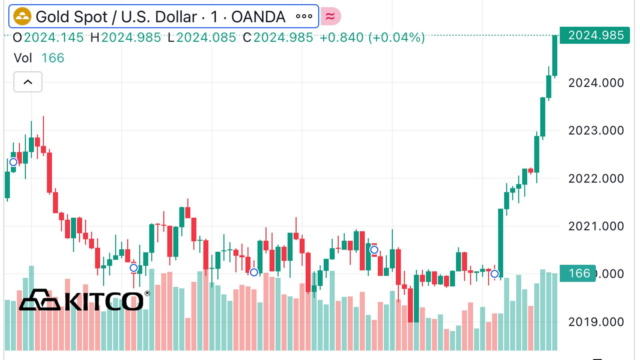

(Kitco News) – Gold and silver prices are down in earlier U.S. trading Monday, with gold hitting a three-week low. Amid a lack of major fresh, fundamental news to start the trading week, precious metals traders are focusing on the outside markets and they are bearish. The U.S. dollar index is firmer, crude oil solidly lower and U.S. Treasury yields have up-ticked a bit. February gold was last down $23.60 at $2,026.30. March silver was last down $0.225 at $23.09.

Asian and European stock markets were mixed overnight. U.S. stock index futures are set to open slightly lower when the New York day session begins.

In weekend news, U.S. congressional leaders have agreed upon a bipartisan federal budget plan for the next year. The House and Senate now have about two weeks to pass the measure, which may not be easy.

The U.S. data points of the week will be the December consumer price index report on Thursday and the December producer price index report on Friday. U.S. inflation has cooled in recent months, which has allowed the Federal Reserve to back off on its tighter monetary policy. The CPI report is seen up 3.3%, year-on-year versus a rise of 3.1% in the November report.

The key outside markets today see the U.S. dollar index slightly higher. Nymex crude oil prices are solidly lower and trading around $71.75 a barrel. Reports said Saudi Arabia has lowered the price of its oil to some of its customers, in a signal of a weaker demand outlook. Meantime, the yield on the benchmark U.S. Treasury 10-year note is presently fetching 4.038%.

U.S. economic data due out Monday includes the employment trends index and consumer credit.

Technically, the gold futures bulls still have the overall near-term technical advantage but are fading. Prices are still in a three-month-old uptrend on the daily bar chart. Bulls’ next upside price objective is to produce a close in March futures above solid resistance at $2,100.00. Bears’ next near-term downside price objective is pushing futures prices below solid technical support at $2,000.00. First resistance is seen at $2,040.00 and then at today’s high of $2,053.30. First support is seen at the overnight low of $2,022.70 and then at $2,015.00. Wyckoff’s Market Rating: 6.5.

The silver bears have the overall near-term technical advantage. Prices are in a choppy, four-week-old downtrend on the daily bar chart. Silver bulls’ next upside price objective is closing March futures prices above

solid technical resistance at $25.00. The next downside price objective for the bears is closing prices below solid support at the November low of $22.26. First resistance is seen at the overnight high of $23.405 and then at Friday’s high of $23.715. Next support is seen at last week’s low of $22.88 and then at the December low of $22.785. Wyckoff’s Market Rating: 4.0.

Try out my “Markets Front Burner” email report. My next one is due out today and is going to be entitled, “When China sneezes…” Front Burner is my best writing and analysis, I think, because I get to look ahead at the marketplace and do some market price forecasting. And it’s free! Sign up to my new, free weekly Markets Front Burner newsletter, at https://www.kitco.com/services/markets-front-burner.html .

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.