Insights from the Latest 13F Filing Highlight Significant Moves in Tech Giants

Jim Simons (Trades, Portfolio), the renowned mathematician and founder of Renaissance Technologies, has made notable changes to his investment portfolio in the fourth quarter of 2023. Known for his quantitative approach to investing, Simons has built one of the most successful hedge funds in the world, leveraging complex mathematical models to predict market movements. His scientific mindset and skepticism of statistical flukes have set him apart in the financial world, leading to unparalleled success in trading across global markets.

Summary of New Buys

Jim Simons (Trades, Portfolio) strategically expanded his portfolio by adding a total of 711 stocks. Noteworthy new acquisitions include:

-

Amazon.com Inc (NASDAQ:AMZN), with 4,296,466 shares, making up 1.01% of the portfolio and valued at $652.81 million.

-

Procter & Gamble Co (NYSE:PG), comprising 1,666,029 shares, which is approximately 0.38% of the portfolio, with a total value of $244.14 million.

-

Alphabet Inc (NASDAQ:GOOG), with 1,435,100 shares, accounting for 0.31% of the portfolio and a total value of $202.25 million.

Key Position Increases

Simons also significantly increased his stakes in 1,589 stocks, with the most prominent being:

-

Meta Platforms Inc (NASDAQ:META), with an additional 2,004,453 shares, bringing the total to 2,101,986 shares. This represents a substantial 2,055.15% increase in share count, impacting the portfolio by 1.1%, and a total value of $744.02 million.

-

Tesla Inc (NASDAQ:TSLA), with an additional 1,838,423 shares, bringing the total to 2,555,019. This adjustment marks a 256.55% increase in share count, with a total value of $634.87 million.

Key Position Reductions

Conversely, Simons reduced his position in 1,357 stocks. The most significant reductions include:

-

Berkshire Hathaway Inc (NYSE:BRK.A) by 958 shares, resulting in an 82.37% decrease in shares and a 0.86% impact on the portfolio. The stock traded at an average price of $533,852 during the quarter and has returned 11.29% over the past three months and 8.96% year-to-date.

-

Netflix Inc (NASDAQ:NFLX) by 977,216 shares, leading to a 70.67% reduction in shares and a 0.63% impact on the portfolio. The stock traded at an average price of $436.54 during the quarter and has returned 24.20% over the past three months and 13.42% year-to-date.

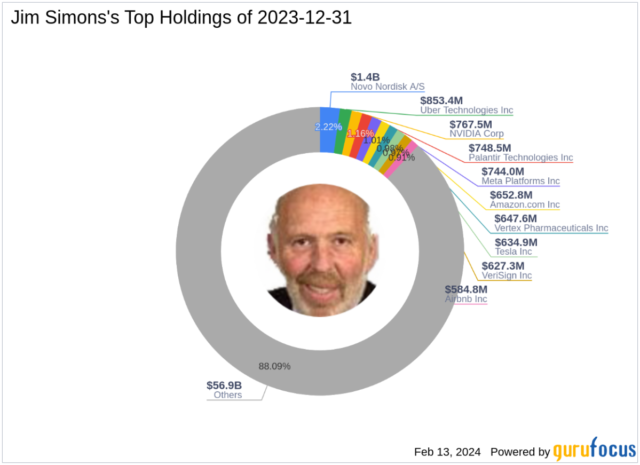

Portfolio Overview

As of the fourth quarter of 2023, Jim Simons (Trades, Portfolio)’s portfolio encompassed 3,683 stocks. The top holdings included 2.22% in Novo Nordisk A/S (NYSE:NVO), 1.32% in Uber Technologies Inc (NYSE:UBER), 1.19% in NVIDIA Corp (NASDAQ:NVDA), 1.16% in Palantir Technologies Inc (NYSE:PLTR), and 1.15% in Meta Platforms Inc (NASDAQ:META). The investments are predominantly concentrated in 11 industries, with a particular focus on Technology, Healthcare, and Consumer Cyclical sectors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.