The hedge fund is run by veteran derivatives trader Boaz Weinstein and has been ramping up its investments in listed funds both in Australia and the United Kingdom. That has put Hearts & Minds firmly in its sights, despite its philanthropic structure deterring other activists from agitating for change.

Hearts & Minds’ $700 million of capital is invested in stocks pitched at the Sohn Hearts & Minds charity event and is allocated to a select group of managers, including Regal Funds Management, Caledonia and TDM Growth Partners. Those managers, in turn, forgo their 1.5 per cent management fee, which are instead donated to medical research.

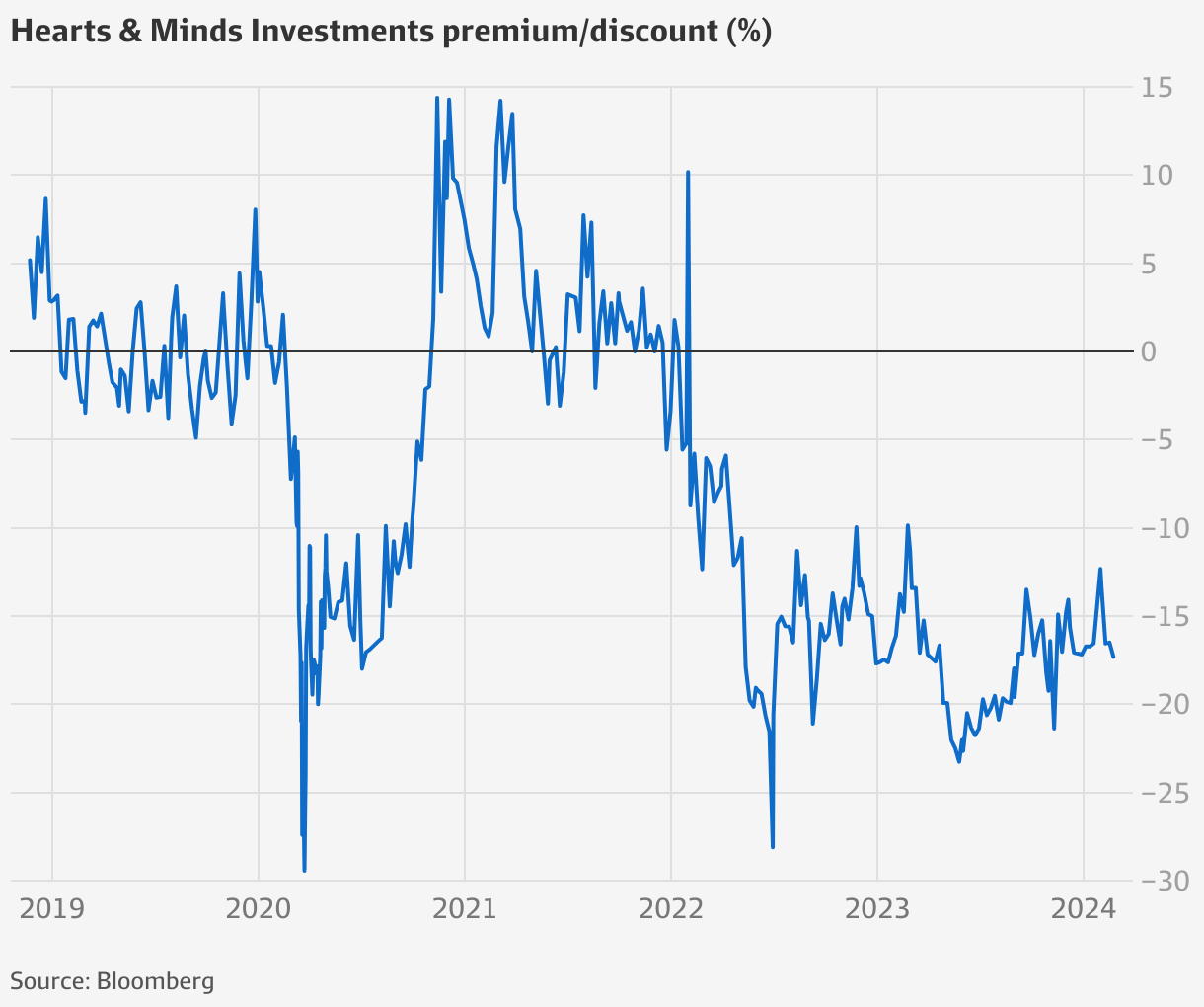

The fund has paid out nearly $50 million to its charities, but has fallen short on the promise of investment returns which have lagged the market, while the share price trades at a persistent double-digit discount to its asset value.

Hearts & Minds last traded at $2.65, some 17 per cent below the net asset value. That means there is a $117 million gap between the $707 million value of the listed investments in the funds and its market capitalisation.

Saba began rapidly buying up shares in the second half of last year and was first revealed as a substantial holder of Hearts & Minds in November after crossing the 5 per cent threshold. The fund has kept buying and by January 10, it had acquired more than 21 million units valued at over $54 million.

Representatives of Hearts & Minds and Saba met for the first time in December, and engaged as recently as last week.

While Mr Cuffe said Saba gave no indication that it intended to push for Hearts & Minds to be wound up, Mr Weinstein is well known for agitating listed funds to take steps to close discounts, including taking legal action.

In a similar campaign in the United States last year, Saba won legal action against BlackRock, which attempted to block Mr Weinstein from using his voting rights to agitate for change in closed-end funds operated by the asset management giant. Saba previously brought and won lawsuits against Eaton Vance and Nuveen in similar cases.

Saba’s presence in other local listed funds overseen by Regal and Pengana Capital has unsettled the local sector. In some instances, instructions have gone out to tell brokers not to sell large blocks to the hedge fund.

Barrenjoey investment bankers Matthew Grounds (centre) and Guy Fowler (left) sit alongside Chris Cuffe on HM1’s board. Peter Rae

But they have added to existing pressure facing boards tasked with governing listed investment companies to deal with persistent discounts to net asset value.

Magellan Financial, which agreed to pay out wealthy activist investor Nick Bolton last year, said it would convert its $2.7 billion closed-end global fund into an exchange-traded fund, while Spheria Asset Management said it would shift investors to an alternative fund if its discount persisted on its $127 million fund.

Debt funds issued by Partners Group and Neuberger Berman have chosen to delist to address discounts.

The Hearts & Minds board is not short of star power or activism experience. Barrenjoey investment bankers Matthew Grounds and Guy Fowler and well-known activists – Geoff Wilson and Gary Weiss – are directors alongside Mr Cuffe.

They have been trying to get ahead of a potential stoush over the company’s share price discount, seeking out contacts who may be able to discourage a campaign to wind down the fund, while balancing the philanthropic intentions to support the charities and their fiduciary duty to shareholders.

Even if Saba were to target the fund more aggressively, Mr Cuffe said it may struggle to get the shareholder support it would need.

“Even if they did [turn activist] I think they would find it difficult unless they owned a lot of stock completely on their own,” he said.

“They know a lot of ultra-high-net-worth family money is behind [Hearts & Minds], and while we’d all like to see the discount disappear, they’re all very much on-side.”

Board open to ideas

Backers of the fund include former ANZ bank chairman Charles Goode, gaming machines billionaire Len Ainsworth and Atlassian co-founder Scott Farquhar.

One major shareholder told The Australian Financial Review that the fund had relied too heavily on tech and growth stocks chosen by stock pickers at the Sohn conference, which left it exposed to a sharp downturn in the sector in 2022.

That downturn caused the fund to re-evaluate its strategy and how the portfolio was constructed, a decision Mr Cuffe believes will help reduce the discount.

“Ahead of the conference stocks, we now run risk control of the picks,” he said. “If they were all in one sector or are all in small caps, or if there’s too much concentration risk, we go back to the particular manager and say, you need to change your stock. We’re more like the conductor of an orchestra now.”

In reference to Saba’s presence on the share register, Mr Cuffe said: “They’ve given the impression that they’re not going to be an agitator – but if they were to, and the ideas were good, tell us.”

“We’re all doing this pro bono, there’s no management fees reaching our profits – we’re doing this from the good of our hearts to help medical research in Australia. If there’s a better way to do things, we’d like to know.”