Night sky with stars and clouds.

getty

If you’ve been reading this column for a while, you’ll know how obsessed I am with the idea of regime changes and their wider ramifications. We are all having to learn to operate in new markets with new rules. That can bring opportunities as well as challenges. I was interested by a forthcoming piece of research by my colleague James Houlden and the Undervalued Asset team. In it, they outline a strategy for identifying potentially undervalued companies.

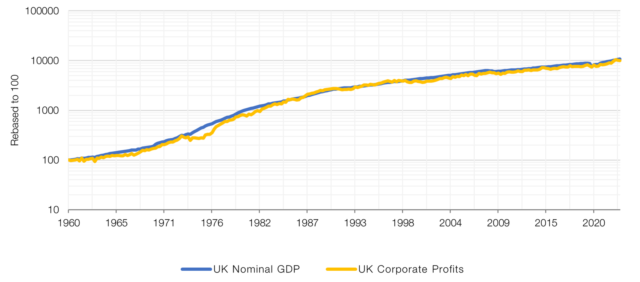

There has been a lot of focus in this brave new inflationary world on the short-term margin impact that higher prices will have on companies. Those who can pass costs on will have a brief period of outperformance, those who see revenues lag costs will struggle. Eventually, the great invisible hand will smooth out these short-term imbalances. Less well-understood is the longer-term impact of inflation, and this is where the Undervalued Asset team have made some interesting observations. Over the longer term, corporate earnings track nominal GDP growth with significant dependability. This is, if you like, a kind of reverse perspective on the fact that equities are an inflation hedge. Take real GDP growth, add inflation, and you get something more or less approximating the long-term growth of corporate profits. Since 1960, nominal GDP in the UK has grown by 7.5% and corporate profits have grown by 7.4%.

UK GDP vs Corporate Profits

Source: UK ONS, Man Group

What the Undervalued Asset team suggest – convincingly – is that many of these companies have already endured their recessionary experience. They use a number of examples, from a steel manufacturer to a building supplies company to a recruitment firm, and show how volumes have been hit dramatically over the past several years, a fact that has been largely hidden by the uptick in nominal GDP. Stocks for these companies are trading at historical low multiples off already somewhat depressed earnings. And yet they have already been through their recessionary experience. The suggestion is that there is significant upside potential once the picture becomes clearer.

Let’s look at a very specific example highlighted by the Undervalued Asset team. The UK housebuilding market has, for reasons too numerous to go into here, but largely to do with political instability, NIMBYism and economic underperformance, been going through a period of significant pain. Brick deliveries are down more than 30%, and yet a leading UK brick manufacturer has managed to grow its revenue by 10%. This, we believe, is largely to do with precisely the kind of inflationary impact we’re discussing here. Obviously, eventually, the housing market will come back in the UK and this firm and others like it, which are currently trading at very low multiples, out to be well-placed to benefit.

Brick Deliveries Down 30%

UK Brick Deliveries

But Revenues Up 10%

Brick Manufacturer Revenues

Obviously, it’s hard to come up with a universal rule here. Some companies will be flattered for a brief time by these inflated numbers and then fail for any number of unrelated reasons. The key thing to keep in mind is that, rather like the US recession that may never arrive, there are a number of sectors whose members are being penalised for pain they have already endured.

I’ve written a lot about regime change over the years, but the thing to keep in mind is that the inflation regime is only one long-term cycle playing its way through the global economic system. Any economy is the composite of many complexly overlapping cycles and regimes, some of them moving very quickly, some of them much more slowly. This narrative of inflation masking volume recessions for cyclicals is just one of I imagine many such occluded discourses that will be revealed by an economic backdrop that is, as they always are, both wholly new and redolent of previous cycles.

I’ll leave you with one final chart from the Undervalued Asset team’s excellent piece. It’s clear that we usually expect recessions to see depressed corporate earnings. 1973 was something of an exception, with stock downgrades outpacing the fall in earnings. 1973 was, like now, a period of high nominal growth (and high inflation). It’s something to bear in mind as we move into the next iteration of this regime.

Not Every Recession Is the Same

S&P and Reratings During Recessions

Follow me on LinkedIn.