Recap for January 10

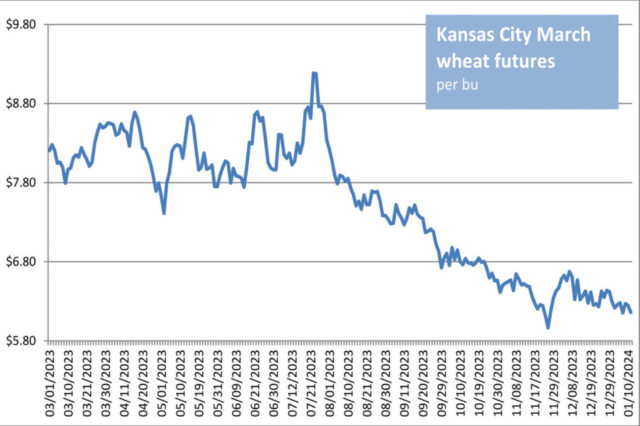

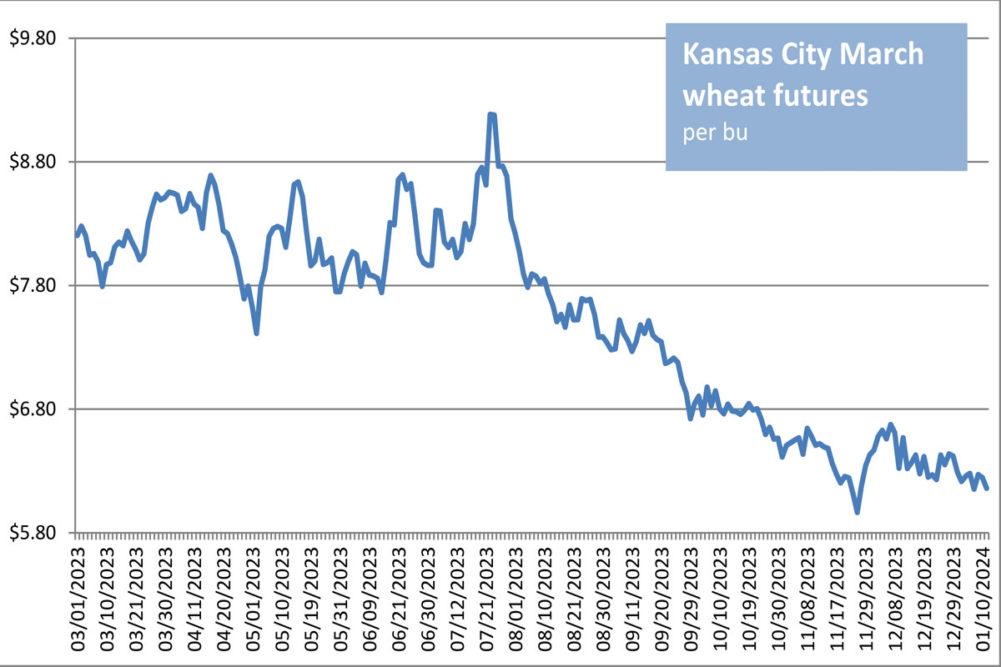

- Weak export demand pressured wheat futures Thursday as traders adjusted positions ahead of fresh supply-demand figures and winter wheat seeding data coming Friday. Soybean futures were flat to slightly higher, consolidating near two-year lows ahead of Friday’s reports. Corn futures were lower under pressure from expectations the USDA could raise corn stocks up 11.4% from a year earlier. The March corn future dropped 1¾¢ to close at $4.57¾ per bu. Chicago March wheat was down 7¢ to close at $6.03¾ per bu. Kansas City March wheat dropped 8½¢ to close at $6.16 per bu. Minneapolis March wheat was down 7¾¢ to close at $7 per bu. March soybeans were steady at $12.36½ per bu; later months edged higher. March soybean meal was down $2.10 to close at $362.20 per ton. March soybean oil was up 0.47¢ to close at 48.72¢ a lb.

- US equity markets dropped early, rallied late and posted mixed closes after the Department of Labor’s Consumer Price Index data indicated inflation rose more than expected in December. Core prices — which exclude volatile food and energy prices — rose 3.9% from a year ago, just above economists’ forecasts for a 3.8% increase. The Dow Jones Industrial Average added 15.29 points, or 0.04%, to close at 37,711.02. The Standard & Poor’s 500 fell 3.21 points, or 0.07%, to close at 4,780.24. The Nasdaq Composite added 0.54 point to close at 14,970.19.

- US crude oil prices were higher Thursday. The February West Texas Intermediate light, sweet crude future was up 65¢ to close at $72.02 per barrel.

- The US dollar index continued lower Thursday.

- US gold futures eased again Thursday. The February contract fell $8.60 to close at $2,019.20 per oz.

Recap for January 9

- Weak demand for US supplies continued to weigh on wheat futures, but the complex notched mixed closes in mostly narrow ranges Wednesday as traders adjusted positions ahead of Friday’s reports from the USDA. Position squaring also was behind mostly lower corn futures. US export demand concerns and rainy forecasts in dry Brazil pulled soy complex futures lower. The March corn future eased ¼¢ to close at $4.59½ per bu; later months were narrowly mixed, mostly lower. Chicago March wheat edged up ¾¢ to close at $6.10¾ per bu. Kansas City March wheat dropped 2½¢ to close at $6.24½ per bu. Minneapolis March wheat added 2¼¢ to close at $7.07¾ per bu; 2025 contracts were lower. March soybeans dropped 12¢ to close at $12.36½ per bu. March soybean meal was down $3.30 to close at $364.30 per ton. March soybean oil was down 0.20¢ to close at 48.25¢ a lb.

- US equity markets continued to regain ground after a rough first week of 2024. The three major indices were higher Wednesday ahead of investors’ latest look at inflation on Thursday with the release of consumer price data for December. The Dow Jones Industrial Average added 170.57 points, or 0.45%, to close at 37,695.73. The Standard & Poor’s 500 was up 26.95 points, or 0.57%, to close at 4,783.45, within 0.3% of the index’s record high. The Nasdaq Composite added 111.94 points, or 0.75%, to close at 14,969.65.

- US crude oil prices were lower Wednesday. The February West Texas Intermediate light, sweet crude future was down 87¢ to close at $71.37 per barrel.

- The US dollar index reverted Wednesday to the downside trend characterizing the sessions surrounding the weekend.

- US gold futures eased again Wednesday. The February contract fell $5.20 to close at $2,027.80 per oz.

Recap for January 8

- US crude oil prices closed higher Tuesday, a day after Saudi Arabi lowered prices and sent Brent and WTI futures sharply lower. Support Tuesday came from expectations that American Petroleum Institute figures will show US crude stock fell by 5.2 million barrels in the week ended Jan. 5, along with Middle East tensions, the closure of a 300,000-barrel-a-day oilfield in Libya and Saudi Arabia emphasizing its desire to stabilize prices. The February West Texas Intermediate light, sweet crude future was up $1.47, around 2%, to close at $72.24 per barrel.

- Wheat complex futures closed higher Tuesday ahead of Friday’s key planting report with support from global export business and freezing temperatures in France. Soybean futures firmed Tuesday in technical buying and short covering. Short covering also was behind corn futures’ ascent from their lowest levels since December 2020 reached a day earlier. The March corn future added 4¼¢ to close at $4.59¼ per bu. Chicago March wheat jumped 13¾¢ to close at $6.10 per bu. Kansas City March wheat advanced 11¾¢ to close at $6.27 per bu. Minneapolis March wheat added 3¢ to close at $7.05½ per bu. March soybeans edged up 3¢ to close at $12.48½ per bu. March soybean meal was down 90¢ for a second day for a close at $367.60 per ton. March soybean oil was up 0.64¢ to close at 48.45¢ a lb.

- Monday’s solid gains gave way to relative quiet for US equity indexes Tuesday, which posted mixed closes. The Dow industrials and S&P 500 indices declined while the Nasdaq eked out a gain on the strength of Nvidia, Amazon and Alphabet. The Dow Jones Industrial Average fell 157.85 points, or 0.42%, to close at 37,525.16. The Standard & Poor’s 500 subtracted 7.04 points, or 0.15%, to close at 4,756.5. The Nasdaq Composite added 13.94 points, or 0.09%, to close at 14,857.71.

- The US dollar index advanced Tuesday, snapping a three-day losing streak.

- US gold futures eased again Tuesday. The February contract fell 50¢ to close at $2,033 per oz.

Recap for January 8

- US crude oil prices fell more than 3% Monday in the wake of sharp price cuts by Saudi Arabia, the top global exporter, along with increased output from Organization of Petroleum Exporting Countries, both of which more than offset supply concerns ramped up by Middle Eastern war. OPEC oil output rose last month as continued cuts by Saudi Arabia and other members of the wider OPEC+ alliance were offset by increases in Angola, Iraq and Nigeria. Angola exited OPEC on Jan. 1. The cartel plans additional production cuts this year. The February West Texas Intermediate light, sweet crude future was down $3.04, or 3.4%, to close at $70.77 per barrel.

- Steep declines in crude oil spilled over into agricultural commodity markets Monday, sending corn futures to three-year lows and soybean futures to two-year lows. Further pressure came from technical selling and ideas South American harvests will be larger than anticipated due to beneficial rains in dry Brazilian cropping districts. Crude oil’s losses also affected wheat futures, as did the onset of snowy weather expected to increase in volume this week across the Midwest and central Plains, a potential benefit to winter wheat now dormant in dry fields. The March corn future shed 5¾¢ for a second straight session, falling Monday to a close of $4.55 per bu. Chicago March wheat shed 19¾¢ to close at $5.96¼ per bu. Kansas City March wheat dropped 12¾¢ to close at $6.15¼ per bu. Minneapolis March wheat pulled back 9½¢ to close at $7.02½ per bu. March soybeans fell 10¾¢ to close at $12.45½ per bu. March soybean meal was down 90¢ to close at $368.50 per ton. March soybean oil was up 0.18¢ to close at 47.81¢ a lb; the September future and beyond were lower.

- After a rough start to 2024, US equity indices opened the second week of the year with gains backed by rallies in large technology companies. All of the so-called Magnificent Seven companies — Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla — posted gains of more than 1%. Boeing was a major exception to the Monday rally, plummeting 8% in the wake of a Boeing jet’s emergency landing after a piece of the plane flew off in mid-air. The Dow Jones Industrial Average advanced 216.9 points, or 0.58%, to close at 37,683.01. The Standard & Poor’s 500 added 66.3 points, or 1.41%, to close at 4,763.54. The Nasdaq Composite jumped 319.7 points, or 2.2%, to close at 14,843.77.

- The US dollar index declined Monday, marking a third consecutive trading day of losses.

- US gold futures eased again Monday. The February contract fell $16.30 to close at $2,033.50 per oz.

Recap for January 5

- Soy complex and corn futures closed lower Friday and sharply lower for the week as beneficial rains fell in the dry growing areas of Brazil, the world’s largest soybean and corn exporter. US winter wheat futures were higher in technical trading and follow-through buying on gains made in Thursday’s session. The front two spring wheat contracts edged higher as well. The US dollar’s descent from three-week highs was supportive. The March corn future fell 5¾¢ to close at $4.60¾ per bu. Chicago March wheat added 2½¢ to close at $6.16 per bu. Kansas City March wheat added 2¼¢ to close at $6.28 per bu. Minneapolis March wheat edged up ¾¢ to close at $7.12 per bu; the July contract and beyond eased. March soybeans dropped 11¼¢ to close at $12.56¼ per bu. March soybean meal was down $6.80 to close at $369.40 per ton. March soybean oil fell 0.53¢ to close at 47.63¢ a lb.

- After a volatile week, US equity markets closed on a high note Friday after a Department of Labor report indicated the US economy added 216,000 jobs in December with most industries increasing employment, a larger gain than November’s 173,000 jobs, and better than forecasters were expecting. For all of 2023, employers added 2.7 million jobs, a slowdown from 4.8 million in 2022, but a better gain than in the several years preceding the COVID-19 pandemic. The Dow Jones Industrial Average added 25.77 points, or 0.07%, to close at 37,466.11. The Standard & Poor’s 500 added 8.56 points, or 0.18%, to close at 4,697.24. The Nasdaq Composite added 13.77 points, or 0.09%, to close at 14,524.07.

- US crude oil prices advanced Friday, the February West Texas Intermediate sweet crude future up $1.62 to close at $73.81 per barrel.

- The US dollar index declined Friday for a second day after a four-session rally spanning the New Year’s Day holiday.

- US gold futures eased Friday. The February contract fell 20¢ to close at $2,049.80 per oz.

| Fresh ideas. Served daily. Subscribe to Food Business News’ free newsletters to stay up to date about the latest food and beverage news. |

Subscribe |