SeaCrest Wealth Management LLC acquired a new position in Vontier Co. (NYSE:VNT – Free Report) in the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund acquired 11,183 shares of the company’s stock, valued at approximately $377,000.

SeaCrest Wealth Management LLC acquired a new position in Vontier Co. (NYSE:VNT – Free Report) in the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund acquired 11,183 shares of the company’s stock, valued at approximately $377,000.

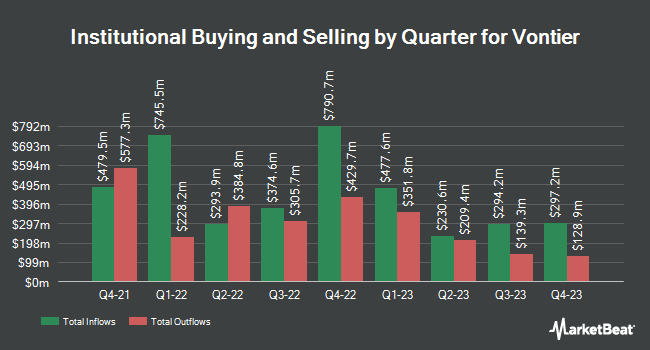

A number of other hedge funds have also recently added to or reduced their stakes in VNT. T. Rowe Price Investment Management Inc. bought a new stake in Vontier in the fourth quarter valued at $127,000,000. FMR LLC lifted its stake in Vontier by 25.8% in the third quarter. FMR LLC now owns 13,493,831 shares of the company’s stock valued at $417,229,000 after buying an additional 2,767,188 shares during the last quarter. Select Equity Group L.P. bought a new stake in Vontier in the first quarter valued at $50,009,000. Norges Bank bought a new stake in Vontier in the fourth quarter valued at $33,980,000. Finally, AQR Capital Management LLC lifted its stake in Vontier by 79.5% in the fourth quarter. AQR Capital Management LLC now owns 2,715,869 shares of the company’s stock valued at $51,629,000 after buying an additional 1,202,784 shares during the last quarter. Institutional investors and hedge funds own 95.83% of the company’s stock.

Analyst Ratings Changes

A number of equities research analysts recently weighed in on VNT shares. Citigroup lifted their price objective on shares of Vontier from $42.00 to $45.00 and gave the company a “buy” rating in a research note on Friday, February 16th. Bank of America upgraded shares of Vontier from a “neutral” rating to a “buy” rating and lifted their price objective for the company from $37.00 to $40.00 in a research note on Thursday, January 11th. Argus lifted their price objective on shares of Vontier from $39.00 to $50.00 and gave the company a “buy” rating in a research note on Monday, March 18th. The Goldman Sachs Group lifted their price objective on shares of Vontier from $37.00 to $41.00 and gave the company a “neutral” rating in a research note on Tuesday, February 20th. Finally, UBS Group lifted their price objective on shares of Vontier from $42.00 to $46.00 and gave the company a “buy” rating in a research note on Friday, February 16th. One investment analyst has rated the stock with a hold rating and six have issued a buy rating to the company. Based on data from MarketBeat.com, Vontier currently has an average rating of “Moderate Buy” and an average target price of $44.14.

View Our Latest Research Report on Vontier

Vontier Price Performance

Shares of Vontier stock opened at $45.36 on Friday. The company has a current ratio of 1.39, a quick ratio of 1.08 and a debt-to-equity ratio of 2.44. The company’s 50-day moving average price is $40.44 and its two-hundred day moving average price is $35.31. Vontier Co. has a 52 week low of $25.48 and a 52 week high of $45.40. The stock has a market cap of $6.98 billion, a PE ratio of 18.82, a price-to-earnings-growth ratio of 1.32 and a beta of 1.30.

Vontier (NYSE:VNT – Get Free Report) last issued its quarterly earnings results on Thursday, February 15th. The company reported $0.80 EPS for the quarter, topping the consensus estimate of $0.78 by $0.02. The firm had revenue of $789.00 million for the quarter, compared to analysts’ expectations of $780.92 million. Vontier had a net margin of 12.18% and a return on equity of 60.00%. Vontier’s revenue for the quarter was down 9.5% compared to the same quarter last year. During the same period in the previous year, the business earned $0.81 earnings per share. As a group, sell-side analysts anticipate that Vontier Co. will post 3.15 EPS for the current fiscal year.

Vontier Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Thursday, March 28th. Investors of record on Thursday, March 7th were paid a $0.025 dividend. The ex-dividend date was Wednesday, March 6th. This represents a $0.10 dividend on an annualized basis and a yield of 0.22%. Vontier’s dividend payout ratio is currently 4.15%.

Vontier Company Profile

Vontier Corporation provides mobility ecosystem solutions worldwide. The company operates through Mobility Technologies, Repair Solutions, and Environmental and Fueling Solutions segments. The Mobility Technologies segment provides digitally equipment solutions for mobility ecosystem, such as point-of-sale and payment systems, workflow automation, telematics, data analytics, software platform, and integrated solutions for alternative fuel dispensing.

See Also

Want to see what other hedge funds are holding VNT? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Vontier Co. (NYSE:VNT – Free Report).

Receive News & Ratings for Vontier Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Vontier and related companies with MarketBeat.com’s FREE daily email newsletter.