It had to end eventually. Whether last week’s shift in the pole position endures is something else entirely.

But for the moment, US equities are no longer leading the horse race for the year to date, based on a set of proxy ETFs through Friday’s close (Mar. 15).

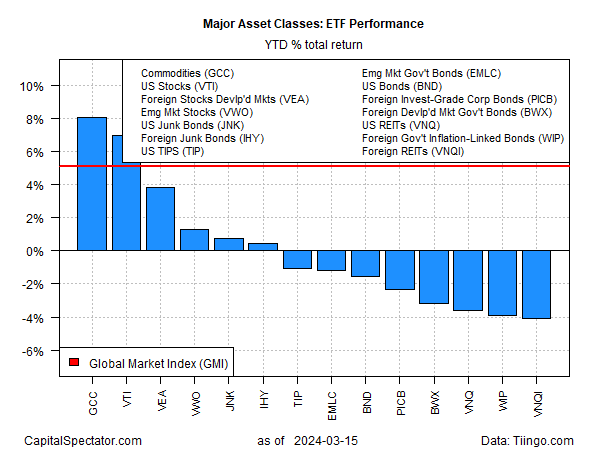

WisdomTree Enhanced Commodity Strategy Fund (), which targets a broad array of raw materials, rallied 2.9% last week, lifting the fund’s year-to-date performance to a strong 8.1%.

The 2024 rise in commodities eclipses the 7.0% rise in American shares, based on Vanguard Total Stock Market Index Fund ETF Shares (NYSE:), which eased 0.3% last week.

Major Asset Classes

Defining and weighting commodities as an asset class is tricky and so GCC’s leadership this year may be anomalous due to technicalities.

Yet a review of other broadly defined commodities funds echoes GCC’s run this year. The iShares S&P GSCI Commodity-Indexed Trust (NYSE:), for instance, is also beating US stocks (VTI) this year.

To be fair, the gray area for defining a beta footprint for commodities writ large leaves room for a wide array of results.

The Invesco DB Commodity Index Tracking Fund (NYSE:), for instance, is posting a relatively weak 3.3% year-to-date gain.

Nonetheless, the fact that some diversified commodities funds are now leading US stocks highlights a change in the directional bias for commodities.

Recall that 2023 was a rough year for the asset class: both GCC and GSG posted modest losses while US stocks soared.

Is 2024 the year when commodities take the performance crown from American equities?

In search of an answer, keep an eye on a key driver of the new commodities run: , which is up 14.5% this year via United States Oil Fund (NYSE:).

Agricultural products are also enjoying a bull run in 2024: Invesco DB Agriculture Fund (NYSE:), for instance, has surged 13.4% year to date.

The question is whether the bounce-back in commodities in 2024 is mostly the effects of mean reversion vs. a regime change for the asset class.

As CapitalSpectator.com , the red ink for commodities generally in 2023 was a conspicuous outlier in an otherwise broad-based rally for asset classes.

On that basis, one could argue that a snap-back rally for commodities was likely.

It’s still unclear if this is something more than a market realignment, but for the moment the odds certainly look better for thinking that commodities are on track to reverse a dismal performance in 2023.