investment in BHP Group Ltd.’s Jansen potash mine is also expected to boost the economy. In Newfoundland and Labrador, where oil production accounts for 20 per cent of output, Suncor Energy Inc.’s Terra Nova offshore oilfield has returned to production after being out of commission since 2019.

But the expected good times in those three provinces don’t mean Canada will avoid an economic contraction.

“We also still think almost all regions of Canada will experience slowdowns in 2024 in response to sharply higher borrowing costs and weaker expansions among our trading partners,” Desormeaux said. “Later this year, rate cuts should help the economy rebound.”

Sign up here to get Posthaste delivered to your inbox.

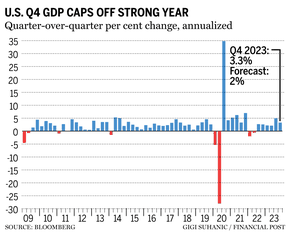

The United States economy’s fourth-quarter growth trounced forecasts as cooling inflation fuelled consumer spending, capping a surprisingly strong year that defied recession calls.

Advertisement 5

Article content

Gross domestic product increased at a 3.3 per cent annualized rate, according to the government’s preliminary estimate out Thursday. For all of 2023, the economy expanded 2.5 per cent.

The economy’s main growth engine — personal spending — rose at a 2.8 per cent rate. Business investment and housing also helped fuel the larger-than-expected advance last quarter. — Bloomberg

- The 35th Annual Economic Outlook Forum, presented by Scotiabank, will be held in Vancouver with a focus on what businesses in the Greater Vancouver region can expect from the local and national economy in the year ahead.

- The federal Department of Finance publishes financial results for November 2023.

- Today’s data: United States personal consumption expenditure index, pending home sales

- Earnings: American Express Co., Colgate-Palmolive Co., Weyerhaeuser Co.

Get all of today’s top breaking stories as they happen with the Financial Post’s live news blog, highlighting the business headlines you need to know at a glance.

Advertisement 6

Article content

The month of January, and, consequently, the new tax year, creates a fresh planning opportunity for post-secondary students to stay one step ahead of the taxman in 2024. This is particularly true when it comes to managing registered education savings plan (RESP) withdrawals to minimize taxes. Read Jamie Golombek’s advice here.

* * *

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line at aholloway@postmedia.com with your contact info and the general gist of your problem and we’ll try to find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers led by Julie Cazzin or one of our columnists can give it a shot.

Recommended from Editorial

Today’s Posthaste was written by Gigi Suhanic, with additional reporting from The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Article content