(Bloomberg) — One Robeco quantitative fund found a way to trounce its peers amid the recent selloff in China stocks — buy the most boring companies.

Most Read from Bloomberg

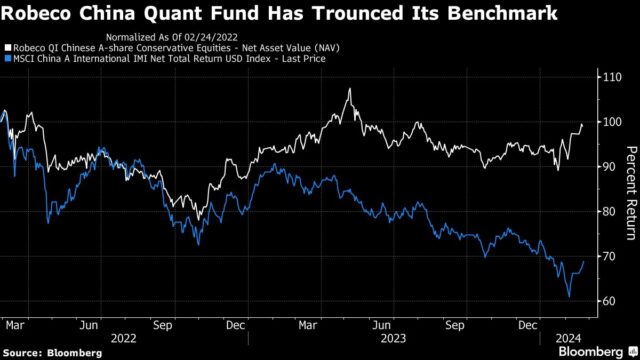

The Dutch asset management firm’s “conservative” China A share fund returned 5.3% over the past year, while the benchmark MSCI China A share index it follows tumbled 21%, according to data compiled by Bloomberg. The outperformance was underpinned by the fund’s heavy weighting in low volatility stocks such as banks and railway companies.

“The low-risk factor is shooting the lights out,” said Weili Zhou, head of quantitative research and investment at Robeco in Rotterdam. “Suddenly the very trendy and hype names — the momentum names — are not that strong, but the low-risk, boring names are shooting the lights out.”

The past two years have been punishing for most China stock investors as the country’s recovery from the pandemic faltered amid a property crisis and persistent deflation. Almost $6 trillion has been wiped off the value of China and Hong Kong equities from their highs in early 2021, according to data compiled by Bloomberg. Most China-based quant investors suffered losses in the turmoil and also faced official restrictions imposed by Beijing to stem the market decline.

Quant funds such as Robeco’s select their holdings based on numerical analysis and customized models. The firm’s conservative China A share fund screens for factors such as low volatility, high dividend yields and positive analyst revisions, according to its fact sheet.

Those criteria have paid off. The fund’s top holding is Industrial and Commercial Bank of China Ltd., whose A shares have gained 27% over the past year, while the second largest is Agricultural Bank of China Ltd., which has jumped 45%.

Overweight China

Robeco also runs an emerging-markets quant fund with an overweight position in China that’s also beaten its peers.

The Robeco QI Emerging Markets Active Equities fund denominated in euros gained 18% over the past 12 months, while its benchmark only rose 3%. The portfolio’s China weighting was 25.7% at the end of January, compared with the benchmark’s weighting of 24.9%, based on its fact sheet.

The outperformance of the emerging-markets fund give credence to Robeco’s strategy of keeping its China holdings in line with the index weighting, Zhou said. Holding an underweight position would introduce country risk that could quickly weigh on performance if the market suddenly turns, she said.

Seeking Alpha

While there are reasons to be cautious about China, the sheer size of its stock market makes it hard to ignore for emerging-market investors. The world’s second-biggest economy represents about a third of the 2,000 or so companies in Robeco’s investible universe of developing-nation shares.

“Quant investing is about playing the law of large numbers,” Zhou said. “The broader the universe, the more stocks you can start with and the better the alpha — and China has been a big alpha deliverer among emerging market countries. If you say goodbye to China, you are saying goodbye to part of the selection alpha.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.