At the close of the first quarter, leveraged funds, which include hedge funds and commodity trading advisers as defined by the Commodities Futures Trading Commission (CFTC), reached an all-time high in their bearish bets against the Bitcoin (BTC) price, just as the cryptocurrency’s surge neared its peak.

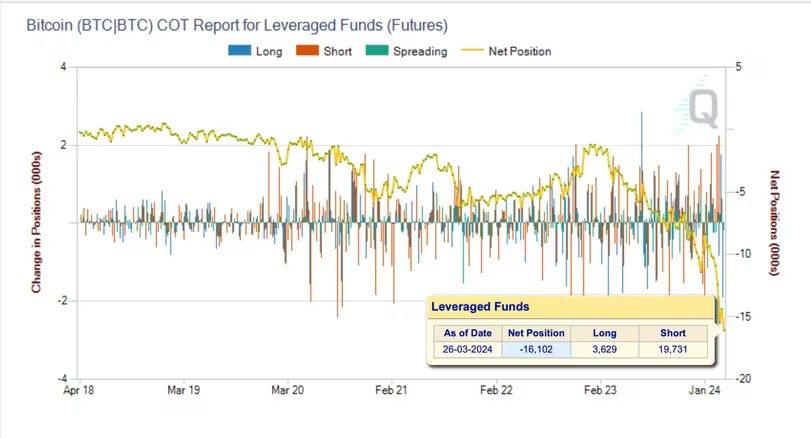

These hedge funds increased their net short positions in the Bitcoin futures contracts traded on the Chicago Mercantile Exchange (CME) to 16,102, setting a record since these futures were introduced in late 2017.

The data, released last week by the CFTC, pertains to the CME’s standard Bitcoin futures contracts, each representing 5 BTC.

Carry Trades Still Yield At Least Twice As Much As The 10-Year Treasury Note

Engaging in a short futures position involves a strategy where a trader opts to sell a futures contract, aiming to profit or protect against a potential decrease in the price of the asset it represents.

This technique is often employed by carry traders or arbitrageurs who short futures while concurrently purchasing the underlying asset, capitalizing on the price variance between the spot and futures markets.

The significant increase in short positions is indicative of hedge funds’ growing interest in engaging in carry trades, as noted by Markus Thielen, CEO of 10x Research.

Thielen emphasized the strong demand among hedge funds for carry trades, highlighting that, despite a 10% decline from its all-time high, Bitcoin has seen its futures premium maintain a double-digit percentage. Hedge funds are seizing this opportunity to benefit from these elevated rates.

Despite Bitcoin reaching peak prices above $73,500 in March and its subsequent loss of bullish momentum, CME futures have sustained an annualized three-month premium exceeding 10%, as per data from Velo Data.

This indicates that carry trades continue to offer returns significantly higher than the 10-year Treasury note, which was yielding a so-called risk-free return of 4.36% at the time of reporting.

The Probability Of The Fed Cutting Rates In June Has Dropped Below 50%

It should be noted that certain hedge funds might have placed direct bets against the market, prompted by recent strong economic data from the U.S. and forward-looking statements from Federal Reserve officials. These developments have diminished the likelihood of imminent, aggressive rate reductions.

Federal Reserve Chairman Jerome Powell, on Wednesday, highlighted the importance of monitoring inflation trends over the next few months, leaving the schedule for an initial rate decrease in limbo. Following the release of positive manufacturing data on Monday, expectations for a rate cut by the Fed in June have fallen to less than 50%.

Furthermore, there is a degree of skepticism among some analysts regarding the potential impact of the upcoming mining reward halving on Bitcoin’s value. The upcoming fourth halving of mining rewards on the Bitcoin blockchain, set to occur later this month, will cut the reward for mining a block to 3.125 BTC from the current 6.25 BTC.

In the past, such halvings have been followed by significant bullish trends in Bitcoin’s value, typically manifesting 12 to 18 months afterward, as the decreased rate of new BTC entering the market meets ongoing demand.

Bitcoin’s Response To The Halving May Not Mirror Its Past Performance

Drawing on historical data suggests an upward trajectory, but David Duong, Coinbase’s head of institutional research, cautions against drawing firm conclusions from such a limited dataset, especially in a landscape transformed by the introduction of spot exchange-traded funds (ETFs) in the United States since January.

Duong highlighted in a recent market update that the introduction of U.S. spot BTC ETFs has significantly changed Bitcoin’s market dynamics.

The influx of billions of dollars into these ETFs over a mere two months has permanently shifted the market structure, allowing major institutional investors to gain exposure to Bitcoin in a new way. Consequently, Bitcoin’s reaction to the upcoming halving event may diverge from past trends.

Duong further noted the importance of cautious interpretation of past cycle analyses due to the small sample size, suggesting that identifying consistent patterns may be challenging. The debut of spot ETFs has already propelled Bitcoin to unprecedented highs before the halving, so its price might end up falling after the halving event.