Today’s financial landscape is buzzing with pivotal movements and strategic decisions across sectors, from ambitious expansions and steadfast investments to the contentious journey of a digital platform towards its initial public offering (IPO). Goldman Sachs sets its sights on India for expansion, hedge funds maintain their positions on Chevron-Hess amidst fluctuating oil markets, and Reddit’s IPO journey reveals the critical role of its vibrant yet unruly user base.

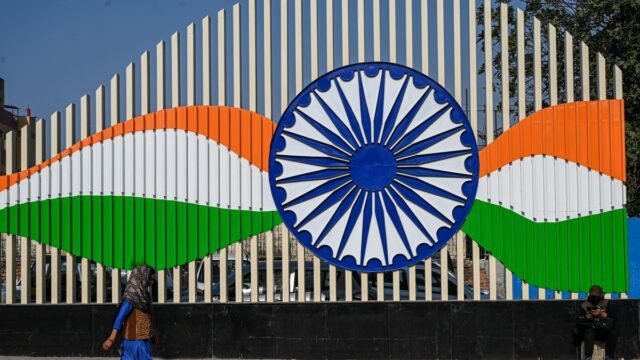

Goldman Sachs’ Strategic Expansion in India

Goldman Sachs, a leading global investment banking, securities, and investment management firm, is eyeing significant expansion opportunities in India. With a robust strategy aimed at tapping into the burgeoning economic growth and digital transformation within the country, Goldman seeks to enhance its presence and operations. This move is part of a broader pattern of international finance entities looking towards Asia for growth prospects, driven by the region’s dynamic economies and technological advancements.

Hedge Funds’ Firm Stance on Chevron-Hess

In the volatile world of oil investments, hedge funds are holding their ground with investments in Chevron and Hess Corporation, signaling a strong belief in the resilience and future profitability of these oil giants. This steadfast approach amidst fluctuating oil prices and market uncertainties reflects a deeper analysis of the energy sector’s long-term potential. It also underscores the strategic patience that characterizes successful investments in natural resources, especially in an era of heightened awareness about energy sources and sustainability.

Reddit’s IPO and the Challenge of Its User Base

Reddit, the popular social media platform known for its vibrant communities and user-generated content, is navigating a turbulent path towards its initial public offering (IPO). With ambitions of achieving a valuation of up to $6.5 billion, significantly lower than its previous $10 billion valuation, Reddit’s journey underscores the complexities of monetizing user-generated platforms. Concerns over user discontent, the impact of meme-driven market sentiment, and the platform’s reliance on unpaid moderators pose significant challenges. The company’s ability to address these issues while retaining its user base’s engagement and loyalty will be crucial to its IPO success and future growth.

The unfolding narratives of Goldman Sachs’ expansion into India, hedge funds’ confidence in Chevron-Hess, and Reddit’s IPO endeavors reflect the multifaceted nature of today’s business and financial landscapes. Each story, while distinct, underscores the importance of strategic foresight, deep market understanding, and the ability to navigate complexities in achieving long-term success.

As these developments continue to unfold, they offer valuable insights into the dynamics of global finance, the energy sector’s future, and the evolving digital economy. The outcomes of these movements will not only shape the involved entities’ trajectories but also have broader implications for market trends, investment strategies, and digital platform monetization practices.