(Bloomberg) — Assets of former Goldman Sachs Group Inc. partner Ryan Thall’s Panview Capital Ltd. have hit $1.1 billion, prompting the Hong Kong-based firm to stop taking money from fresh investors since year-end, said a person with knowledge of the matter.

Most Read from Bloomberg

Assets expanded nearly sevenfold from $160 million in January 2020, said the person, who asked not to be identified because the information is private. The firm will only accept new money to replace existing investors for now. Thall declined to comment.

Panview Asian Equity Fund has generated positive returns every year since its November 2019 inception, gaining 21% last year and another 9.8% in the first two months of 2024, according to a newsletter seen by Bloomberg News.

That made it a standout when regional peers have struggled to make money and raise capital in the past three years, with geopolitical tensions and China’s economic slowdown weighing on markets and investor appetite.

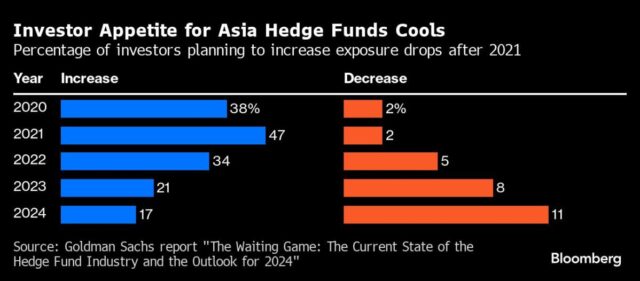

Asian stock-focused hedge funds have lost an annualized 6.5% on average between the end of 2020 and January 2024, while global equity peers managed a 0.8% gain, according to data from Eurekahedge Pte. While 47% of investors planned to increase exposure to Asian hedge funds in 2021, that dropped to 17% in the latest Goldman Sachs survey released last month.

Still, investors appear to be partial to those that have a broader geographical focus and have churned out consistent returns during market turmoil.

Singapore-based Keystone Investors Pte is another example. The Liu Xuan-led spinoff from Schonfeld Strategic Advisors has more than doubled assets to more than $2 billion, from the $800 million at its April 2022 inception, and will stop accepting new investors from early April, Chief Executive Officer Ken Tonkinson confirmed.

Keystone has a focus on China but can trade global themes. The pan-Asia hedge fund returned around 10% in the first two months, after surging nearly 21% last year, the CEO confirmed. It also hasn’t had a losing year.

With Hideki Kinuhata, Thall once co-led Oryza Capital Ltd., a hedge fund under Goldman Sachs Investment Partners that focused on Asia and raised $1 billion within a year after it was set up in 2013. They also oversaw Asia investments for GSIP’s global hedge fund. Goldman Sachs shut the two funds in 2018, amid fickle investor demand for such products when easy monetary policy propelled a decade-long rally for stock benchmarks, leaving hedge funds trailing in performance.

At the end of February, Japan represented Panview’s largest market by combined dollar value of bullish and bearish wagers, followed by Greater China. It had more long than short investments in Japan, while maintaining a mostly balanced exposure to Greater China, according to the newsletter.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.