(Bloomberg) — Arriving at a conference in Paris in 2017, Yutaro Rubio was surprised to see unfamiliar faces. He’d tracked alternative UCITS for a decade at that point, and usually he’d know pretty much everyone who took the time to attend these events.

Most Read from Bloomberg

“They were largely fixed income investors chasing high yielding alternatives,” he said. “That makes you think, some of these guys perhaps didn’t fully understand the strategy.”

Looking back, that was the golden era for alternative UCITS — a structure used in Europe as a retail-friendly alternate to hedge funds. Total assets hit an all-time-high of around $433 billion at the start of 2018 according to research by Kepler Absolute Hedge. Rubio attributes a significant proportion of the rise to these more transient investors looking to stash money while interest rates were near-zero.

The industry has since been in free-fall. Hedge fund strategies in general suffered several years of outflows, and UCITS face tighter restrictions on leverage, concentration and short positions than their Cayman Islands cousins, as well as lower returns. More recently, higher interest rates have washed out some of their former investor base.

“This is one of the troughs for the industry,” said Rubio, who is head of UCITS research at International Asset Management Ltd. “Partly driven by performance as some of the funds didn’t deliver what investors were expecting.”

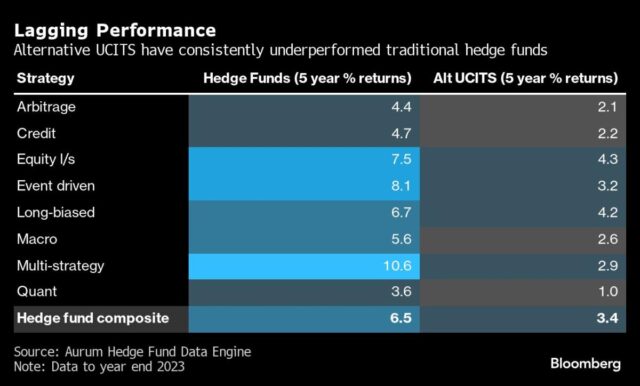

Despite fees on many UCITS funds being similar to traditional hedge funds, data from investment firm Aurum show the latter to be more effective in handling larger volumes of assets at higher Sharpe ratios — a measure of a fund’s returns against its level of risk.

The decline of this corner of the UCITS market has been almost as swift as its rise. Undertakings for Collective Investment in Transferable Securities have been around since the 1980s, housing trillions of euros in a variety of global assets, but the use case for alternative investments really came into its own after the 2008 financial crisis when European regulators tightened the rules around investing in hedge funds.

UCITS offer clients flexibility to invest smaller amounts and withdraw cash on a regular, often daily, basis. This opens the door to customers who would struggle with hedge funds’ long lock-up periods and multimillion-dollar investment requirements. There is plenty of overlap, with hedge funds offering their own UCITS.

But the features are only attractive if returns are also competitive — and with 5% interest rates available by parking cash at a bank, the underperformance of UCITS has become even starker.

The industry lost $38 billion last year, according to Kepler’s research, bringing total assets to $240 billion — slightly more than half the 2018 peak. UCITS funds actually improved their performance last year, but the 4.3% average return still fell below the cash rate.

Exit Signs

FE Investments, which manages around $5 billion in assets, said it has reduced its allocation to alternative UCITS “meaningfully” since the first quarter of 2023, driven by stock and bond portfolio correlations and improving cash yields.

“Money market funds have been an attractive place to be for multi-asset investors, so a lot of what we had in alternative UCITS went into that instead, offering 5% per year, risk-free,” said Adam Rizvi, a fund analyst at the firm.

Some UCITS have closed in response to the pressure. Blackstone Inc. announced its multi strategy fund would shutter late last year after assets declined from a peak of $2.3 billion to just $200 million. The firm said at the time it would be moving capital to “newer strategies that offer greater flexibility.” Famed short seller Jim Chanos also shuttered his UCITS fund in 2023, just a year after it was launched.

New Ideas

While the UCITS universe may be shrinking, there are still bright spots that suggest the cycle could turn.

Last year saw some successful fund-raises, with AQR’s Alternative Trends UCITS Fund gathering over $500 million since its February launch, and the Empureon Volatility One Fund reaching over $300 million. UCITS launch numbers also ticked up after three years of declines, according to Kepler, with more in the pipeline for 2024.

Additionally, more US managers are taking an interest in UCITS products as a means of tapping a broader pool of European investors, according to IAM’s Rubio. The rules around UCITS are now viewed as well established, at least in the EU.

With central bank rate cuts on the horizon, the prospect of lower cash yields could also lure back some investors. FE Funds sees alternative UCITS funds as an option for it to diversify if signs emerge of instability, positive correlation within stock and bond portfolios, or cash rates coming back down.

“We probably have another six months of good yields, and from there, allocators will start looking for new ideas,” IAM’s Rubio added. “We might not see the flows coming back meaningfully until next year, but there is already some early movement.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.