Fidelity mining sector analyst Sam Heithersay said there was more volatility ahead, noting the size of the still-young industry made it difficult to forecast than more mature metal markets.

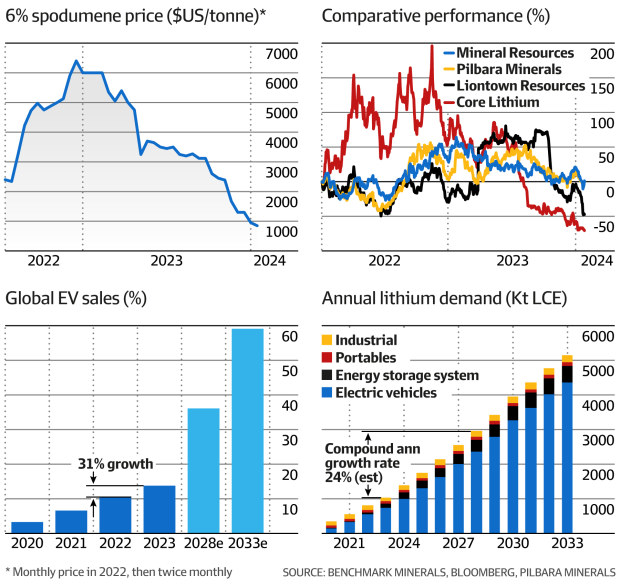

“Iron ore is a 3-billion-tonne market, copper is around 25 million tonnes, lithium is probably only a one-and-a-half-million tonne market at the moment, so it doesn’t take much for swings in supply to create these spikes in pricing,” he said.

“One of the main challenges we’re finding is understanding the supply chain and the inventories that have been built over 2022 and 2023, so we can assess how quickly they’re unwinding – that’s proving quite challenging.”

That sentiment was echoed by fellow Fidelity analyst Justin Teo, who noted that news IGO’s Greenbushes site would curb production seemed at odds with traditional commodity cycle patterns.

‘Sanguine’ on outlook

“We’re seeing funny dynamics. Greenbushes sits on the low-cost end, but it’s cutting production anyway. Normally, the lowest cost producer stays around, and the others drops out,” he said.

“Now everyone else is incentivised to wait around and play a kind-of game of chicken. The game lasts until you run out of money.”

But even with production cuts and mines closures, ANZ commodity strategists Daniel Hynes and Soni Kumari said the niche nature of the lithium market meant the impact to prices could take some time to be felt.

“Lithium is not traded actively in any great quantity on commodity exchanges, which can reflect changes in sentiment relatively quickly,” the pair wrote in a note on Thursday.

“Lithium is a small market, with spot purchases making up only a fraction of supply.”

The pair added that most sales of the commodity rely on term contracts – which may not reflect current market demand/supply dynamics.

“The impact on prices from recent supply cutbacks will not be reflected in industry prices until those long-term contracts end.”

Jon Bishop, who covers metals and mining at Jarden Securities, said the firm was “somewhat sanguine” on the long-term outlook for lithium, despite being among the first to warn of the impending crash in prices after initiating coverage of the sector in 2022.

Lithium’s rout

“We took an early view on the sector that it was well over done. The projections were ridiculous in terms of consumption,” he told The Australian Financial Review.

“But we do believe that the market will be still dominated by lithium-ion battery in some form … the demand outlook is just not the hockey stick that the bulls believed last year,” he said.

Mr Bishop said he thought the cycle was nearing a bottom as prices had begun to hit hard rock lithium producers, but he warned there would likely be some “decent sized gyrations” still ahead.

“We’re expecting bumps because of the market size and the impact of destocking and restocking,” he said.

“We’re not calling the price to go ridiculously back into $US2000 a ton, but we do think it will probably creep back over $US1000 over time. It may overshoot in a restocking cycle and have another drop when inventories doubled again, and so on and so forth.”