“This also lines up with a reversal of some of the ‘negative’ momentum trades being unwound.”

The huge rotation in positioning has pulled down the short interest in some of the ASX’s most heavily shorted stocks, including some lithium and nickel miners, which have ranked among the most shorted for months.

The rotation out of nickel and lithium producer IGO is among the most pronounced. More than 25 million shares in the beaten-up stock were covered by short sellers in the final days of February, amounting to more than $200 million based on the current share price.

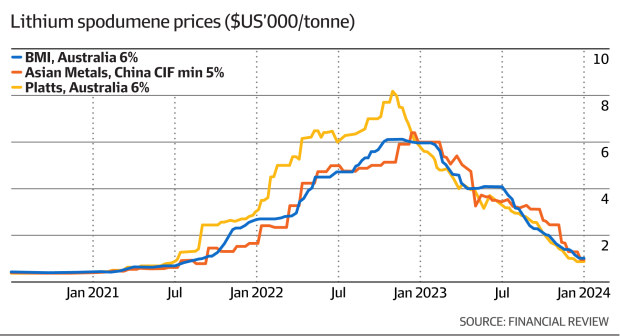

The stock had plunged more than 40 per cent in the last 12 months, pulled down by a sustained rout in the price of nickel and lithium.

The metals collapse drove short positions in IGO to as high as 4.3 per cent of the share float by February 26. Days later, that figure plunged to just 0.85 per cent, coinciding with an 8 per cent jump in the share price the same week.

Core Lithium also recorded a steep drop in short interest from around 13 per cent in mid-February – which at the time made it the third most shorted stock on the index – to now stand at around 8.8 per cent. Short sellers also piled out of coal producer Yancoal and financial group Macquarie, covering around $100 million worth of shares in the final days of February.

Earlier this week analysts at Goldman Sachs warned traders against misconstruing the recent rally in nickel and lithium price, attributing the rise to commodity traders also covering their short positions.

Lithium developer Sayona Mining and nickel explorer Chalice Mining both recorded steep declines in short interest last month, which coincided with strong share price performances.

Despite the shake-up, hedge funds are continuing to bet heavily against Pilbara Minerals, the bourse’s long-standing most-shorted stock. At 21 per cent of the share float, shorts on the iron ore and lithium producer now amount to more than $2.5 billion based on current share prices.

Hedge funds caught short

Short sellers also ditched some of last month’s best performing stocks, including discount jewellery retailer Lovisa and logistic tech developer WiseTec. Both stocks have rallied more than 20 per cent so far this year.

Long-short fund manager at Totus Capital, Ben McGarry, said it was a difficult environment for short selling in February.

“Equity markets continue to melt up driven by excitement about [artificial intelligence], a more dovish Federal Reserve and expectations of a soft landing or no landing for the global economy,” he said.

“The consumer slowdown we had expected in 2023 hasn’t yet materialised and at full-employment, banks and housing exposed stocks have been resilient.”

As hedge funds retreated from the ASX’s most heavily shorted stocks, they simultaneously piled into some of Australia’s biggest public companies.

Commonwealth Bank, the ASX’s largest stock by market capitalisation, drew more than $300 million in fresh short bets in the final days of February.

Before the surge, short interest in the big four bank had been trending lower since mid-December, with Barrenjoey bank analyst Jon Mott noting in a February report that short covering was one factor behind CBA’s strong rally in 2024.

Iron ore giant Rio Tinto has become another target, with bets against the stock now amounting to around 3 per cent of the miner’s float, it’s higher point in more than 3 years. Similar jumps were recorded for bets against CSL, BHP and Wesfarmers.

However, it was Seven Group that has drawn the starkest increase in short bets. The Kerry Stokes’ owned company has recorded a 1.5 per cent jump in short interest since its full-year results were released in mid-February alongside news of a bid for the remaining stake in fellow ASX-lister Boral.

The short bets against Seven Group now amount to more than $250 million.