(Bloomberg) — A former UBS Group AG banker is launching a new hedge fund in Hong Kong, betting on a revival of stock sales in Asia that have plunged to a decade low.

Pascal Guttieres said a European insurer is close to inking a multi-year deal to back his Viridian Asset Management with $150 million. He expects to start trading in the summer, pending regulatory approval, with as much as $400 million of capital and 12 employees, including Chief Operating Officer Arnaud Carcel, formerly of Axa Investment Managers.

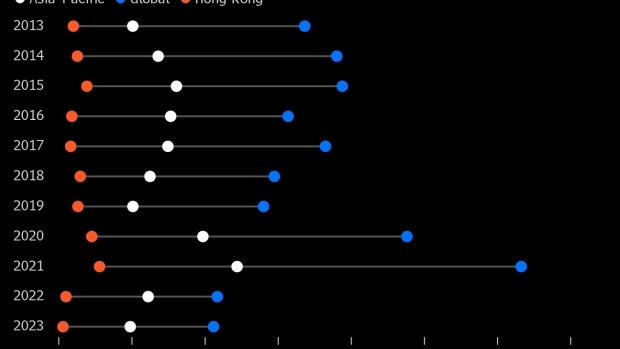

Money raised from Asia-Pacific share sales tumbled last year to the lowest in at least a decade, according to data compiled by Bloomberg. In Hong Kong, a traditional capital-raising hub for Chinese companies, deal value was just $12.6 billion, barely over one-tenth of the 2021 peak, as the mainland was beset by geopolitical tensions, regulatory uncertainties and a weak economic outlook.

“I think the worst two years are behind us,” Guttieres said in a phone interview from Miami. “Not just in Asia, but globally, there is going to be a ramp up in the equity capital markets business in the next two years.”

Equity issuance around the world has slumped in the past two years as interest-rate hikes fueled recession fears. Money raised from share sales globally tumbled to about one-third of the 2021 peak, according to data compiled by Bloomberg.

“In uncertain times, no investor is looking to deploy significant amounts of capital at once, which a deal requires,” Guttieres said. “Also, valuations outside the US were too low for sellers and issuers to want to sell.”

The former banker, who is moving back to Hong Kong in June, isn’t alone in wagering on a revival of deal flows. The $61 billion Millennium Management is backing a similar hedge fund venture planned by former Goldman Sachs Group Inc. banker Jamie Goodman with $500 million, Bloomberg News reported this week.

“Viridian will buy shares during those offerings if the valuations are deemed attractive, based on analysis of company fundamentals, business outlooks and technical factors,” Guttieres said.

His plans come even after regulators globally tightened scrutiny over block trades, taking aim at the disclosure of and trading on non-public information ahead of deals.

Guttieres headed UBS’s block trading team for Europe, the Middle East and Africa out of London, before moving to Hong Kong in 2012 to oversee the same business in Asia outside of Japan. He then spent seven years as a portfolio manager at Segantii Capital Management Ltd. in Hong Kong and Dubai. Segantii is a key player in the region’s equity capital markets.

Viridian will likely focus on the Japanese, Indian and South Korean markets in the first two or three years, before the eventual rebound in share sales in Hong Kong and China, Guttieres said. Stocks in India and Japan been rallying, in part as investors pull out of China, with a gauge of Hong Kong-listed Chinese stocks entering its fifth straight year of loss.

Japanese companies are facing pressure to improve governance and returns to minority shareholders. That may lead to more unwinding of ubiquitous cross-shareholdings through share sales, said Guttieres, who named his company after his favorite color, a shade of green.

India has been a chief beneficiary from multinational companies diversifying supply chains away from China, which will prompt more firms to raise money for expansion, he added. With its growing middle class, it’s also attracting international capital moving from China.

(Adds value of Hong Kong share sales in the third paragraph. An earlier version corrected the timing of plans to start trading)

©2024 Bloomberg L.P.