As we work on reauthorizing the 2023 Farm Bill, it’s always important to look at how best to update and improve farm safety net programs, which help farmers manage the inevitable ups and downs in the marketplace, including extreme weather and global conflicts.

We did this in the 2018 Farm Bill when we added a new reference price “escalator” to the Price Loss Coverage program and created the Dairy Margin Coverage program. Minnesota dairy farmers tell me that the DMC was an important improvement.

But one essential part of the commodity program has gone largely unchanged for over 40 years. In fact, decisions made by a farmer’s grandparents still drive the program.

The Farm Bill’s primary commodity programs, Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) program provide financial assistance to farmers growing specific crops when they experience a substantial drop in crop prices or revenue. Eligible crops include wheat, feed grains, rice, seed cotton, oilseeds, pulse crops, and peanuts. Payments are made based on an estimate of the “base acres,” or this historic acreage of these crops planted.

What happens is that payments are made based on surveys done over 40 years ago of which crops were being planted and where they were being planted. Things have changed over the decades, including the addition of soybeans and other oilseeds 20 years ago. But commodity payments for ARC and PLC today are still made for many farms based on decisions that a farmer’s parents or grandparents or previous owner made 40 years ago.

What is most surprising is that there is no requirement that the current farmer plant the crop that is triggering the payment.

Farmers know that a lot has changed in 40 years, some things dramatically. We plant different crops and deploy modern techniques and precision agriculture. As agriculture has changed, so have the risks, and yet we still have the same commodity programs based on what farmers grew decades ago, not what is in the ground now.

As a result, commodity payments don’t match up with risks and aren’t targeted to the farmers putting crops in the ground and experiencing real-time price or revenue declines.

Here’s an example: there are 35 million acres of “unbased” cropland, or land that is ineligible for commodity payments. Farmers working on “unbiased” acres cannot participate in ARC or PLC, even if they have recently grown or are currently growing a commodity covered under the program.

On the other hand, there are 48 million base acres that have not recently grown a covered commodity but, under the law, can still collect payments for crops that haven’t been planted there for years. The result? Billions of dollars in commodity program payments go to landlords that aren’t farming, and millions of acres of working farmland are not eligible for any support because they weren’t included in a decades-old survey.

This makes no sense, but wait, it gets worse.

The Commodity program is actually contributing to land price inflation. Land that is counted as base acres in the commodity program is more expensive to purchase and more costly to rent, making it harder and more expensive for beginning farmers to find land to farm. Today, more than 50% of cropland across the country is rented, not owned by the people doing the hard work and trying to support their families by planting and harvesting crops. Beginning farmers often have only one choice: rent cheaper and less productive land without base acres designation, and so miss out on the base acre support because they can’t afford the higher rent on a base acre land.

We should, at the very least, more closely align base acres with what’s actually being grown on that land.

As the average age of farmers rises, we shouldn’t allow decisions made more than 40 years ago to block the next generation of farmers from getting into the business. Beginning farmers already struggle to find the cash and access to loans to buy or rent land. This is a significant barrier to entry and to getting to break even for beginning farmers, who are more likely to rent land.

A recent study from the Food and Agricultural Policy Research Institute (FAPRI) demonstrates the results if we don’t change something. We intended for commodity programs to be a risk management tool for active farmers, but in reality, many of these payments are siphoned off by absentee landlords and investors and don’t contribute to mitigating the risks that actual farmers take. The FAPRI study found that a 10% increase to the PLC program would result in hundreds of millions of taxpayer dollars flowing to landlords and investors, not farmers. It’s long overdue for us to have a real conversation about updating the base acre formula so that it’s based on current reality, not planting decisions made more than 40 years ago. And we can’t allow small and beginning farmers to be squeezed out by big players who own farm land as an investment, and are getting rich on taxpayer-funded federal crop payments never intended for them.

If we do a better job of aligning payments and recent plantings, then financial support will more likely get to the farmers who actually grow that crop. This could generate savings we can plow back into the safety net, which is what the National Corn Growers Association has thoughtfully asked us to do.

Updating the base acres is an important step, and we can do more to help the next generation of farmers who are being squeezed out.

With this in mind, I’ve introduced bills to help beginning farmers access land, capital, and new markets. I’ve also joined a bipartisan proposal to lower the barriers to crop insurance for beginning farmers. It is a no-brainer to support our next generation of farmers, and that’s why now is the time to update base acres.

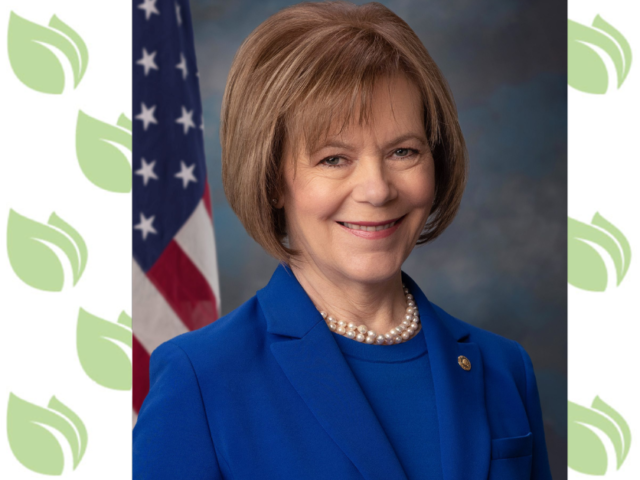

About the author: Senator Tina Smith is Chair of the Ag Subcommittee on Commodities, Risk Management, and Trade and oversees commodities, crop insurance, and trade,