(Bloomberg) — Hedge funds piled into tech stocks in the weeks before Nvidia Corp. earnings. Now, they’re cashing out and selling at the fastest pace in seven months.

Most Read from Bloomberg

Professional managers offloaded their positions for four straight sessions last week, including Thursday, the day after Nvidia posted results, according to data from Goldman Sachs Group Inc.’s prime-brokerage unit. The intensity of the selling ranks in the 98th percentile of the past five years.

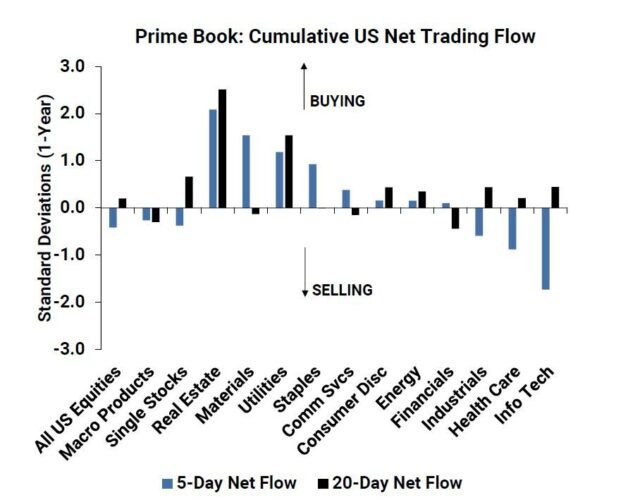

The data suggests traders are booking profits on their tech wagers after a six-week buying streak and putting that extra cash into less volatile stocks, such as consumer staples. Companies that make household products saw the most net buying in 10 weeks, according to Goldman’s prime brokerage.

In a report, Goldman’s traders also pointed to data that underscored the market’s confidence in tech stocks. The put-call skew, often used as a measure of investor fear, has moved lower, and retail trading activity in Nvidia was in the 99.96th percentile for the week.

But with sentiment running so high, there’s reasons to be concerned. Outside of Nvidia’s one-day surge, the Nasdaq 100 struggled as it posted losses three out of the last four sessions.

“This has raised some tension about the sustainability of momentum from here now,” wrote Peter Callahan, a specialist in tech, media and telecom at the bank. Now that all the big tech companies have reported, the focus of the next few days will shift to economic data and the timing of interest rate cuts, he added.

–With assistance from Michael Msika.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.