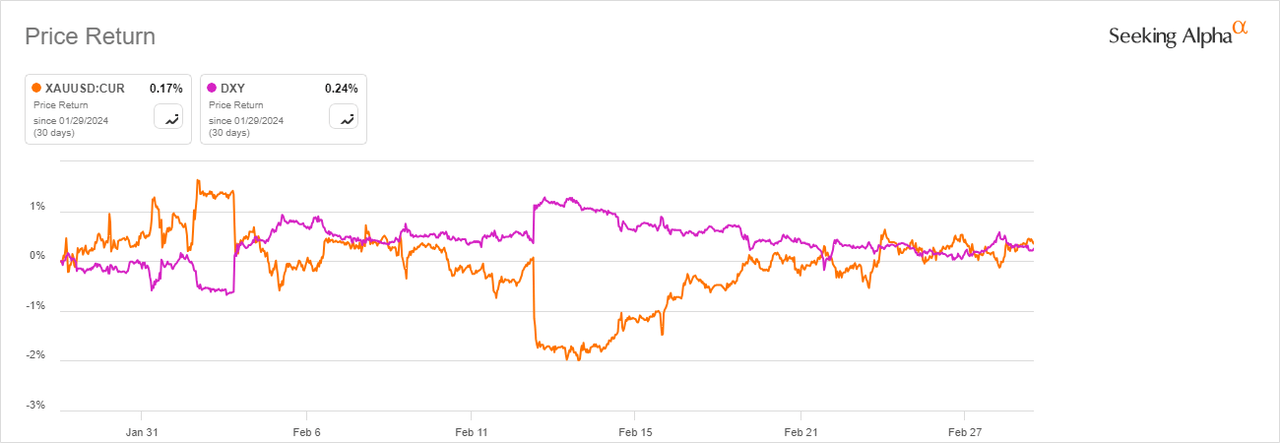

Gold prices dipped in cautious trade on Thursday, set for their second-straight monthly decline, as market participants await U.S. inflation data that could impact the course for interest rates. On the day, spot gold (XAUUSD:CUR) was down 0.2% to $2,031.37 an ounce by 6:11 am ET.

The U.S. Federal Reserve’s favoured core measure of personal consumption expenditures is due on Thursday, and is forecast to rise 0.4% on the month in January. Recent economic data releases have indicated that the U.S. economy remains robust, prompting investors to push back bets on rate cuts by the Federal Reserve to later in the year, weighing on nonyielding bullion.

Among base metals, copper futures (HG1:COM) held steady at $3.83, but were on course for a second-consecutive monthly loss, while nickel was on track for the first monthly rise since July last year on supply worries in Indonesia and Russia.

Nickel was the worst performer last year among all base metals, falling by around 40%, due to softening demand and a steady rise in Indonesia output, Reuters reported.

William Blair & Company in an article noted that, alongside lithium, nickel has probably seen the largest expansion in production volumes compared to other metals. “However, the most significant consequence of this expansion (in Indonesia) is that total primary nickel production has surged to peak levels, leading to market imbalances. The International Nickel Study Group expects this year’s surplus to be the largest in the last decade.”

Turning to energy, oil prices also eased on the day, weighed down by demand concerns, while signs that U.S. interest rates could remain elevated for longer, heaped more pressure.

Analysts at ANZ noted that, their price outlook remains unchanged. Projects 2024 annual average prices of $86/bbl for Brent crude and $81/bbl for WTI. End-of-quarter prices should hit the mid to upper $80s in the second to third quarters this year.

Brokerage further adds, growth in the non-OPEC supply of oil surprised the market last year. However, expect that growth to diminish as falling drilling activity catches up with the US shale oil industry.

Elsewhere, among agriculture commodities, soybean and cocoa prices fell, while wheat futures gained. ING analysts write, recent estimates from the Brazilian Association of Vegetable Oil Industries show that soybean production in the country could drop to 153.8mt in 2024, down 1.5% from its previous estimates. The decrease is driven by expectations that yields will fall from 3.6kg/ha in 2023 to 3.4kg/ha in 2024.

Similarly, soybean export estimates decreased from 98.1mt to 97.8mt, while ending stock estimates were also revised down by 30% to 4mt at the end of 2024, the report said.

-

Energy

Metals

Agriculture

Commodity ETFs

Gold ETFs:

Other Metal ETFs:

Oil ETFs:

Agriculture ETFs: