(Bloomberg) — China’s growth target for the year — and how it plans to get there — plus the speed of the energy transition will be top of mind for commodities investors as the government gathers for its annual legislative meetings in Beijing next week.

Most Read from Bloomberg

Other issues that could draw more policy fine-tuning include China’s backsliding on its energy efficiency goals, as well as persistent anxieties around the supply of fuels, food and raw materials, including the minerals critical for advanced manufacturing and decarbonization.

China’s heft as the world’s largest commodities importer sets the tone for global markets from oil and gas to copper and grains. It’s also home to the world’s largest coal, steel and aluminum industries, and ground zero for the planet’s adoption of renewable energy. Here’s a rundown of what to look out for as the National People’s Congress unfolds.

Metals Stimulus

Construction, whether for real estate or infrastructure, is the bedrock of metals demand. How Beijing plans to manage the ongoing collapse in the property market, and whether it’ll deploy more state spending as a counterweight, could be decisive in setting the direction of prices from copper to iron ore, the key ingredient in steel.

Bulls will be hoping for more fiscal support, which will show up in targets for bond sales and the budget deficit. Last year’s figures were relatively unambitious given how much the economy had slumped during the pandemic. This year may be no different as Beijing seeks to strike a balance between delivering growth and the strained finances of local authorities.

Read More: Iron Ore Bears Take Control as Market Eyes Beijing’s Response

Even if the government does decide to open its wallet, there’s a caveat. As the economy matures, infrastructure spending is becoming less dependent on smokestack industries like steel and cement. Materials like copper are likely to benefit more as funds are steered toward greener investments.

Power Plans

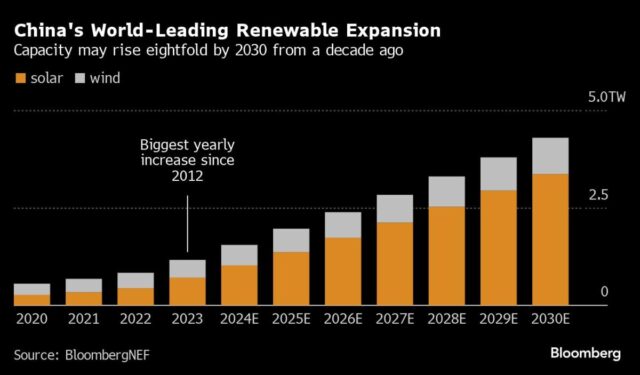

China has pushed coal production to record levels after the power shortages of recent years, but now it’s fast approaching a 2025 deadline to start using less of the fuel. In the wings is a world-leading clean energy industry. At stake, President Xi Jinping’s pledge to peak national emissions by the end of the decade, the key milestone on the road to net zero.

China’s top coal mining hubs have already indicated that production growth will slow this year and that even more investment will be made in renewables, a theme that’s likely to be taken up at the national level by the congress in Beijing. But more needs to be done to ensure that electricity grids and markets are capable of absorbing all of the extra clean power.

Read More: China’s Coal Boom Slows as Top Mining Hubs Focus on Renewables

Still, the meeting is unlikely to pass without a shout-out for fossil fuels. Even as coal output flattens, more gas production is being demanded for the years to come to mitigate China’s dependence on foreign sources of the fuel. The authorities will also expect the nation’s oil majors to keep crude output elevated.

Energy Efficiency

After two years in which energy security was paramount, expect more focus on efficiency as the environment and climate issues swing to the fore. Officials in recent months have bemoaned how China is lagging on some of its goals, including improving air quality and making the necessary strides toward reducing how much energy and emissions are needed for economic growth.

Having so much coal to burn has come at a cost. Beijing’s air pollution worsened in 2023, bucking the trend of recent years. Energy consumption, meanwhile, grew faster than gross domestic product for the first time since 2005, according to the Centre for Research on Energy and Clean Air.

Read More: China’s 2025 Climate Goals in Peril After Emissions Surge: CREA

Renewed emphasis on the environment would help China maintain its incredible expansion in renewables, and put more pressure on local governments to rein in energy-intensive industries. Caps on production or capacity growth are already in place or planned for steel, aluminum, oil refining and maybe copper. Comments at the congress on strengthening regulation of carbon-heavy sectors could hint at further curbs to come.

Carbon traders will also be looking for steers on China’s emissions market, which is soon expected to enroll new industries for the first time since launching in 2021. Opposition to the European Union’s carbon regime might gain traction, another potential flashpoint for trade as advanced economies compete for the fruits of decarbonization.

Food Security

The impact of the pandemic on supply chains and rising geopolitical tensions mean that food security will remain a top priority. The threat of extreme weather linked to climate change, in particular, is likely to be a draw on the government’s finances.

Over the past year, the wheat harvest was damaged by heavy rains, while heat waves scorched the cotton crop, lifting prices and the country’s already weighty import needs. President Xi has urged improvements in preventing and mitigating disasters that affect farming, but implementation has often fallen to debt-burdened local governments.

Read More: China’s Xi Urges Better Disaster Relief in Food Security Push

Limitations on land and water are also forcing choices on which crops to promote, and driving the adoption of higher-yielding genetically modified varieties. However much Beijing preaches the virtues of self-sufficiency, efforts to diversify where it gets its imports from are likely to continue apace.

–With assistance from Fran Wang, Winnie Zhu, Kathy Chen and Jessica Zhou.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.