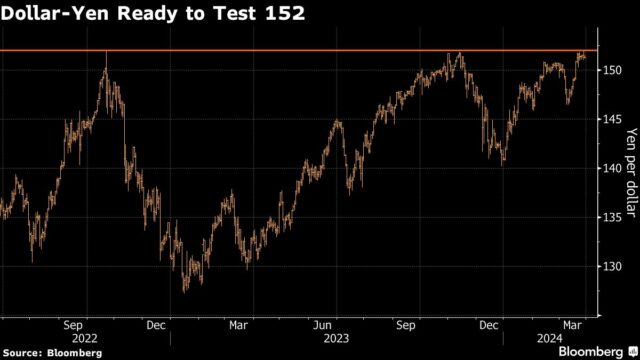

(Bloomberg) — Yen watchers are pointing to 152 per dollar as the next key level for the beleaguered currency, with strategists warning that a breach opens the door to intervention while option positioning threatens to accelerate declines.

Most Read from Bloomberg

The significance of the level to policymakers has been on display, with warnings from Tokyo of bold action against speculative trading.

Meanwhile, hedge funds are estimated to have billions of dollars in derivatives that rise in value the nearer the yen gets to 152 — but evaporate if the barrier is crossed. A selloff in the yen would then be at risk of accelerating as traders race to cover short positions that linked to the original options.

“Fund managers have chosen it as a barrier for their exotic trades as they feel it will be hard for the market to rally past it,” said Ruchir Sharma, global head of FX option trading at Nomura International Plc in London. “The market would be very nervous about spot gapping higher through the barrier.”

Sharma estimates there are several billions dollars of exotic options maturing in April that have barriers between 152-153.

The yen traded little changed at 151.34 per dollar as of 1:30 p.m. in Tokyo Thursday, having backed away from 151.97 touched a day earlier that was the weakest since 1990.

Policymakers in Tokyo kept a low profile Thursday after the nation’s top currency official, Masato Kanda, on Wednesday pledged to take appropriate action against excessive swings in the market. He later said, following a three-way meeting between the finance ministry, the central bank and financial regulator, that speculative moves in markets wouldn’t be tolerated.

“Market perception is they have drawn a line in the sand at 152,” said Paresh Upadhyaya, director of fixed income and currency strategy at Amundi, US. “The key question is their commitment.”

Traders are also on edge given that Japan’s fiscal year is drawing to an end right when many global markets are about to close for Easter, which creates concerns about rapid repositioning and limited liquidity.

Read more: Japanese Markets Face Risks as Fiscal Year-End Falls on Easter

Adding to this, the Federal Reserve’s preferred measure of inflation is due and may fuel the view that US interest rates aren’t likely to come down any time soon, and that would weigh on the yen.

At the same time, a summary of the Bank of Japan’s March 18-19 meeting that was released Thursday indicates Governor Kazuo Ueda and his fellow board members are in favor of taking a slow approach to rate hikes, which may also put pressure on the yen.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.