Anchor Investment Management LLC acquired a new stake in shares of Brookfield Co. (NYSE:BN – Free Report) in the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor acquired 10,768 shares of the company’s stock, valued at approximately $432,000.

Anchor Investment Management LLC acquired a new stake in shares of Brookfield Co. (NYSE:BN – Free Report) in the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor acquired 10,768 shares of the company’s stock, valued at approximately $432,000.

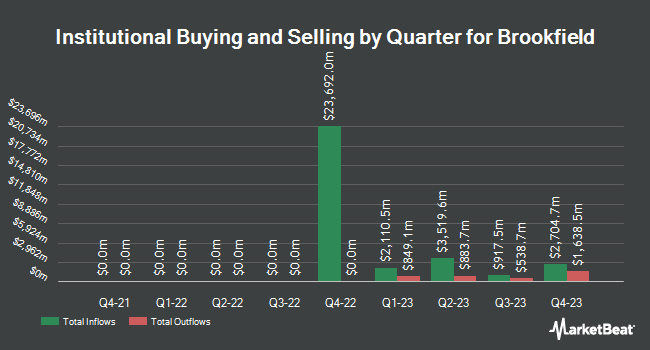

Other institutional investors and hedge funds also recently modified their holdings of the company. TIAA FSB purchased a new stake in shares of Brookfield during the 4th quarter worth about $799,000. Triasima Portfolio Management inc. purchased a new stake in shares of Brookfield during the 4th quarter worth about $37,672,000. Victory Capital Management Inc. purchased a new stake in shares of Brookfield during the 4th quarter worth about $1,548,000. American Century Companies Inc. purchased a new stake in shares of Brookfield during the 4th quarter worth about $1,483,000. Finally, Barclays PLC purchased a new position in Brookfield in the 4th quarter worth approximately $748,000. Institutional investors and hedge funds own 58.22% of the company’s stock.

Brookfield Price Performance

Shares of BN opened at $40.99 on Friday. The firm has a market capitalization of $67.22 billion, a price-to-earnings ratio of 66.11 and a beta of 1.49. The company has a debt-to-equity ratio of 1.35, a quick ratio of 0.99 and a current ratio of 1.15. Brookfield Co. has a one year low of $28.25 and a one year high of $42.64. The stock’s fifty day moving average is $40.32 and its 200-day moving average is $36.38.

Brookfield (NYSE:BN – Get Free Report) last issued its quarterly earnings results on Thursday, February 8th. The company reported $0.83 EPS for the quarter, beating analysts’ consensus estimates of $0.69 by $0.14. Brookfield had a return on equity of 3.22% and a net margin of 1.18%. The company had revenue of $24.52 billion for the quarter, compared to analyst estimates of $1.15 billion. During the same period last year, the company earned $1.12 earnings per share. The company’s quarterly revenue was up 1.3% compared to the same quarter last year. Equities analysts anticipate that Brookfield Co. will post 3.75 EPS for the current year.

Brookfield Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Thursday, March 28th. Investors of record on Wednesday, March 13th will be paid a dividend of $0.08 per share. The ex-dividend date is Tuesday, March 12th. This represents a $0.32 annualized dividend and a yield of 0.78%. This is a boost from Brookfield’s previous quarterly dividend of $0.07. Brookfield’s dividend payout ratio (DPR) is currently 51.61%.

Insider Activity at Brookfield

In related news, major shareholder Gp Ltd Bcp sold 354,813 shares of the stock in a transaction on Friday, December 22nd. The stock was sold at an average price of $2.08, for a total value of $738,011.04. Following the completion of the transaction, the insider now owns 28,533,584 shares in the company, valued at approximately $59,349,854.72. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. In other Brookfield news, Director Ocm Growth Holdings Llc sold 12,365 shares of Brookfield stock in a transaction dated Monday, December 18th. The stock was sold at an average price of $12.76, for a total transaction of $157,777.40. Following the transaction, the director now owns 16,492,168 shares of the company’s stock, valued at approximately $210,440,063.68. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, major shareholder Gp Ltd Bcp sold 354,813 shares of Brookfield stock in a transaction dated Friday, December 22nd. The shares were sold at an average price of $2.08, for a total value of $738,011.04. Following the transaction, the insider now directly owns 28,533,584 shares in the company, valued at approximately $59,349,854.72. The disclosure for this sale can be found here. Insiders sold 5,612,448 shares of company stock valued at $12,428,405 over the last 90 days. 11.00% of the stock is currently owned by corporate insiders.

Wall Street Analysts Forecast Growth

A number of equities analysts have weighed in on BN shares. BMO Capital Markets upped their price target on Brookfield from $42.00 to $44.00 and gave the stock an “outperform” rating in a report on Friday, February 9th. Canaccord Genuity Group upped their price target on Brookfield from $41.00 to $42.50 and gave the stock a “hold” rating in a report on Friday, February 9th. Royal Bank of Canada increased their target price on Brookfield from $52.00 to $53.00 and gave the company an “outperform” rating in a research note on Monday, February 12th. JPMorgan Chase & Co. increased their target price on Brookfield from $48.00 to $52.00 and gave the company an “overweight” rating in a research note on Thursday, February 1st. Finally, TD Securities increased their target price on Brookfield from $61.00 to $62.00 and gave the company an “action list buy” rating in a research note on Sunday, February 11th. Two investment analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has assigned a strong buy rating to the company’s stock. Based on data from MarketBeat, the stock currently has an average rating of “Moderate Buy” and an average target price of $47.45.

Brookfield Profile

Brookfield Corporation is an alternative asset manager and REIT/Real Estate Investment Manager firm focuses on real estate, renewable power, infrastructure and venture capital and private equity assets. It manages a range of public and private investment products and services for institutional and retail clients.

See Also

Want to see what other hedge funds are holding BN? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Brookfield Co. (NYSE:BN – Free Report).

Receive News & Ratings for Brookfield Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Brookfield and related companies with MarketBeat.com’s FREE daily email newsletter.