Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Sign up here to get it sent straight to your inbox every Monday.

Does the format, content and tone work for you? Let me know: harriet.agnew@ft.com

BlackRock to buy Global Infrastructure Partners for $12.5bn

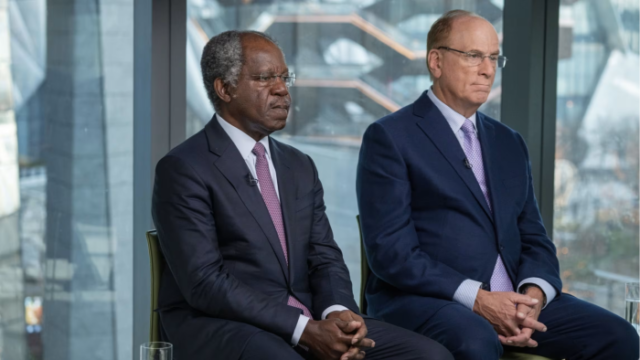

BlackRock chief executive Larry Fink has been searching for years for the right private markets partner to make his $10tn money manager as formidable a player in alternative investments as it is in traditional asset management.

On Friday, he announced a transaction that may do just that. BlackRock has struck a deal to buy Global Infrastructure Partners for more than $12.5bn in cash and stock, a move that will substantially boost its footprint in alternative assets.

Acquiring GIP, which has about $106bn in assets under management, will make BlackRock the world’s second-largest manager of private infrastructure assets, and bolster the leadership of its alternatives business.

Fink has been openly hunting for a transformational deal along the lines of the 2009 purchase of BGI from Barclays that gave BlackRock a dominant position in passive investing and helped make it the world’s largest money manager.

But his overtures to private equity, private credit and hedge funds rarely got beyond the first meal, write my colleagues Brooke Masters and Antoine Gara in this analysis. Often the cultures or business models clashed. When the alternatives titans got intrigued by the idea of a tie-up, they proved unwilling to give BlackRock the majority control it wanted.

Global Infrastructure Partners was different. When Fink and GIP founder Adebayo Ogunlesi met for an October dinner at Fasano, an Italian restaurant steps away from Rockefeller Center in New York, the menu included plans for a combination that could shake up the investment management industry.

Ogunlesi had built GIP in less than two decades into one of the standout firms in the lucrative private investment industry. With just 400 people, his infrastructure investment outfit had grown to hold $106bn in assets including stakes in airports in Sydney and London, ports, green energy and large pipelines.

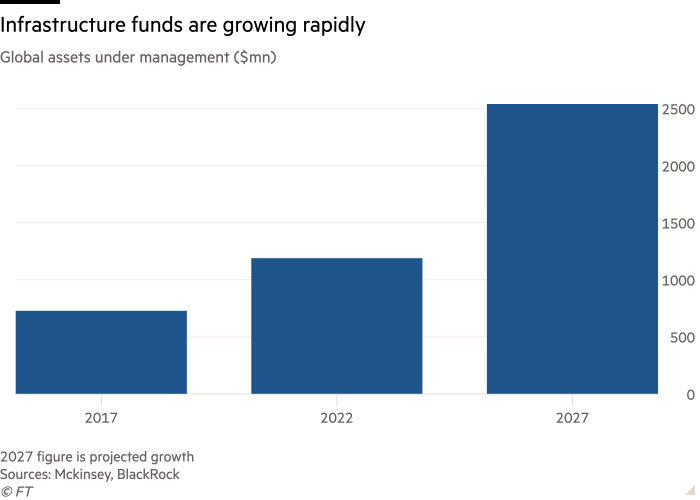

Fink and Ogunlesi, who met when they worked at First Boston before it was bought by Credit Suisse in the 1980s, shared a vision that infrastructure investments would be the fastest-growing part of the private markets in the coming years.

They also believed that private capital, an industry started decades ago by small teams of mercenary dealmakers, was entering a phase of consolidation in which size, resources and the ability to win access to the world’s largest companies would be paramount.

Fink told analysts on Friday that the combination would feed and meet growing demand for infrastructure from sovereign wealth funds and rich individuals.

“BlackRock and GIP will be able to connect our clients with bigger and better opportunities while also accelerating growth, diversifying revenues and generating earnings for our shareholders,” he said. “We could not be more excited.”

Read the full analysis of how the deal came about here. And don’t miss Antoine and Brooke’s profile of Ogunlesi, who rose to head investment banking at Credit Suisse before founding GIP in 2006.

Terry Smith and Nick Train suffer outflows

The continued march of cheap passive equity offerings and the more recent move towards high-yielding cash products has two prominent casualties: Terry Smith and Nick Train.

The pair of UK star fund managers suffered £2.2bn in outflows last year, writes Sally Hickey in London.

Terry Smith’s Fundsmith Equity Fund and Nick Train’s WS Lindsell Train UK Equity Fund were hit by redemptions every month in 2023, with annual net outflows totalling £1.4bn and £800mn, respectively, data from Fundsmith and Morningstar show.

The wave of redemptions reflects a tougher environment for active fund managers. Volatile markets have hampered the performance of the two funds, while investors have been lured by low-cost trackers and cash products offering the highest rates in a decade.

A combination of cost of living pressures, higher mortgage rates and the underperformance of UK equity markets compared with US equity and global fixed-income markets has caused UK investors to pull out of investment funds over the past two years.

“The entire equity fund management sector saw large outflows in 2023 and it is impossible for us to avoid that trend,” Smith, founder and chief executive of Fundsmith said in an emailed response.

The Fundsmith Equity Fund has not outperformed the MSCI World index since 2020, returning 12.4 per cent last year compared with the index’s 16.8 per cent. Fundsmith’s assets under management dropped from £28.9bn at the end of December 2021 to £23.7bn two years later.

However, the fund has beaten the MSCI World index on an annualised basis since its inception in 2010, returning 15.3 per cent compared with the index’s 11.5 per cent.

Smith’s style is to invest in a small number of “high quality, resilient, global growth companies”, primarily in the US, that he aims to hold for the long term.

The top five contributors to the fund’s performance last year were Meta Platforms, Microsoft, Novo Nordisk, L’Oréal and IDEXX Laboratories. The five biggest detractors were Estée Lauder, McCormick, Diageo, Mettler-Toledo and Brown Forman.

“We have made it clear from the outset that we do not expect our strategy, or indeed any strategy, to outperform the market or even make a positive return in all reporting periods and market conditions,” Smith said. “We think that investors should judge our returns over the long term.”

Chart of the week

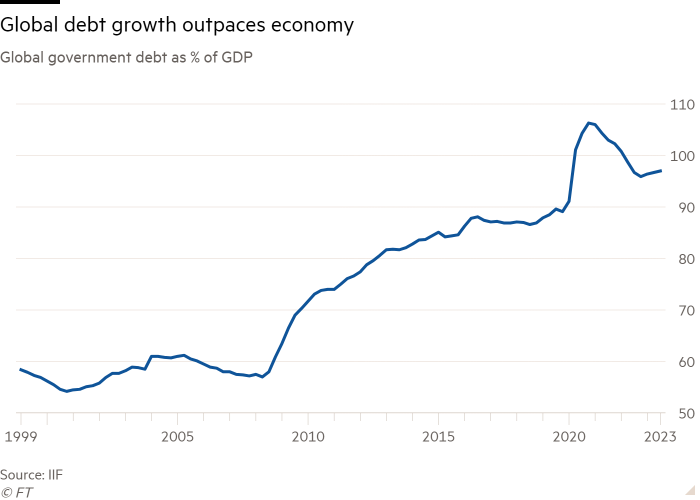

Investors are warning governments around the world over “unmoored” levels of public debt, saying excessive pre-election borrowing promises risk sparking a bond market backlash.

Government debt issuance in the US and the UK is expected to soar to the highest level on record in the coming year, with the exception of the early stages of the Covid pandemic, writes Mary McDougall in London.

Emerging markets are set to add to the deluge of bond sales, after government debt climbed to an all-time high of 68.2 per cent of GDP last year, according to the Institute of International Finance.

Deficits are “out of control and the real story is that there’s no mechanism for bringing them under control”, said Jim Cielinski, global head of fixed income at Janus Henderson.

He added that the issue would become a serious concern to markets “in the next six to 12 months as something that matter[s] a lot”.

The US Treasury will issue around $4tn of bonds this year with a maturity of between two and 30 years according to estimates from Apollo Global Management, up from $3tn last year and $2.3tn in 2018.

Net issuance, which is adjusted for Federal Reserve purchases and existing debt falling due, will be $1.6tn over 12 months to the end of September according to calculations by RBC Capital Markets, the second highest year on record. The Canadian bank estimates that net issuance in 2024-2025 will surpass pandemic-era levels.

The scale of borrowing is likely to distract markets from their more typical focus on the future path of interest rates, fund managers say.

“We are truly in an unmoored environment for government debt compared with previous centuries,” said Robert Tipp, head of global bonds at PGIM Fixed Income. “Everyone is getting a pass right now, whether you are in the US or Italy, but there have been some signs recently that investors and rating agencies are starting to think about this again.”

Five unmissable stories this week

Private equity can no longer rely on borrowing cheap money to fuel returns, and will have to go back to its roots of sourcing good deals and making operational improvements, according to Marc Nachmann, global head of asset and wealth management at Goldman Sachs. “Private equity will look different over the next 10 years than it looked over the past 10 years,” he said.

The Securities and Exchange Commission has approved the first spot bitcoin exchange traded funds in a watershed moment that cryptocurrency enthusiasts are betting will draw new retail and institutional investors into the market. The US regulator cleared 11 ETFs to list, with sponsors ranging from established players like Fidelity and Invesco to newcomers including Grayscale and Ark Invest.

A portfolio manager at Izzy Englander’s Millennium Management is preparing to launch what would be the biggest new hedge fund in more than a year after securing $3bn of capital from his employer and taking up to 30 investment staff with him. Diego Megia is targeting $4bn to $5bn of investor capital for the launch of macro hedge fund Taula Capital.

Hedge funds are challenging private equity firms over restrictions that dictate who can lend to or buy the debt of buyout-backed companies, weighing legal action to capitalise on a surge in corporate distress. Elsewhere in private equity, the Blackstone Group has raised $1.3bn for a fund tailored to wealthy individual clients, signalling a revival of momentum in its efforts to reach investors beyond its base of institutions such as pension funds.

Shares in Jupiter plunged after the UK asset manager said investors pulled more money than feared from its funds last year and announced the exit of a high-profile fund manager. Ben Whitmore, whose funds include the £2.1bn Jupiter UK Special Situations Fund and the £1.6bn Jupiter Income Trust, is leaving at the end of July to set up his own firm.

And finally

Leaving on a jet plane . . . The big hotel openings of 2024.

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew@ft.com