That makes risk management essential

WASHINGTON — Across Iowa, several commodity prices hit a stride coming into March. Corn prices rallied 31 cents from February lows, while soybeans jumped 55 cents. Cattle prices remain at an all-time high, following yearslong trend of growth for the livestock.

The market for red meat, specifically, is unprecedented, according to John Greiner, a broker at Kat’s Grain in Washington. The livestock’s value roughly follows that of the grain used to feed it, but on a lengthy delay given the animals’ gestation and growing time of at least a year and a half, often longer.

But corn and soy values plummeted fast last winter. That means red meat’s upward momentum is bound to end sooner or later, despite the recent value increases for grain.

“It’s almost a four-year bull market, which, I don’t think it’s ever been seen before,“ he said. ”It’s highly recommended that beef producers manage their risk here. Sure, prices could go higher, but to sit here and rely on that is extremely dangerous, especially if you’re buying high-priced calves.“

The price bumps in corn and soy are less flashy, but still worth noting after months of downward momentum. Greiner said favorable harvests in South America drove that trend with an influx of supply. But with production season restarting in the U.S., all eyes are back on conditions there.

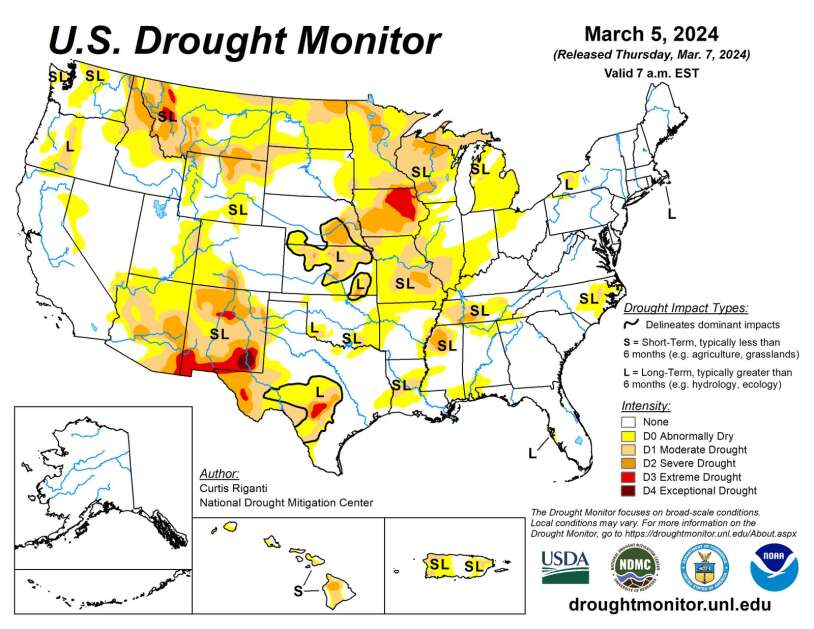

And those conditions look uncertain.

Greiner said investors were likely hoping to hedge their bets in case of trouble from a drought stretching across the Midwest — and especially concentrated in Iowa — that have some buyers worried about production.

“That’s the new focus, ‘What if?’ It’s really that simple“ he said. “We’re going into U.S. spring very dry. It’s good for planting because if you get a little sprinkle of rain, you’re going to be able to plant the next day. But … if we were to turn out with a very hot, dry June, there’s no subsoil moisture. So those plants will run down and we typically don’t replenish our subsoil moisture in July and August.”

A 31-cent jump in corn prices represents growth of 8% in the course of a few weeks, the greatest increase of the grain’s price in the last seven months. The jump is not monstrous by any means, but will certainly adjust bottom lines for many growers.

While the uptick was more or less expected, Greiner said producers and brokers now awaited next month’s price report with bated breath. A second month of growing commodity values could point to more eyebrow-raising trends.

“What would be a surprise would be if we had another 30-cent rally on corn. That’s the next question,“ he said. ”Do we go back down and retest those lows if we have good U.S. spring weather? Or do we throw another 30 cents on the upside? And that’s the uncertainty.“

Comments: Kalen.McCain@southeastiowaunion.com