(Bloomberg) — Hedge funds turned bearish on the Swiss Franc just one week after boosting long bets, amid speculation the central bank is no longer supporting the currency with purchases and could even lower interest rates soon.

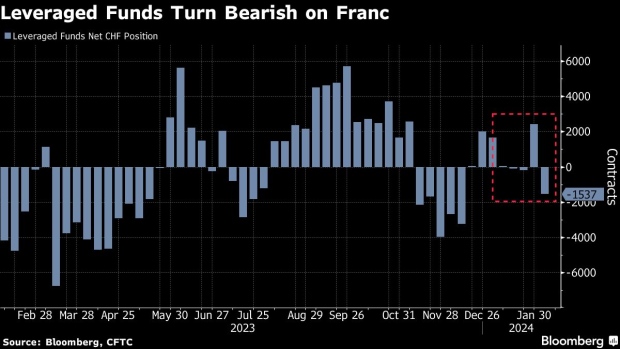

Weekly positioning data from the CFTC show leveraged funds — a group of market players including hedge funds — became net sellers of the franc in the week ended Feb. 6. It’s an abrupt change from the prior week, when the market was the most long it’s been since November.

The repositioning comes as Swiss National Bank data released last week suggested the central bank was also pivoting to become a net seller. It said in December it would no longer only focus on currency purchases.

The SNB’s purchases have been a key support for the currency, which rose to the highest since 2015 against both the dollar and the euro, putting downward pressure on consumer prices. But with inflation below the bank’s 2% ceiling and policymakers calling an end to their tightening cycle last month, the bullish case appears to be waning.

“The market is still waiting for a more clear signal and openness from the SNB, and it is not surprising that some leveraged positions are starting to tilt toward a cut,” said Sascha Kever, an asset manager at Pkb Privatbank AG in Lugano. A 25 basis point cut at its next meeting March could push EUR/CHF up to 0.9800, a level last seen in July, he added.

Last week’s repositioning by leveraged funds marks the third time they’ve reversed course this year. The market entered 2024 bullish on the franc, then turned flat amid calls the currency was overvalued, before flipping to bet on gains again — with analysts this time citing its appeal as a haven currency.

The Swiss currency has fallen nearly 4% versus the dollar since the end of December, the third-worst performance among Group-of-10 currencies. In London, it was trading around 0.8751, near its lowest level since mid-December hit on Friday. Against the euro, it slipped to its weakest in nearly three weeks.

“I am not in the camp of those who believe that the SNB is currently selling CHF in the market,” said Ulrich Leuchtmann, head of FX research at Commerzbank AG in Frankfurt. “But there are rumors, so it’s possible that people are confused, and this should lead to volatility in positioning.”

CFTC data show leveraged funds held 1,537 contracts tied to bets the franc will fall, the most since mid-December. That’s down from 2,433 long bets the week prior, which was the highest level since early November.

Read more: Swiss Franc’s Bearish Case Is Starting to Unfold: Trader Talk

Bank of America Corp currency strategists Claudio Piron and Athanasios Vamvakidis recommend shorting the franc against the pound and euro, they wrote in a Feb. 9 note.

Position “for CHF weakness from an overvalued level as the SNB stops shrinking its balance sheet, has started to intervene and has expressed concerns about the strong currency,” they said.

–With assistance from Alessandro Speciale.

©2024 Bloomberg L.P.