Crypto Whales Are Loading Up — Are You?

New research shows the biggest crypto buyers are back. And this time? They could hold for the possibility that Bitcoin will surpass $100,000 in 2024. You don’t want to miss the next massive crypto bull run like we saw in 2020 and 2021. To know exactly what’s going on and what to buy… Get Access To Benzinga’s Best Crypto Research and Investments For Only $1.

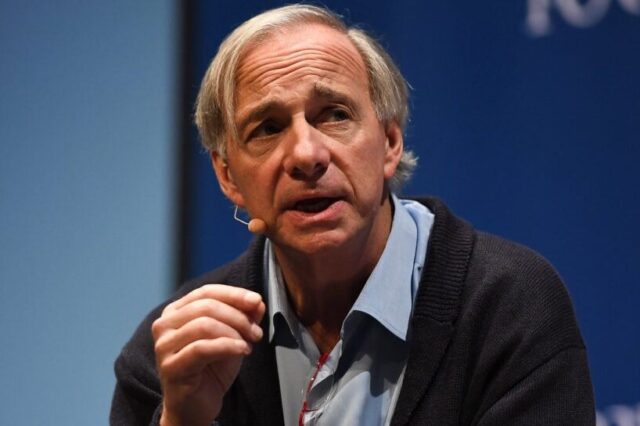

A popular asset allocation strategy promoted by hedge funds, including Bridgewater Associates‘ Ray Dalio, is reportedly facing investor redemptions after underperforming promises.

What Happened: Bridgewater and other hedge funds promised superior returns with their “risk-parity portfolios,” but after half a decade of subpar performance, investors are pulling their money out, Bloomberg reported.

ENTER TO WIN $500 IN STOCK OR CRYPTO

Enter your email and you’ll also get Benzinga’s ultimate morning update AND a free $30 gift card and more!

Large investors, including public pension funds in New Mexico, Oregon, and Ohio, have withdrawn their investments, leading to a $70 billion decline in these funds from their peak three years ago. This comes despite reassurances from hedge funds that things could improve in the next decade.

Risk parity was successful only during the Great Financial Crisis of 2008-09 and “that was really its heyday,” said Eileen Neill, as per the report, whose firm advises New Mexico’s $17 billion worth of public employee pension.

Since 2019, risk-parity funds have consistently underperformed the standard 60/40 global stock-bond mix, according to a broad industry index, as per the report. This lackluster performance has led to a significant investor exodus, with Verus estimates compiled from eVestment data showing a drop in risk-parity fund assets from a peak of $160 billion in 2021 to roughly $90 billion by the end of 2023.

What Is Risk-Parity? A risk-parity portfolio, according to a University of Massachusetts Amherst paper, “defines a well-diversified portfolio as one where all asset classes have the same marginal contribution to the total risk of the portfolio.” This approach prioritizes risk management over chasing high returns and involves portfolio rebalancing and leverage.

Unlike traditional 60/40 stock-to-bond portfolios, risk-parity focuses on risk distribution rather than dollar amounts invested in each asset class.

The risk-parity portfolio was first launched in 1996 to manage Dalio’s trust assets, as per Bloomberg, and was lauded as a way to “use deep economic research to craft the best possible portfolio, instead of trying to call the next big thing.”

FREE REPORT: How To Learn Options Trading Fast

In this special report, you will learn the four best strategies for trading options, how to stay safe as a complete beginner, a 411% trade case study, PLUS how to access two new potential winning options trades starting today.Claim Your Free Report Here.

Instead of taking on high risk in a bid to chase superior returns, the approach propounded diversification across an array of assets such as commodities and bonds, with each as an equal driver of the portfolio’s volatility.

See Also: Best High-Yield Investments To Earn

Defenders Of The Strategy: Proponents of the strategy argue that exiting now, with stocks at record highs, is a “classic investor error.” Bridgewater claims its “All Weather” fund that targets 10% volatility may be underperforming currently, but believes risk-parity remains superior for long-term investing, especially with potential stagnation in stock gains.

The “All Weather” iteration fell 22% in 2022, with Michael Markov of Markov Processes blaming the underperformance on it being less reactive to short-term market swings and correlation changes.

Risk-parity funds also face stiff competition from private credit funds and top hedge funds with consistent returns.

Michael Shackelford, chief investment officer at the Public Employees Retirement Association of New Mexico, reportedly said, “If I’m going to have 6% or 8% of my portfolio in something else, I’d rather that something else be a bucket of really good performing hedge funds.”

Investors should focus on future performance, argued Jordan Brooks of AQR Capital Management, whose firm manages $13.7 billion in risk-parity investments. “It’s investors’ job at the end of the day not to look backward but forward to what’s the best portfolio to navigate the next decade,” he said.

The SPDR S&P 500 ETF Trust (NYSE:SPY), an exchange-traded fund that mirrors the S&P 500 Index, ended Monday’s session up 0.92% at $499.72, according to Benzinga Pro data. The RPAR Risk Parity ETF (NYSE:RPAR) closed the previous session 0.16% lower at $18.63 and is down over 5% over the past year.

Read Next: 2024 Win For President Joe Biden Or Donald Trump Would Be ‘Threatening’ For Markets, Ray Dalio Says

Crypto Whales Are Loading Up — Are You?

New research shows the biggest crypto buyers are back. And this time? They could hold for the possibility that Bitcoin will surpass $100,000 in 2024. You don’t want to miss the next massive crypto bull run like we saw in 2020 and 2021. To know exactly what’s going on and what to buy… Get Access To Benzinga’s Best Crypto Research and Investments For Only $1.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.