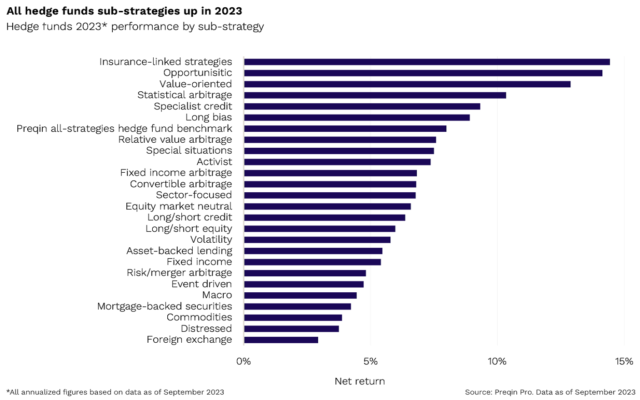

Last year’s top-performing hedge fund strategy might surprise you. No, despite a 22% rally in developed market stocks, it wasn’t the “long bias” hedge funds – those that typically have positive net shares exposure. And it wasn’t macro hedge funds either, even with all the wild swings we saw driven by fluctuating interest rates, inflation, and other economic factors. In fact, the best-performing category was one you’ve probably never heard of: insurance-linked strategies.

These hedge funds generated 14.4% in 2023, data provider Preqin reported, based on annualized figures as of the end of September. That was almost double the average hedge fund return of 8%, and head and shoulders above every other strategy category. These funds predominantly invest in catastrophe bonds (or “cat bonds”) – financial instruments that transfer the risk of natural disasters from insurance companies to investors, who stand to gain higher yields in return but risk losing their principal if a specific catastrophe occurs. These bonds did spectacularly last year, with the Swiss Re Global Cat Bond Index gaining 19.7%. That’s well above the 5.7% return from the Bloomberg Global Aggregate Index, which is made up of investment-grade government and corporate bonds.

So it’s no wonder hedge funds and other investors are paying attention to them. On top of their strong potential for returns, cat bonds also offer diversification benefits since their performance generally isn’t correlated (meaning, it doesn’t go hand-in-hand) with traditional asset classes like stocks or regular bonds. They’re driven, after all, by hurricanes, earthquakes, and the like, not by market rallies and crashes. The major risk you face with investing in cat bonds is, instead, tied to these very catastrophes. And if the specified disastrous event occurs and meets the criteria in the bond’s terms, you could lose some or all of the money you’ve invested in it.

I go over all of this in a lot more detail – as well as how to invest in cat bonds – in an Insight I wrote here.