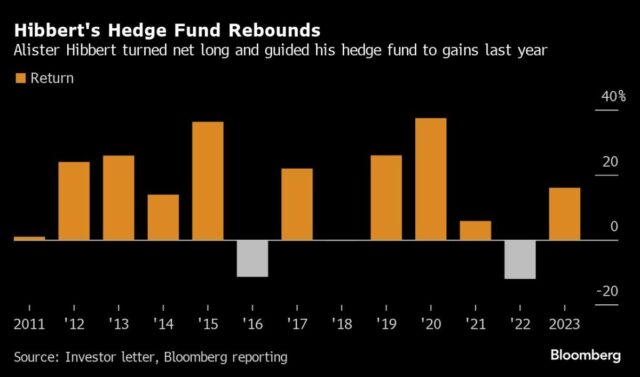

(Bloomberg) — BlackRock Inc.’s star hedge fund manager Alister Hibbert posted double-digit gains in a strong period for stock pickers, bouncing back from his worst-ever annual losses the year before.

Most Read from Bloomberg

The BlackRock Strategic Equity Hedge Fund made 16% in 2023, its best in three years, according to a person with knowledge of the matter and an investor letter seen by Bloomberg. The strategy, which managed $9.6 billion at the end of November, had lost 12% in 2022, the person said, asking not to be identified because the information is private.

A spokesperson for BlackRock declined to comment.

London-based Hibbert has long been one of the best-paid risk-takers at the world’s biggest asset manager and key to BlackRock’s expansion into active management. As a driver of the firm’s performance fees, he earned a nine-figure sum in 2020, more than triple the size of Chief Executive Officer Larry Fink’s $30 million payout.

Read More: BlackRock’s Hedge Fund Star Gets Paid More Than Larry Fink

Gains last year were bolstered by the hedge fund turning net long equities in the fourth quarter of 2022 from its overall short tilt, with bets on semiconductors and other cyclical stocks aiding performance at a time when others were particularly bearish, Hibbert told clients in another letter explaining his rebound during the first half of the year.

STMicroelectronics NV and ASML Holding NV were among the hedge fund’s top holdings at the end of November along with Microsoft Corp. and Mastercard Inc., all of which soared last year. The fund’s gains compare to a 26% rise in the S&P 500 Index including reinvested dividends.

BlackRock’s money pool joined equity fund peers such as TCI, Light Street Capital Management, Viking Global Investors, Tiger Global Management and Coatue Management to make money in what turned out to be a strong year for old-fashioned stock-pickers.

Hibbert, who spreads his bets across dozens of long and short stocks positions, started the hedge fund in 2011 with $13 million and turned it into one of the largest long/short money pools, generating annualized returns of about 14%.

Here are some other equity hedge funds returns:

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.