Investors looking to improve their portfolio performance may benefit from considering the advice of experienced professionals, including hedge fund managers. TipRanks accumulates data from Form 13-F filings submitted by 483 hedge funds, providing insights into their stock buying and selling activity. Using the TipRanks Stock Screener tool, we have shortlisted two technology stocks: Monday.com (NASDAQ:MNDY) and Smartsheet (NYSE:SMAR). Both stocks carry a “Strong Buy” rating and were bought by hedge funds in the last quarter.

Let’s take a closer look.

Monday.com

Monday.com provides a comprehensive work operating system to enhance team collaboration and project management. The company is expected to attract new customers with the introduction of new artificial intelligence-related updates, which should aid its topline growth.

MNDY recently reported better-than-expected results for the fourth quarter. Following the release, TD Cowen analyst Derrick Wood reiterated a Buy rating on the stock with a price target of $250 (20.4% upside).

As per TipRanks’ database, hedge funds bought 105,600 shares of Monday.com last quarter. Several hedge fund managers increased their holdings in the stock, including Cathie Wood of ARK Investment Management and Kenneth Tropin of Graham Capital Management, among others. Also, the Hedge Fund Confidence Signal is currently Very Positive.

Is Monday.com Stock a Good Buy?

Analysts remain bullish about MNDY stock, with a Strong Buy consensus rating based on 12 Buys and two Holds. Over the past year, the stock has soared by more than 32%, and the average MNDY price target of $245.83 implies an upside potential of 18.4% at current levels.

Importantly, the MNDY stock carries an Outperform Smart Score of nine. As per our database, stocks with a Smart Score between 8 and 10 have the potential to outperform market expectations.

Smartsheet

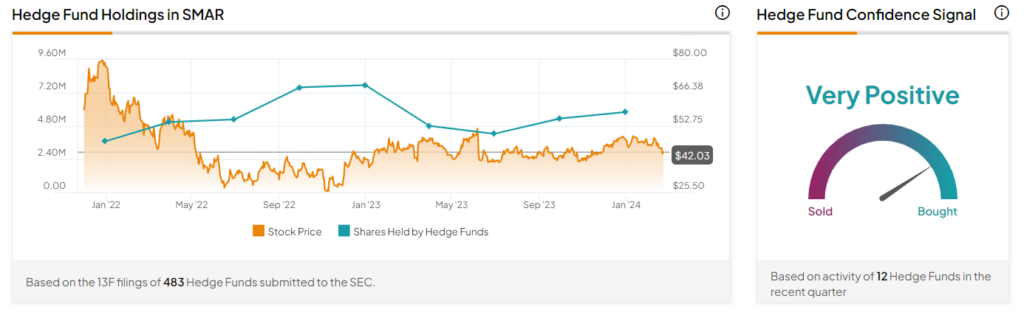

Smartsheet is a cloud-based platform that enables organizations to manage and automate work processes, projects, and tasks efficiently. SMAR’s topline in 2024 is expected to benefit from the rising adoption of its premium offerings.

Interestingly, the stock has a “Very Positive” signal from TipRanks’ Hedge Fund Trading Activity tool. The tool shows that hedge funds bought 459,400 shares of this company in the last quarter. Our data shows that Moore Capital Management’s Louis Moore Bacon and Woodline Partners’ Michael Rockefeller were among the hedge fund managers who increased their exposure to SMAR stock.

What Is the Price Target for SMAR?

The stock has received 13 Buy and two Hold recommendations for a Strong Buy consensus rating. The average Smartsheet stock price target of $55.69 implies 32.5% upside potential from the current level. Shares of the company have declined 4% in the past year. It is worth noting that SMAR stock carries an Outperform Smart Score of nine.

Concluding Thoughts

Seeking advice from financial experts seems to be a prudent investment strategy during uncertain market conditions. For more ideas on Top Expert Picks, investors can visit the TipRanks Expert Center and make informed investment decisions.

Find out which stock the biggest hedge fund managers are buying right now.