(Bloomberg) — A US hedge fund specializing in natural gas profited from an unusually large bet that volatility would ease in Europe, showing the growth of the options market after banks and hedge funds piled in following Russia’s invasion of Ukraine.

Most Read from Bloomberg

Miami-based Statar Capital LLC doubled its €350 million investment buying €50 put options in early November, according to a people familiar with the situation who asked not to be named because the matter is private. The fund closed the position throughout February in line with declining prices in the region that have also led to lower volatility. The profit has led traders to call it ‘the trade of the year’.

The contracts were valued around €13 to €15 when the positions were taken in early November and jumped to near €25 by early February, based on Bloomberg calculations. The options market wouldn’t have been big enough to absorb the trade — which involved an unusually high volume of puts — before the influx of hedge funds into gas following increased volatility after the Ukraine war started.

Statar, founded by former Citadel and D.E. Shaw & Co. trader Ron Ozer, had significant success trading gas at height of the energy crisis. Hedge funds and banks flocked to the market and are now increasingly turning to derivative contracts to either profit from or simply protect their positions against sharp upward or downward price moves. Even with volatility easing, traders are warning that the price swings will remain strong until a new wave of supply in 2026, fully replaces Russian flows.

Read More: Europe Moves Into a New World After a Crippling Energy Crisis

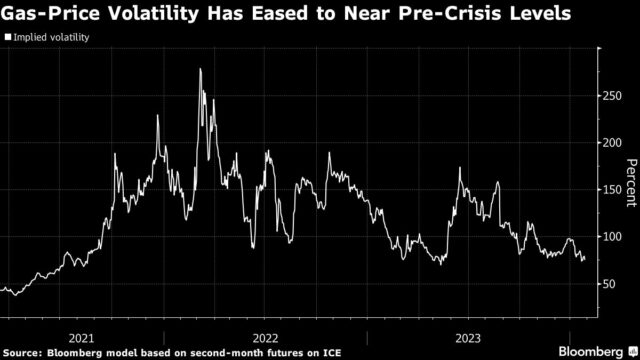

While a mostly mild winter and continued demand destruction in the industrial sector have contributed to a drop of about 47% in futures contracts in the past year, the region’s greater reliance on imports leaves it vulnerable to potential global disruptions. Implied volatility — a measure of how expensive derivative contracts are — has also moved lower since November.

Commodity trading has been a lucrative business for hedge funds, with Citadel making more than $4 billion in 2023, helping drive profits for one of the world’s largest hedge funds, Bloomberg reported. Gas trading has also contributed to bumper profits for major energy companies like Norway’s Equinor ASA and Shell Plc.

Statar ended 2023 with $2.9 billion under management after registering it’s first annual loss since it was founded in September 2018, according to a separate source familiar with the numbers. The fund returned -0.6% in 2023 compared to 30.3% a year earlier, the person said.

A spokesperson for Statar declined to comment.

–With assistance from Nishant Kumar, Devika Krishna Kumar and Alex Longley.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.