For full access to real-time updates, breaking news, analysis, pricing and data visualization subscribe today.

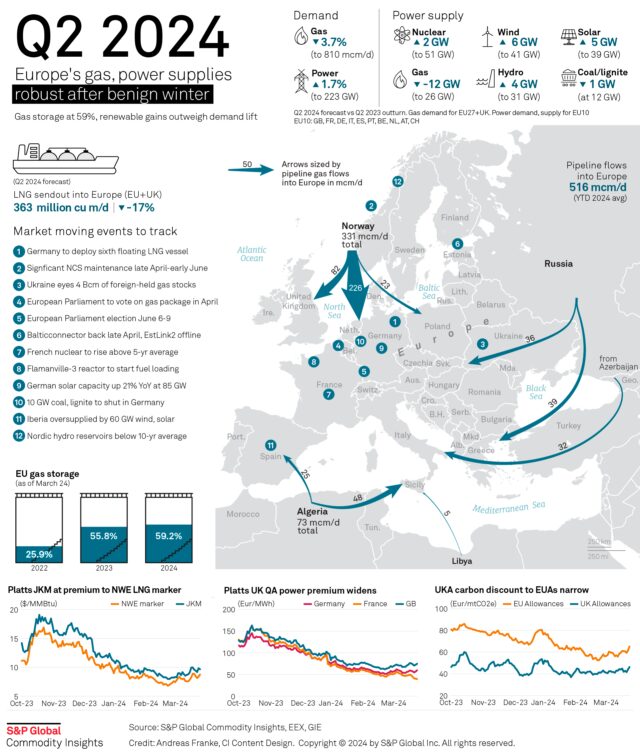

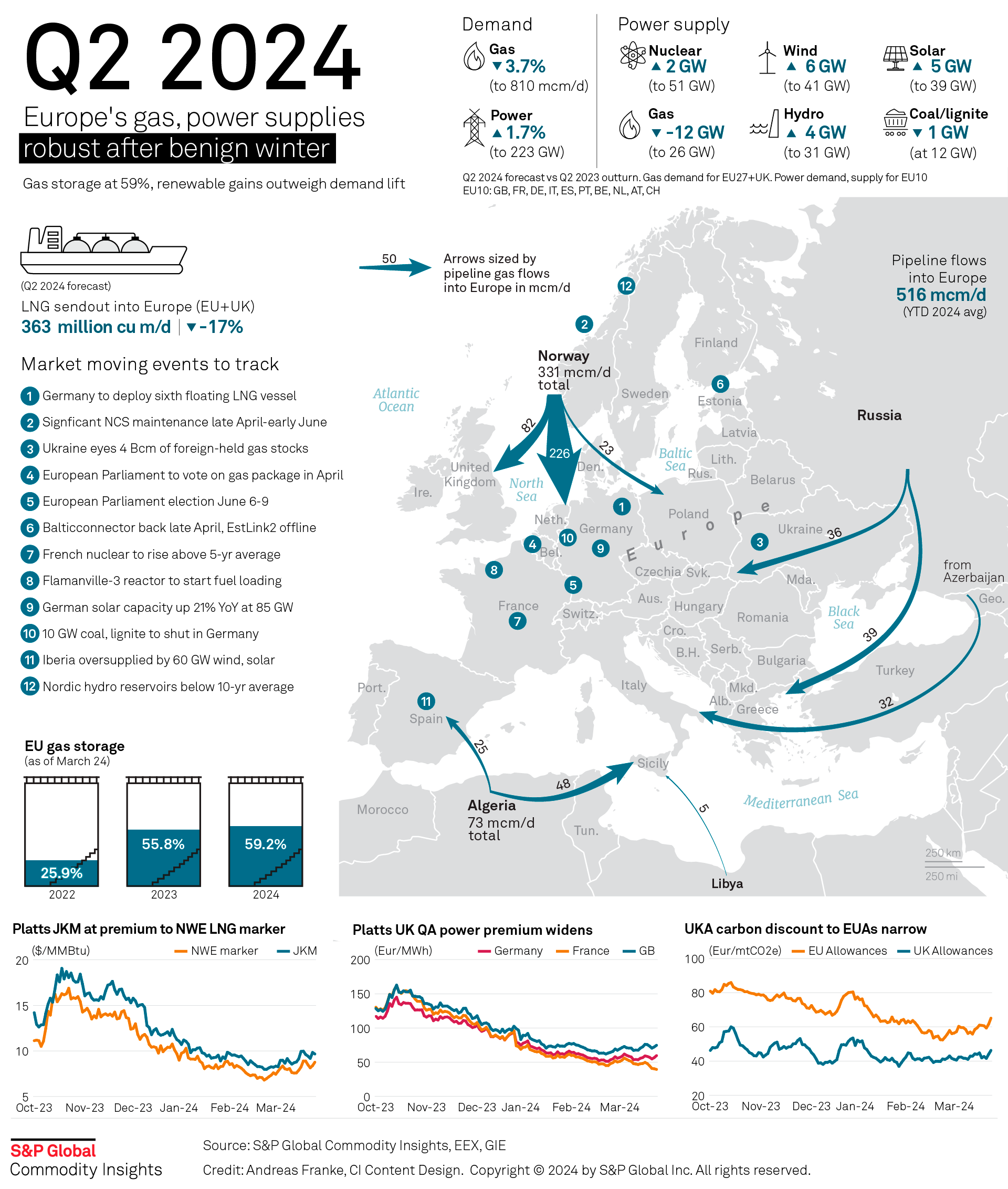

Europe is entering its “gas summer” with prices back at what could be considered normal levels and with gas storage stocks in robust health. Another mild winter and weak demand have left the EU’s gas storage sites filled to 59% of capacity, while demand in the EU and UK is set for a 3.7% year-on-year decline in Q2 2024, according to forecasts from S&P Global Commodity Insights.

Meanwhile, electricity demand across ten core markets is forecast to rise 1.7% with Europe’s power markets entering spring in the best supply shape since 2020. Solar output is forecast to exceed gas-fired power generation for the first time in Q2.

Carbon prices are expected to show more resilience finding stability just above Eur60/mtCO2e after EU Allowances fell close to three-year lows. The European Commission is expected to release 2023 EU ETS verified emissions data on April 3 with S&P Global analysts forecasting a drop of 11% year-on-year.

Related story:

US RENEWABLES TRACKER: Solar output continues to outshine other resources in Q4 (subscriber content)

Not registered?

Receive daily email alerts, subscriber notes & personalize your experience.