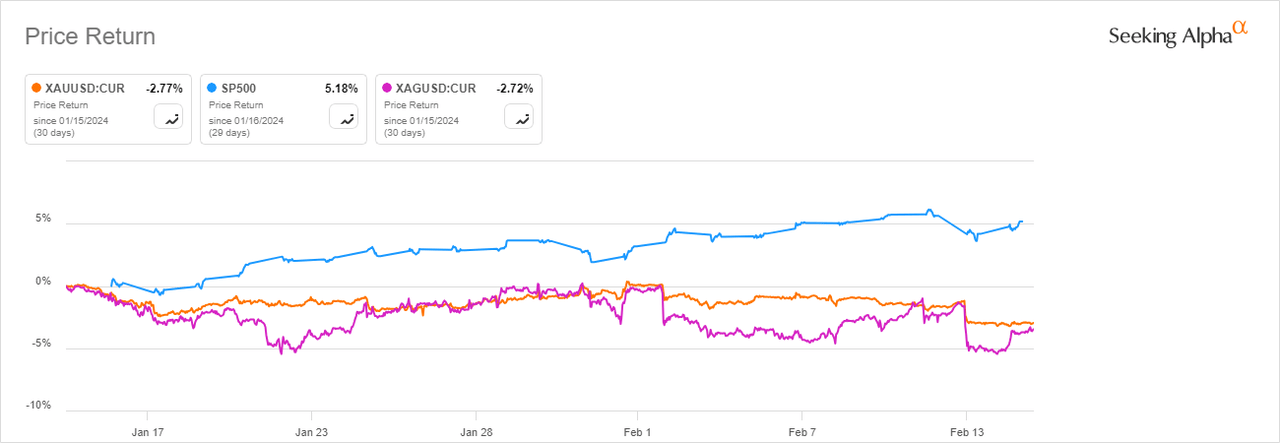

Unexpectedly high January inflation numbers have tempered hopes for swift and deeper interest rate cuts this year. While gold is traditionally seen as a safe way to preserve wealth during economic and geopolitical turmoil, the non-yielding metal suffers when interest rates rise.

Fed Vice Chair for Supervision Michael Barr backed the “careful approach” to rate cuts advocated by Chair Jerome Powell, while Chicago Fed President Austan Goolsbee cautioned against delaying action for too long.

Meanwhile, in the energy complex, oil prices were weighed down by the International Energy Agency’s warning of slowing demand growth this year while a larger than expected jump in U.S. crude inventories also added to the worries.

“We see the market largely balanced in the current quarter and expect fundamentals to improve as demand recovers. Nevertheless, negative sentiment should see OPEC extend its current production cuts into the second quarter, which should push up oil prices. We maintain our short-term target of USD85/bbl and expect that to lift above USD90/bbl by year-end,” ANZ analysts said in a note.

Furthermore, analysts at ANZ said, a slump in nickel prices has seen a quick reaction from producers around the world. While BHP wrote off its nickel division and announced a review of the operations, Glencore mothballed its New Caledonia smelter, and Trafigura pulled investment from the Goro Nickel Project. This comes as Indonesia grapples with Environment, Social and Governance issues in its nickel industry. “A strict mining-approval process is also causing closures. While those closures won’t rectify the oversupply, they may go some way to stopping the slide in prices.”

Among other base metals, copper prices (HG1:COM) inched +0.56% higher to $3.72, supported by a slight pullback in the U.S. dollar index (DXY), while prices traded in a narrow range as markets in top metals consumer China were closed for the Lunar New Year holidays.

A weaker U.S. currency makes dollar-priced metals less expensive for holders of other currencies. Elsewhere, data showed Japan’s economy slipped into recession as it unexpectedly shrank for a second straight quarter on weak domestic demand.

In the agriculture space, soybean and wheat prices inched lower, while cocoa ticked up. The U.S. Department of Agriculture last week forecast 2024 net farm income at $116 billion, down from $156 billion in 2023 and a record $186 billion in 2022, all in nominal dollars. That would be the fifth-highest on record after the past three years, plus 2013, Reuters reported.

Recent Commodity Price Movements

-

Energy

Metals

Agriculture

Commodity ETFs

Gold ETFs:

Other Metal ETFs:

Oil ETFs:

Agriculture ETFs: