Analyzing Hedge Funds’ Affinity for IBM: A Look at 13F Filings

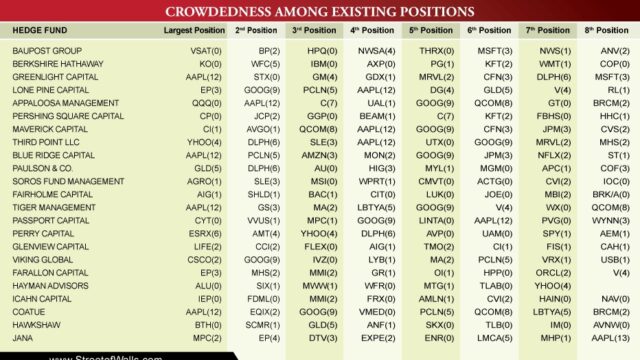

The latest batch of 13F filings, mandatory quarterly reports submitted to the Securities and Exchange Commission (SEC) by institutional investment managers, sheds light on the recent investment trends for International Business Machines Corp (IBM). A review of these filings reveals that IBM was held by 15 out of the 21 hedge funds analysed for the reporting period ending December 31, 2023.

Reading Between the Lines

However, such filings only paint a partial picture as they reflect long positions but not short ones, potentially masking any bearish stances. Yet, tracking these holdings over time can still provide valuable insights into emerging trends. From the period ending September 30, 2023, to December 31, 2023, eight funds ramped up their IBM positions, while four trimmed theirs. Across all funds scrutinised, there was a collective increase of 125,783 IBM shares, translating to a 2.94% uptick in hedge fund ownership.

Investment Sentiment

This data suggests a positive swing in hedge fund sentiment towards IBM. However, it’s crucial to bear in mind that 13F filings have inherent limitations and do not offer a comprehensive view of investment strategies. As such, this information should be considered a catalyst for further research rather than a definitive guide to hedge fund positions.

According to Validea’s multi-factor investor model, based on the strategy of Pim van Vliet, IBM rates highest with a score of 87%, indicating strong investor interest in the stock. International Business Machines Corporation currently boasts a market capitalization of $151.40B and a share price of $165.80 USD. Other key financials include a dividend yield of 5.22%, a P/E ratio of 21.42, revenue per share of $67.30, and a 4.55% return on assets.