(Bloomberg) — ExodusPoint Capital Management clients pulled about $1 billion from Michael Gelband’s hedge fund in 2023, the second straight year of withdrawals, according to people familiar with the matter.

Most Read from Bloomberg

That followed hundreds of millions of dollars of withdrawals in 2022 and prompted ExodusPoint to raise fresh capital after being closed to new cash for three years. It gathered $1 billion last year to offset the redemptions, one of the people said. The hedge fund, beset by a stretch of lackluster returns, manages about $12 billion.

A spokesperson for the New York-based firm declined to comment.

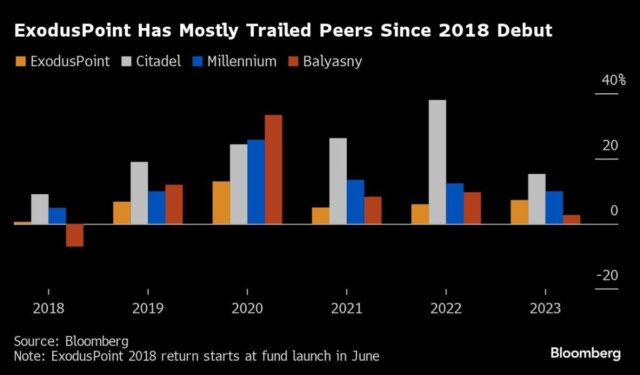

ExodusPoint debuted in 2018 with $8 billion, the biggest hedge fund launch ever. Since then, it has significantly underperformed many of its biggest multistrategy peers, including Ken Griffin’s Citadel and Izzy Englander’s Millennium Management. It logged its best annual performance in 2020, returning 13%. This year the fund is up 2.3% through March 22.

Some investors are losing patience.

Underperforming hedge funds with long lockups and high fees are looking less attractive compared with relatively high-returning Treasuries. Multistrats have faced additional scrutiny, too, with more clients saying they plan to yank cash from the strategy in 2024 than they did a year earlier, according to a Goldman Sachs Group Inc. report.

ExodusPoint has struggled to build out its equities group since the firm’s launch, with Gelband’s fixed-income unit accounting for most of the fund’s performance. Last year, it ended its relationship with Pythagorean Trading and Ritter Alpha, external firms that traded equities on its behalf, regulatory filings show. The firm also shuttered its Paris unit, which opened in 2019 with about 20 people, filings showed.

Late last year, ExodusPoint stopped Dubai-based portfolio manager Bhavit Sawjani from trading after racking up more than $70 million of losses. Sawjani still works at the firm but no longer runs capital, and his team has been disbanded.

The firm made several hires recently to bolster its equities unit, including portfolio managers Yash Agarwal and Todd Finegold, who both previously worked at Citadel, and James Tjarksen from Point72. Last year, ExodusPoint also hired Adam Galeon, a longtime health-care portfolio manager, to head its long-short equities operation.

The last time ExodusPoint opened to fresh cash was in 2020, when it raised more than $3 billion.

(Updates with names of new hires in ninth paragraph. A previously published version corrected ExodusPoint’s 2020 performance in chart and fourth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.