Michalow, a multi-millionaire in his forties who left his hedge fund after making an off-color joke, and now asking for millions more, might not cut the most sympathetic figure. But his case also captures the way in which hedge funds’ secrecy can hamstring their employees’ attempts to preserve their own reputations.

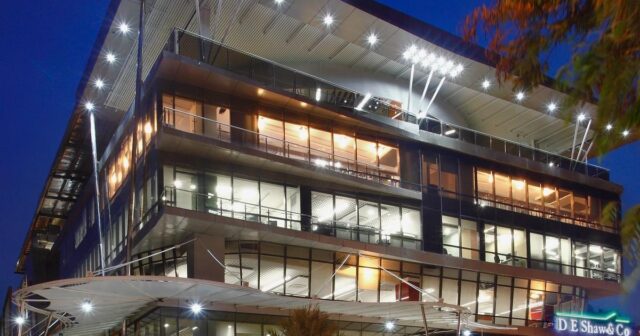

Hedge funds are micro-cultures and many of those cultures are very protective of the secret sauce behind how they invest and trade. For quant funds like D.E. Shaw, which rely on proprietary algorithms to make money, that secretiveness can verge into a cultish level of clandestine.

In their eagerness to keep their talent and ideas to themselves, quant funds have ramped up the language in their employment contracts, attempting to make it nearly impossible for traders who know the math behind trades to take it with them to a competitor. But that insularity has metastasized with funds now writing all kinds of protections into their agreements, and using things like deferred compensation as a cudgel to get talent to sign on.

What has helped fuel the phenomenon is that quant funds often recruit straight out of undergraduate and graduate programs, offering huge sums of money to people that are relatively new to the workforce and unfamiliar with employment contracts. Once they sign and the money pours in, it becomes less and less likely that anybody feels the urge to sue and courts remain largely blind to what’s actually in these very private contracts.

Michalow, who lays out in his brief that he signed on with D.E Shaw as an undergraduate, clearly has an axe to grind with his former employer even after his pretty hefty defamation reward, but it’s also clear that the “release-for-pay” issue is not just a D.E. Shaw problem.